Answered step by step

Verified Expert Solution

Question

1 Approved Answer

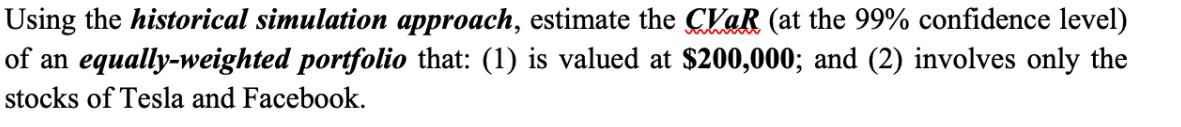

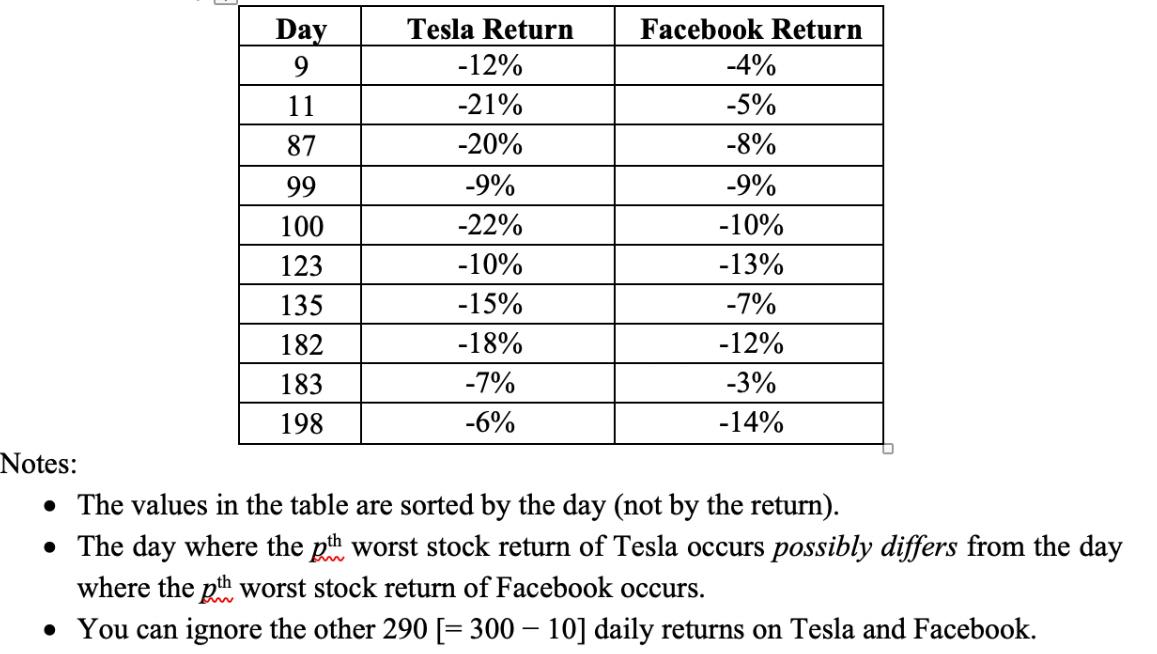

Using the historical simulation approach, estimate the CVaR (at the 99% confidence level) of an equally-weighted portfolio that: (1) is valued at $200,000; and

Using the historical simulation approach, estimate the CVaR (at the 99% confidence level) of an equally-weighted portfolio that: (1) is valued at $200,000; and (2) involves only the stocks of Tesla and Facebook. Day 9 11 87 99 100 123 135 182 183 198 Tesla Return -12% -21% -20% -9% -22% -10% -15% -18% -7% -6% Facebook Return -4% -5% -8% -9% -10% -13% -7% -12% -3% -14% Notes: The values in the table are sorted by the day (not by the return). The day where the pth worst stock return of Tesla occurs possibly differs from the day where the pth worst stock return of Facebook occurs. You can ignore the other 290 [= 300 - 10] daily returns on Tesla and Facebook.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started