Using the income and expenditure information for 2019, complete a cash flow statement for Crystal Gomez. Date this statement January through December of 2019. Use the "cash flow" concept for this financial statement including all money inflows as income and all outflows as expenditures. This is not a monthly cash flow statement, but for the entire year. The distinction between fixed and variable income and expenses is open to interpretation. Try to differentiate but be sure to total your entries for each row in the third column of the cash flow statement. Did Crystal have a cash surplus or a cash deficit in 2019? What impact would the 2019 cash surplus (deficit) have on the September 1, 2019 balance sheet?

Using the income and expenditure information for 2019, complete a cash flow statement for Crystal Gomez. Date this statement January through December of 2019. Use the "cash flow" concept for this financial statement including all money inflows as income and all outflows as expenditures. This is not a monthly cash flow statement, but for the entire year. The distinction between fixed and variable income and expenses is open to interpretation. Try to differentiate but be sure to total your entries for each row in the third column of the cash flow statement. Did Crystal have a cash surplus or a cash deficit in 2019? What impact would the 2019 cash surplus (deficit) have on the September 1, 2019 balance sheet?

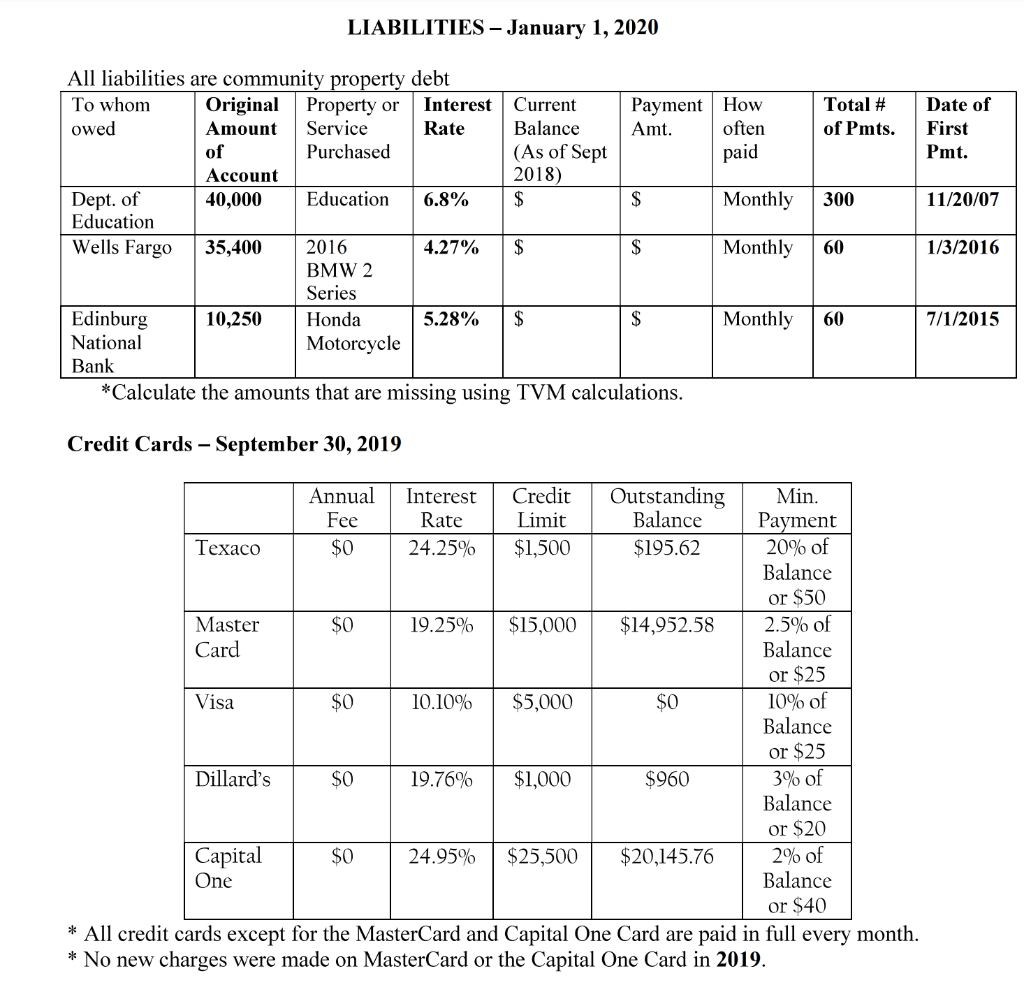

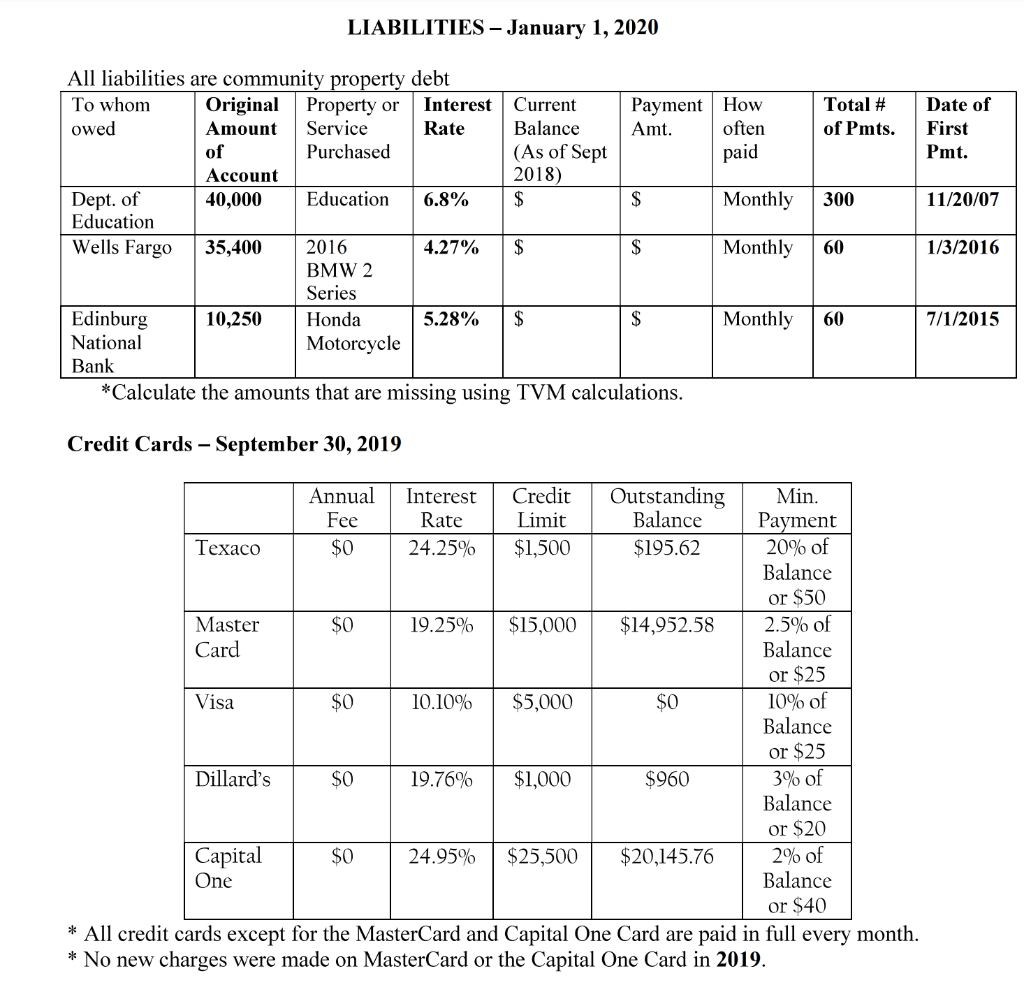

LIABILITIES - January 1, 2020 Total # of Pmts. Date of First Pmt. 300 11/20/07 All liabilities are community property debt To whom Original Property or Interest Current Payment How owed Amount Service Rate Balance Amt. often of Purchased (As of Sept paid Account 2018) Dept. of 40,000 Education 6.8% $ $ Monthly Education Wells Fargo 35,400 2016 4.27% $ $ Monthly BMW 2 Series Edinburg 10,250 Honda 5.28% $ Monthly National Motorcycle Bank * Calculate the amounts that are missing using TVM calculations. 60 1/3/2016 $ 60 7/1/2015 Credit Cards - September 30, 2019 Annual Fee $0 Interest Rate 24.25% Credit Limit $1,500 Outstanding Balance $195.62 Texaco $0 19.25% $15,000 $14,952.58 Master Card Min. Payment 20% of Balance or $50 2.5% of Balance or $25 10% of Balance or $25 3% of Balance or $20 2% of Balance Visa $0 10.10% $5,000 $0 Dillard's $0 19.76% $1,000 $960 $0 24.95% $25,500 Capital One $20,145.76 or $40 * All credit cards except for the MasterCard and Capital One Card are paid in full every month. * No new charges were made on MasterCard or the Capital One Card in 2019. LIABILITIES - January 1, 2020 Total # of Pmts. Date of First Pmt. 300 11/20/07 All liabilities are community property debt To whom Original Property or Interest Current Payment How owed Amount Service Rate Balance Amt. often of Purchased (As of Sept paid Account 2018) Dept. of 40,000 Education 6.8% $ $ Monthly Education Wells Fargo 35,400 2016 4.27% $ $ Monthly BMW 2 Series Edinburg 10,250 Honda 5.28% $ Monthly National Motorcycle Bank * Calculate the amounts that are missing using TVM calculations. 60 1/3/2016 $ 60 7/1/2015 Credit Cards - September 30, 2019 Annual Fee $0 Interest Rate 24.25% Credit Limit $1,500 Outstanding Balance $195.62 Texaco $0 19.25% $15,000 $14,952.58 Master Card Min. Payment 20% of Balance or $50 2.5% of Balance or $25 10% of Balance or $25 3% of Balance or $20 2% of Balance Visa $0 10.10% $5,000 $0 Dillard's $0 19.76% $1,000 $960 $0 24.95% $25,500 Capital One $20,145.76 or $40 * All credit cards except for the MasterCard and Capital One Card are paid in full every month. * No new charges were made on MasterCard or the Capital One Card in 2019

Using the income and expenditure information for 2019, complete a cash flow statement for Crystal Gomez. Date this statement January through December of 2019. Use the "cash flow" concept for this financial statement including all money inflows as income and all outflows as expenditures. This is not a monthly cash flow statement, but for the entire year. The distinction between fixed and variable income and expenses is open to interpretation. Try to differentiate but be sure to total your entries for each row in the third column of the cash flow statement. Did Crystal have a cash surplus or a cash deficit in 2019? What impact would the 2019 cash surplus (deficit) have on the September 1, 2019 balance sheet?

Using the income and expenditure information for 2019, complete a cash flow statement for Crystal Gomez. Date this statement January through December of 2019. Use the "cash flow" concept for this financial statement including all money inflows as income and all outflows as expenditures. This is not a monthly cash flow statement, but for the entire year. The distinction between fixed and variable income and expenses is open to interpretation. Try to differentiate but be sure to total your entries for each row in the third column of the cash flow statement. Did Crystal have a cash surplus or a cash deficit in 2019? What impact would the 2019 cash surplus (deficit) have on the September 1, 2019 balance sheet?