Answered step by step

Verified Expert Solution

Question

1 Approved Answer

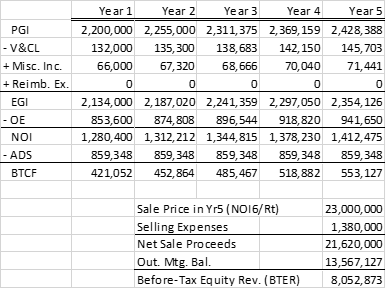

Using the information above, determine the NET PRESENT VALUE of the project (UNLEVERED) by applying discounted cash flow analysis. Assume the project is purchased, all

Using the information above, determine the NET PRESENT VALUE of the project (UNLEVERED) by applying discounted cash flow analysis. Assume the project is purchased, all cash, in year 0 for $20 million. Assume the investors overall required return unlevered, Yo, is 10.5 percent; the required return of the equity investor levered, Ye, is 15.0 percent; the going-in capitalization rate, Ro, is 6.5 percent; the going-out cap rate, Rt is 6.75; the mortgage rate is 4.0% and a 5-year holding period.

PGI - V&CL + Misc. Inc. + Reimb. Ex. EGI - OE NOI - ADS BTCF Year 1 Year 2 Year 3 Year 4 Year 5 2,200,000 2,255,000 2,311,375 2,369,159 2,428,388 132,000 135, 300 138,683 142, 150 145,703 66,000 67,320 68,666 70,040 71,441 0 0 0 0 0 0 2,134,000 2,187,020 2,241,359 2,297,050 2,354, 126 853,600 874,808 896,544 918,820 941,650 1,280,400 1,312,212 1,344, 815 1,378,230 1,412,475 859,348 859,348 859,348 859,348 859,348 421,052 452,864 485,467 518,882 553,127 Sale Price in Yr5 (NO16/Rt) Selling Expenses Net Sale Proceeds Out. Mtg. Bal. Before-Tax Equity Rev. (BTER) 23,000,000 1,380,000 21,620,000 13,567,127 8,052,873 PGI - V&CL + Misc. Inc. + Reimb. Ex. EGI - OE NOI - ADS BTCF Year 1 Year 2 Year 3 Year 4 Year 5 2,200,000 2,255,000 2,311,375 2,369,159 2,428,388 132,000 135, 300 138,683 142, 150 145,703 66,000 67,320 68,666 70,040 71,441 0 0 0 0 0 0 2,134,000 2,187,020 2,241,359 2,297,050 2,354, 126 853,600 874,808 896,544 918,820 941,650 1,280,400 1,312,212 1,344, 815 1,378,230 1,412,475 859,348 859,348 859,348 859,348 859,348 421,052 452,864 485,467 518,882 553,127 Sale Price in Yr5 (NO16/Rt) Selling Expenses Net Sale Proceeds Out. Mtg. Bal. Before-Tax Equity Rev. (BTER) 23,000,000 1,380,000 21,620,000 13,567,127 8,052,873Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started