Using the Ganado Germany analysis

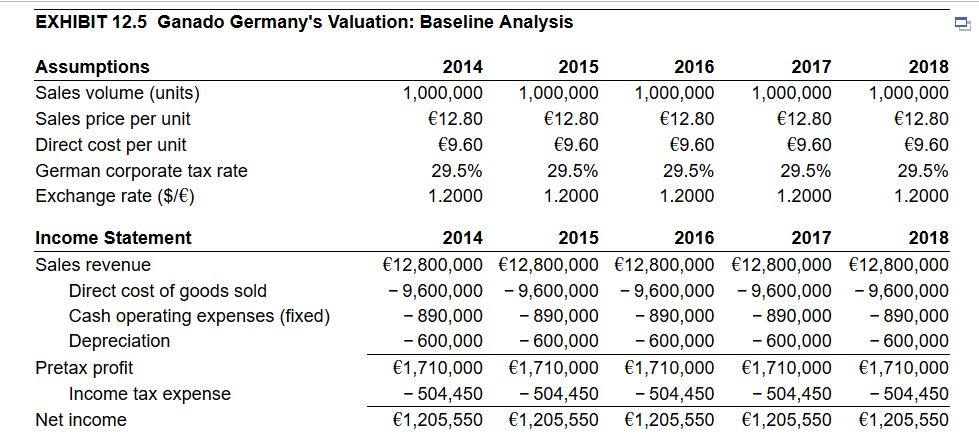

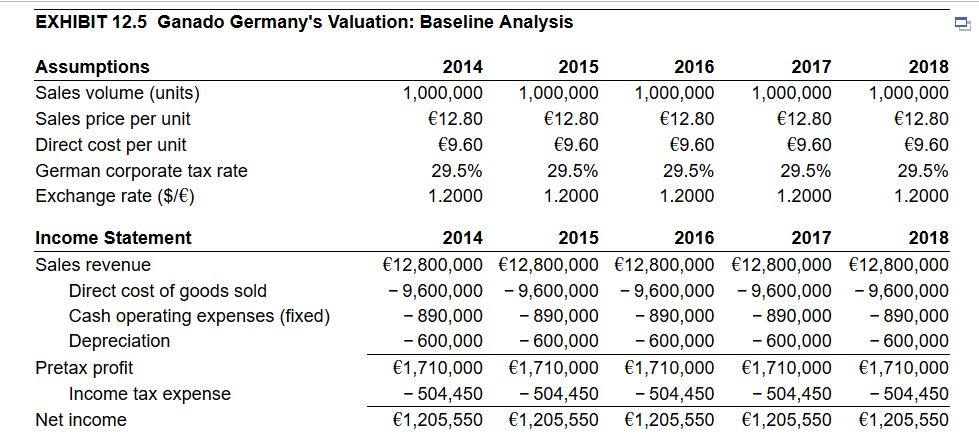

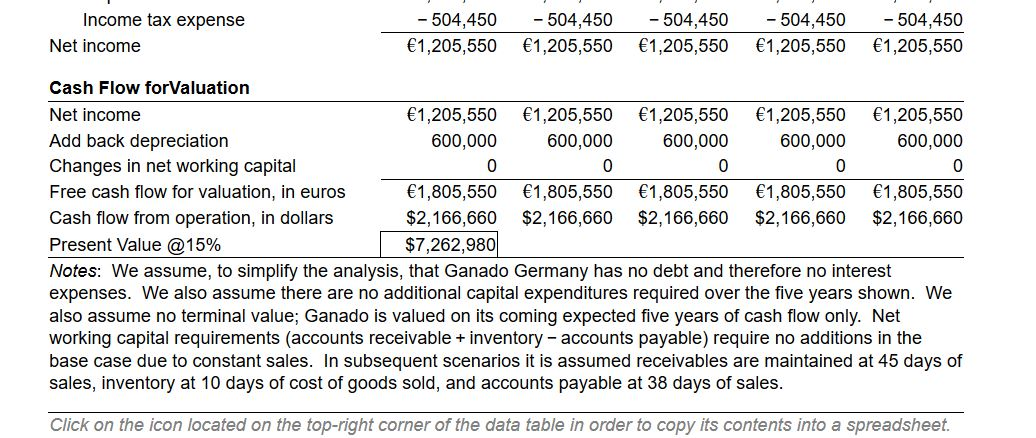

Ganado Germany-All Domestic Competitors. Using the Ganado Germany analysis in Exhibits 12.5, B3, and 12.6, 3, where the euro depreciates, how would prices, costs, and volumes change if Ganado Germany was operating in a mature mostly-domestic market with major domestic competitors. (Select the best response.) O A. Ganado Germany could not change price to try and pass-through exchange rate changes. As a result, all of its operating parameters would remain the same, but its value would fall when valued in U.S. dollars by its U.S. parent company. O B. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany), and would try and increase the price in euros by keeping the sales volumes the same. OC. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany) by increasing the price and sales volumes at the same time, which will in turns raise the direct costs as well. OD. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany), and would try and increase sales volumes dramatically by keeping the price in euros the same. EXHIBIT 12.5 Ganado Germany's Valuation: Baseline Analysis Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) 2014 1,000,000 12.80 9.60 29.5% 1.2000 2015 1,000,000 12.80 9.60 29.5% 1.2000 2016 1,000,000 12.80 9.60 29.5% 1.2000 2017 1,000,000 12.80 9.60 29.5% 1.2000 2018 1,000,000 12.80 9.60 29.5% 1.2000 Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income 2014 2015 2016 2017 2018 12,800,000 12,800,000 12,800,000 12,800,000 12,800,000 -9,600,000 -9,600,000 -9,600,000 - 9,600,000 -9,600,000 - 890,000 - 890,000 - 890,000 - 890,000 - 890,000 - 600,000 - 600,000 - 600,000 - 600,000 - 600,000 1,710,000 1,710,000 1,710,000 1,710,000 1,710,000 - 504,450 - 504,450 -504,450 - 504,450 - 504,450 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Income tax expense Net income -504,450 1,205,550 -504,450 1,205,550 -504,450 1,205,550 - 504,450 1,205,550 -504,450 1,205,550 Cash Flow forValuation Net income 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Add back depreciation 600,000 600,000 600,000 600,000 600,000 Changes in net working capital 0 0 0 0 0 Free cash flow for valuation, in euros 1,805,550 1,805,550 1,805,550 1,805,550 1,805,550 Cash flow from operation, in dollars $2,166,660 $2,166,660 $2,166,660 $2,166,660 $2,166,660 Present Value @ 15% $7,262,980 Notes: We assume, to simplify the analysis, that Ganado Germany has no debt and therefore no interest expenses. We also assume there are no additional capital expenditures required over the five years shown. We also assume no terminal value; Ganado is valued on its coming expected five years of cash flow only. Net working capital requirements (accounts receivable + inventory-accounts payable) require no additions in the base case due to constant sales. In subsequent scenarios it is assumed receivables are maintained at 45 days of sales, inventory at 10 days of cost of goods sold, and accounts payable at 38 days of sales. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. EXHIBIT 12.6 Ganado Germany: Case 4Sales Price, Volume, and Costs Increase Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) 2014 1,000,000 14.80 9.60 29.5% 1.0000 2015 1,000,000 14.80 9.60 29.5% 1.0000 2016 1,000,000 14.80 9.60 29.5% 1.0000 2017 1,000,000 14.80 9.60 29.5% 1.0000 2018 1,000,000 14.80 9.60 29.5% 1.0000 Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income 2014 2015 2016 2017 2018 15,488,000 15,488,000 15,488,000 15,488,000 15,488,000 - 11,000,000 - 11,000,000 - 11,000,000 - 11,000,000 - 11,000,000 - 890,000 -890,000 -890,000 -890,000 - 890,000 - 600,000 - 600,000 -600,000 - 600,000 - 600,000 2,998,000 2,998,000 2,998,000 2,998,000 2,998,000 -884,410 - 884,410 -884,410 -884,410 -884,410 2,113,590 2,113,590 2,113,590 2,113,590 2,113,590 HICUIC la CAPCIUC UUT,TIU UUTTIU UUT,TIU UUTTIU UUTTIU Net income 2,113,590 2,113,590 2,113,590 2,113,590 2,113,590 Cash Flow forValuation Net income Add back depreciation Changes in net working capital Free cash flow for valuation, in euros Cash flow from operation, in dollars Present Value @15% 2,113,590 600,000 - 89,907 2,623,683 $2,623,683 $9,018,195 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet Ganado Germany-All Domestic Competitors. Using the Ganado Germany analysis in Exhibits 12.5, B3, and 12.6, 3, where the euro depreciates, how would prices, costs, and volumes change if Ganado Germany was operating in a mature mostly-domestic market with major domestic competitors. (Select the best response.) O A. Ganado Germany could not change price to try and pass-through exchange rate changes. As a result, all of its operating parameters would remain the same, but its value would fall when valued in U.S. dollars by its U.S. parent company. O B. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany), and would try and increase the price in euros by keeping the sales volumes the same. OC. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany) by increasing the price and sales volumes at the same time, which will in turns raise the direct costs as well. OD. Ganado Germany would most likely try to profit from its now weak-currency home country (Germany), and would try and increase sales volumes dramatically by keeping the price in euros the same. EXHIBIT 12.5 Ganado Germany's Valuation: Baseline Analysis Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) 2014 1,000,000 12.80 9.60 29.5% 1.2000 2015 1,000,000 12.80 9.60 29.5% 1.2000 2016 1,000,000 12.80 9.60 29.5% 1.2000 2017 1,000,000 12.80 9.60 29.5% 1.2000 2018 1,000,000 12.80 9.60 29.5% 1.2000 Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income 2014 2015 2016 2017 2018 12,800,000 12,800,000 12,800,000 12,800,000 12,800,000 -9,600,000 -9,600,000 -9,600,000 - 9,600,000 -9,600,000 - 890,000 - 890,000 - 890,000 - 890,000 - 890,000 - 600,000 - 600,000 - 600,000 - 600,000 - 600,000 1,710,000 1,710,000 1,710,000 1,710,000 1,710,000 - 504,450 - 504,450 -504,450 - 504,450 - 504,450 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Income tax expense Net income -504,450 1,205,550 -504,450 1,205,550 -504,450 1,205,550 - 504,450 1,205,550 -504,450 1,205,550 Cash Flow forValuation Net income 1,205,550 1,205,550 1,205,550 1,205,550 1,205,550 Add back depreciation 600,000 600,000 600,000 600,000 600,000 Changes in net working capital 0 0 0 0 0 Free cash flow for valuation, in euros 1,805,550 1,805,550 1,805,550 1,805,550 1,805,550 Cash flow from operation, in dollars $2,166,660 $2,166,660 $2,166,660 $2,166,660 $2,166,660 Present Value @ 15% $7,262,980 Notes: We assume, to simplify the analysis, that Ganado Germany has no debt and therefore no interest expenses. We also assume there are no additional capital expenditures required over the five years shown. We also assume no terminal value; Ganado is valued on its coming expected five years of cash flow only. Net working capital requirements (accounts receivable + inventory-accounts payable) require no additions in the base case due to constant sales. In subsequent scenarios it is assumed receivables are maintained at 45 days of sales, inventory at 10 days of cost of goods sold, and accounts payable at 38 days of sales. Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet. EXHIBIT 12.6 Ganado Germany: Case 4Sales Price, Volume, and Costs Increase Assumptions Sales volume (units) Sales price per unit Direct cost per unit German corporate tax rate Exchange rate ($/) 2014 1,000,000 14.80 9.60 29.5% 1.0000 2015 1,000,000 14.80 9.60 29.5% 1.0000 2016 1,000,000 14.80 9.60 29.5% 1.0000 2017 1,000,000 14.80 9.60 29.5% 1.0000 2018 1,000,000 14.80 9.60 29.5% 1.0000 Income Statement Sales revenue Direct cost of goods sold Cash operating expenses (fixed) Depreciation Pretax profit Income tax expense Net income 2014 2015 2016 2017 2018 15,488,000 15,488,000 15,488,000 15,488,000 15,488,000 - 11,000,000 - 11,000,000 - 11,000,000 - 11,000,000 - 11,000,000 - 890,000 -890,000 -890,000 -890,000 - 890,000 - 600,000 - 600,000 -600,000 - 600,000 - 600,000 2,998,000 2,998,000 2,998,000 2,998,000 2,998,000 -884,410 - 884,410 -884,410 -884,410 -884,410 2,113,590 2,113,590 2,113,590 2,113,590 2,113,590 HICUIC la CAPCIUC UUT,TIU UUTTIU UUT,TIU UUTTIU UUTTIU Net income 2,113,590 2,113,590 2,113,590 2,113,590 2,113,590 Cash Flow forValuation Net income Add back depreciation Changes in net working capital Free cash flow for valuation, in euros Cash flow from operation, in dollars Present Value @15% 2,113,590 600,000 - 89,907 2,623,683 $2,623,683 $9,018,195 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 2,113,590 600,000 0 2,713,590 $2,713,590 Click on the icon located on the top-right corner of the data table in order to copy its contents into a spreadsheet