Answered step by step

Verified Expert Solution

Question

1 Approved Answer

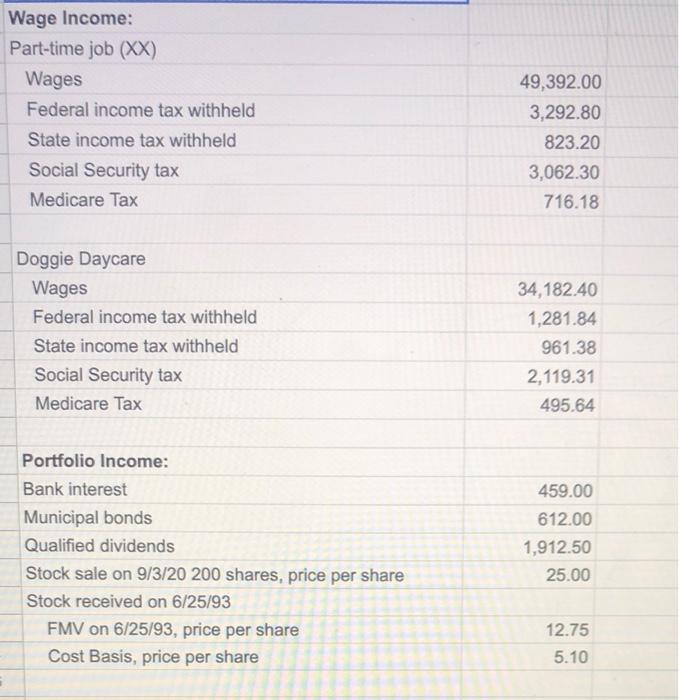

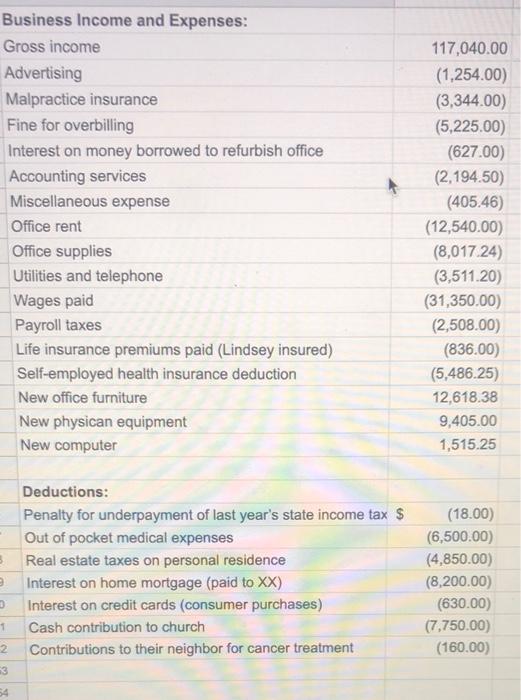

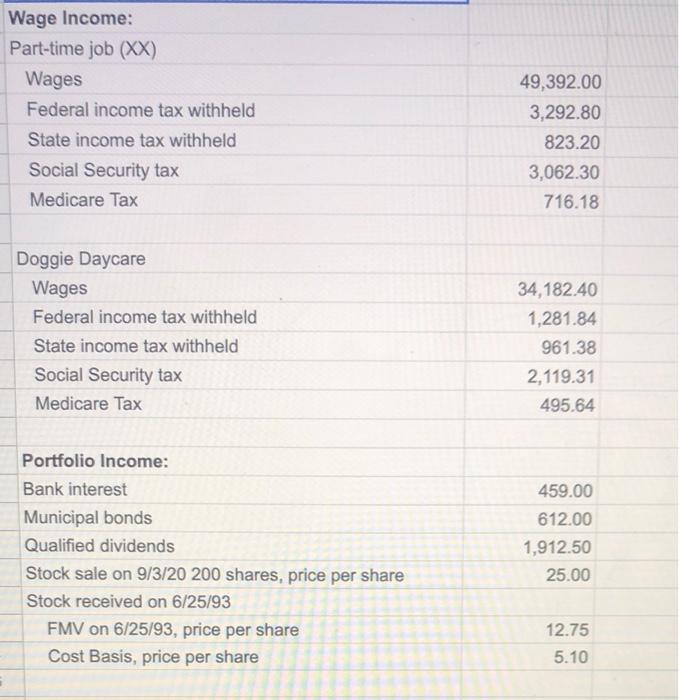

Using the individual income tax formula prepare a document that projects your clients tax liability and tax due/refund. Using the 2021 tax rate sheet. Wage

Using the individual income tax formula prepare a document that projects your clients tax liability and tax due/refund. Using the 2021 tax rate sheet.

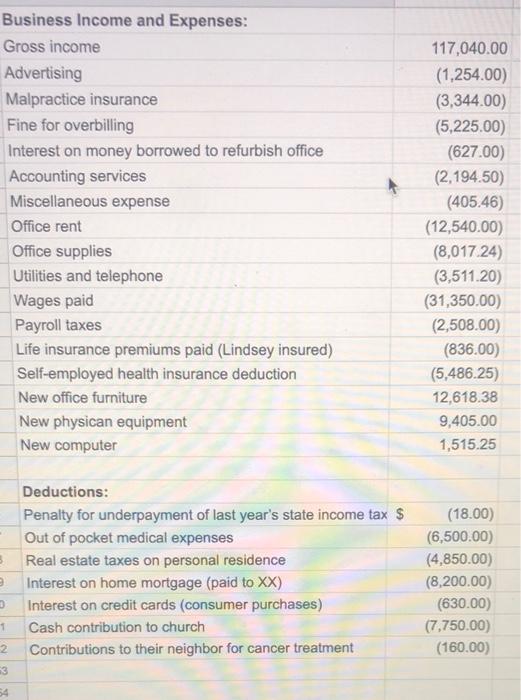

Wage Income: Part-time job (XX) Wages Federal income tax withheld State income tax withheld Social Security tax Medicare Tax 49,392.00 3,292.80 823.20 3,062.30 716.18 Doggie Daycare Wages Federal income tax withheld State income tax withheld Social Security tax Medicare Tax 34,182.40 1.281.84 961.38 2,119.31 495.64 Portfolio Income: Bank interest Municipal bonds Qualified dividends Stock sale on 9/3/20 200 shares, price per share Stock received on 6/25/93 FMV on 6/25/93, price per share Cost Basis, price per share 459.00 612.00 1,912.50 25.00 12.75 5.10 Business Income and Expenses: Gross income Advertising Malpractice insurance Fine for overbilling Interest on money borrowed to refurbish office Accounting services Miscellaneous expense Office rent Office supplies Utilities and telephone Wages paid Payroll taxes Life insurance premiums paid (Lindsey insured) Self-employed health insurance deduction New office furniture New physican equipment New computer 117,040.00 (1,254.00) (3,344.00) (5,225.00) (627.00) (2.194.50) (405.46) (12,540.00) (8,017.24) (3,511.20) (31,350.00) (2,508.00) (836.00) (5.486.25) 12,618.38 9,405.00 1,515.25 . Deductions: Penalty for underpayment of last year's state income tax $ Out of pocket medical expenses Real estate taxes on personal residence Interest on home mortgage (paid to XX) Interest on credit cards (consumer purchases) Cash contribution to church Contributions to their neighbor for cancer treatment (18.00) (6,500.00) (4,850.00) (8,200.00) (630.00) (7,750.00) (160.00) 1 2 3 54 Wage Income: Part-time job (XX) Wages Federal income tax withheld State income tax withheld Social Security tax Medicare Tax 49,392.00 3,292.80 823.20 3,062.30 716.18 Doggie Daycare Wages Federal income tax withheld State income tax withheld Social Security tax Medicare Tax 34,182.40 1.281.84 961.38 2,119.31 495.64 Portfolio Income: Bank interest Municipal bonds Qualified dividends Stock sale on 9/3/20 200 shares, price per share Stock received on 6/25/93 FMV on 6/25/93, price per share Cost Basis, price per share 459.00 612.00 1,912.50 25.00 12.75 5.10 Business Income and Expenses: Gross income Advertising Malpractice insurance Fine for overbilling Interest on money borrowed to refurbish office Accounting services Miscellaneous expense Office rent Office supplies Utilities and telephone Wages paid Payroll taxes Life insurance premiums paid (Lindsey insured) Self-employed health insurance deduction New office furniture New physican equipment New computer 117,040.00 (1,254.00) (3,344.00) (5,225.00) (627.00) (2.194.50) (405.46) (12,540.00) (8,017.24) (3,511.20) (31,350.00) (2,508.00) (836.00) (5.486.25) 12,618.38 9,405.00 1,515.25 . Deductions: Penalty for underpayment of last year's state income tax $ Out of pocket medical expenses Real estate taxes on personal residence Interest on home mortgage (paid to XX) Interest on credit cards (consumer purchases) Cash contribution to church Contributions to their neighbor for cancer treatment (18.00) (6,500.00) (4,850.00) (8,200.00) (630.00) (7,750.00) (160.00) 1 2 3 54

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started