Answered step by step

Verified Expert Solution

Question

1 Approved Answer

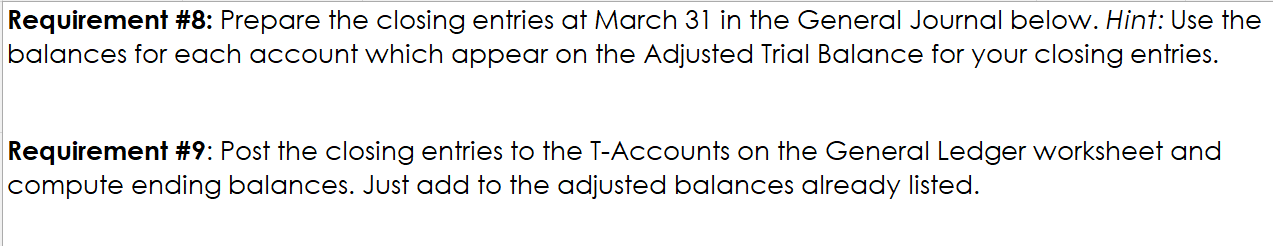

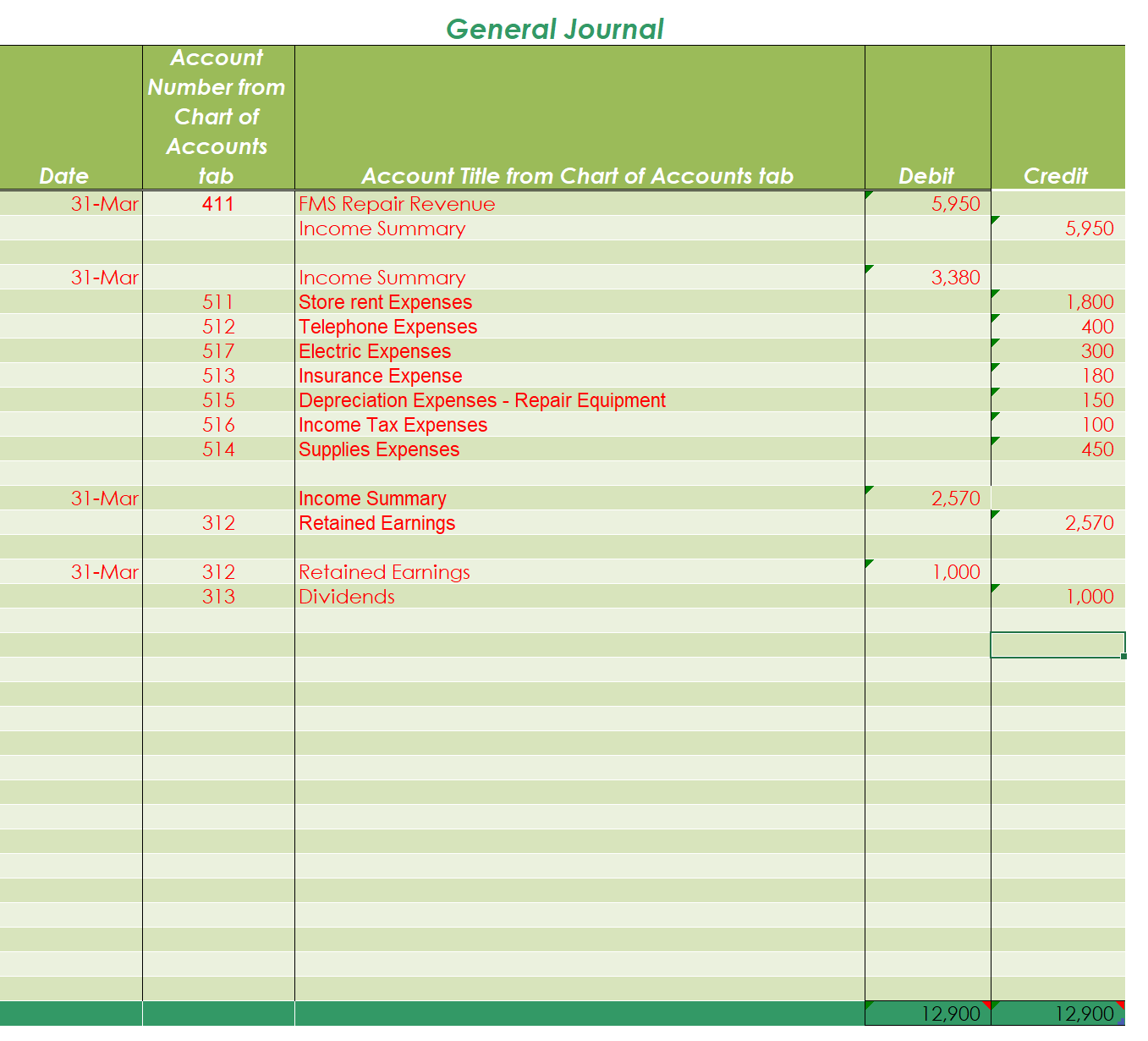

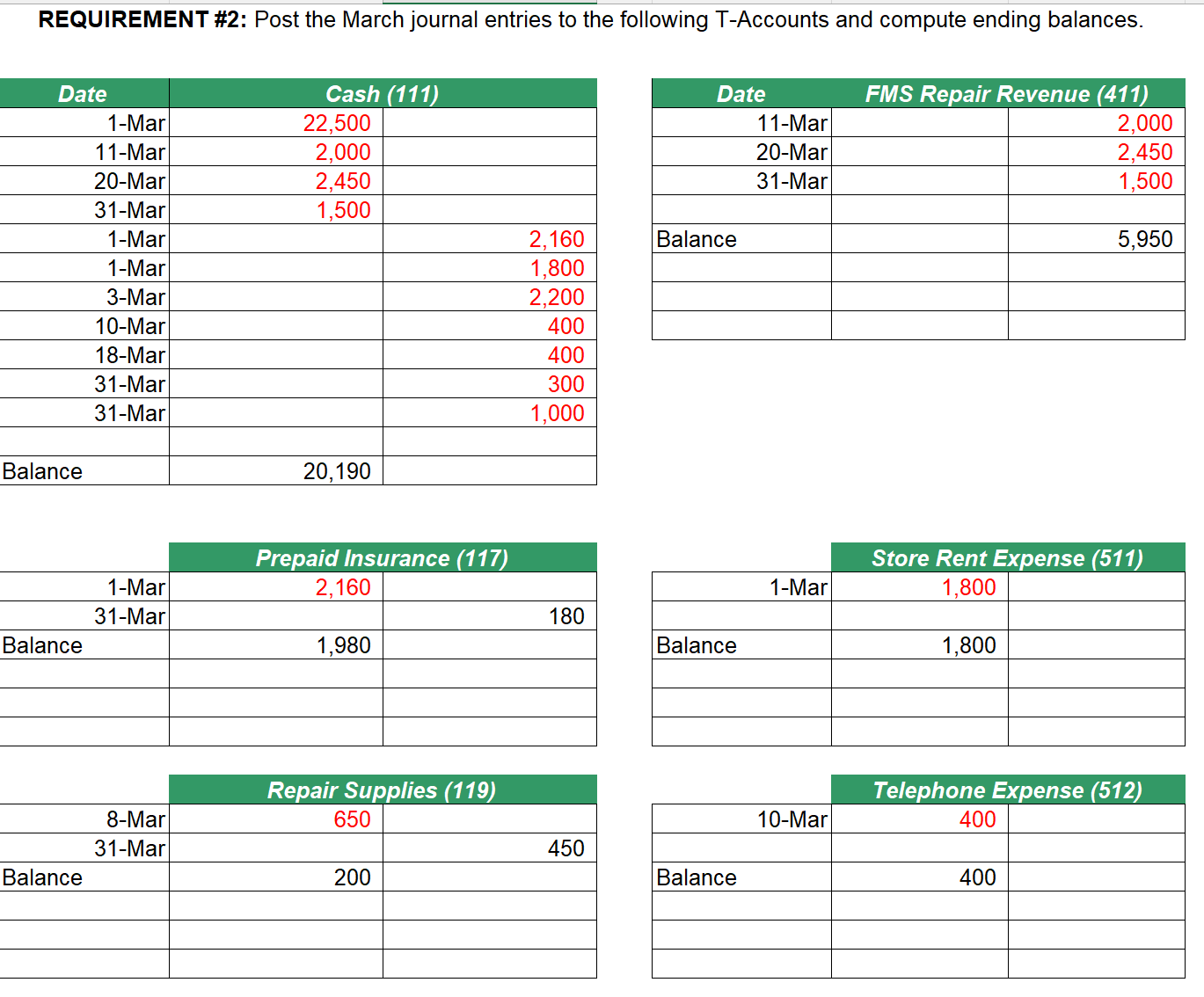

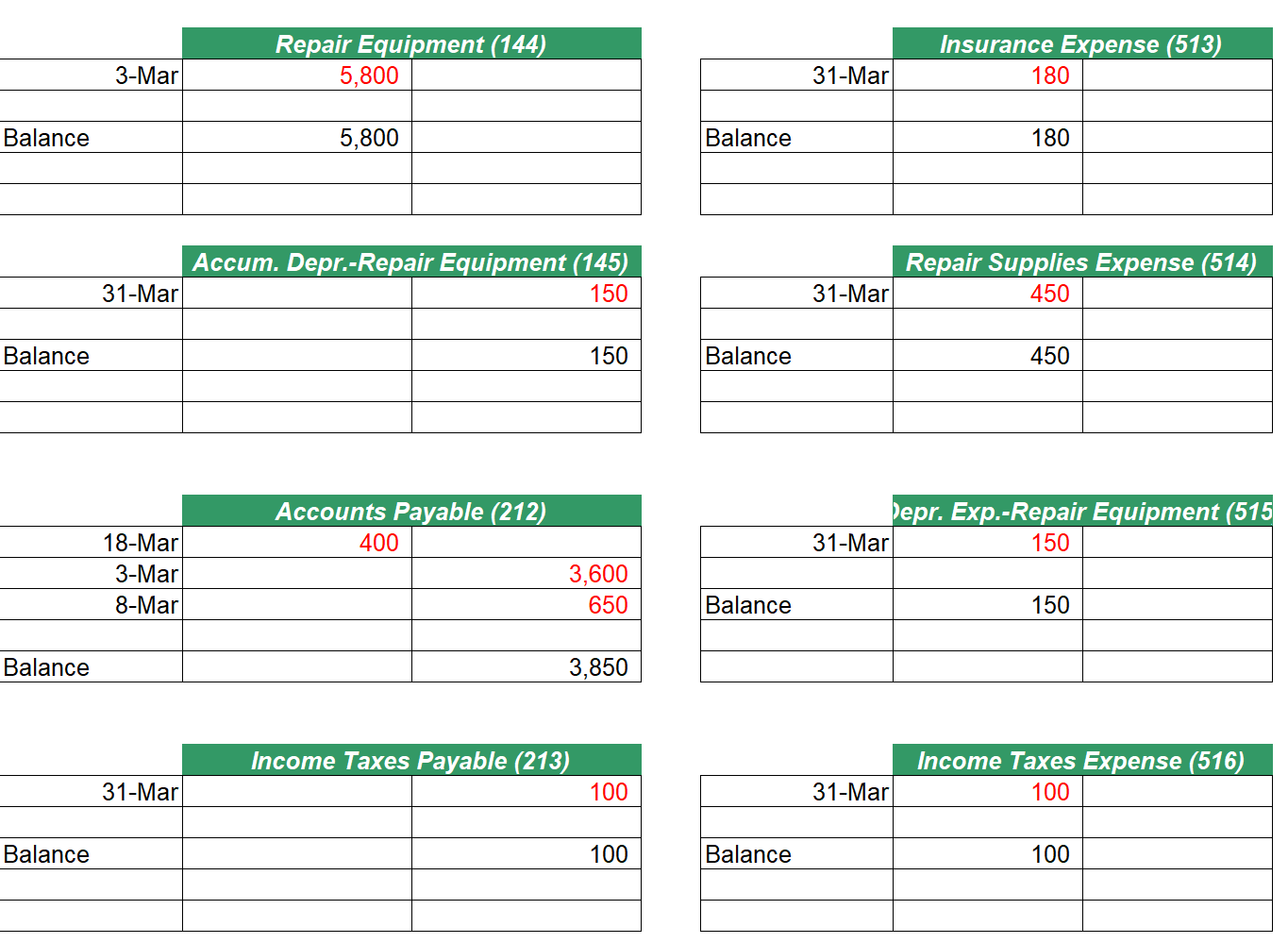

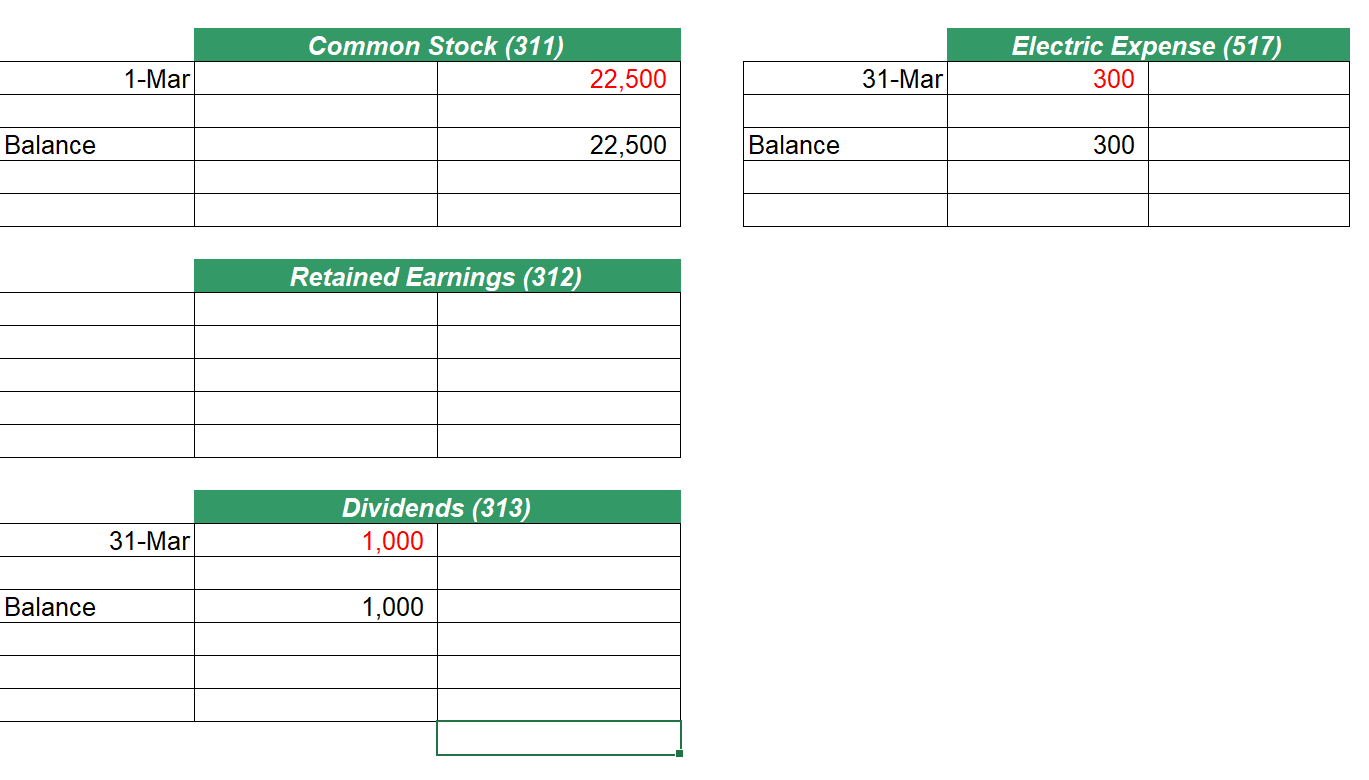

Using the information below from requirements 8 - 10 update the requirement 2 journal T- account below: Please update the journal below using the information

Using the information below from requirements 8 - 10 update the requirement 2 journal T- account below:

Please update the journal below using the information above:

REQUIREMENT \#2: Post the March journal entries to the following T-Accounts and compute ending balances. Requirement \# 10: Prepare a post-closing trial balance as of March 31 in the space Requirement \#8: Prepare the closing entries at March 31 in the General Journal below. Hint: Use the balances for each account which appear on the Adjusted Trial Balance for your closing entries. Requirement \#9: Post the closing entries to the T-Accounts on the General Ledger worksheet and compute ending balances. Just add to the adjusted balances already listed. \begin{tabular}{|l|r|l|} \hline & \multicolumn{2}{|c|}{ Repair Equipment (144) } \\ \hline 3-Mar & 5,800 & \\ \hline & & \\ \hline Balance & 5,800 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Accum. Depr.-Repair Equipment (145) } \\ \hline 31-Mar & & 150 \\ \hline Balance & & 150 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|r|r|r|} \hline & \multicolumn{2}{|c|}{ Accounts Payable (212) } \\ \hline 18-Mar & 400 & \\ \hline 3-Mar & & 3,600 \\ \hline 8-Mar & & 650 \\ \hline Balance & & 3,850 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ Income Taxes Payable (213) } \\ \hline 31-Mar & & 100 \\ \hline Balance & & 100 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Insurance Expense (513) } \\ \hline 31-Mar & 180 & \\ \hline & & \\ \hline Balance & 180 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Repair Supplies Expense (514) \begin{tabular}{|l|r|l|} \hline 31-Mar & 450 & \\ \hline & & \\ \hline Balance & 450 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & Pepr. Exp.-Repair Equipment (515 \\ \hline 31-Mar & 150 & \\ \hline & & \\ \hline Balance & 150 & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Income Taxes Expense (516) } \\ \hline 31-Mar & 100 & \\ \hline & & \\ \hline Balance & 100 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} General Journal \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountNumberfromChartofAccountstab & Account Title from Chart of Accounts tab & Debit & Credit \\ \hline \multirow[t]{2}{*}{ 31-Mar } & 411 & FMS Repair Revenue & 5,950 & \\ \hline & & Income Summary & & 5,950 \\ \hline \multirow[t]{8}{*}{ 31-Mar } & & Income Summary & 3,380 & \\ \hline & 511 & Store rent Expenses & & 1,800 \\ \hline & 512 & Telephone Expenses & & 400 \\ \hline & 517 & Electric Expenses & & 300 \\ \hline & 513 & Insurance Expense & & 180 \\ \hline & 515 & Depreciation Expenses - Repair Equipment & & 150 \\ \hline & 516 & Income Tax Expenses & & 100 \\ \hline & 514 & Supplies Expenses & & 450 \\ \hline \multirow[t]{2}{*}{ 31-Mar } & & Income Summary & 2,570 & \\ \hline & 312 & Retained Earnings & & 2,570 \\ \hline \multirow[t]{2}{*}{ 31-Mar } & 312 & Retained Earnings & 1,000 & \\ \hline & 313 & Dividends & & 1,000 \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & 12,900 & 12,900 \\ \hline \end{tabular} \begin{tabular}{|l|l|r|} \hline \multicolumn{1}{|c|}{} & \multicolumn{2}{|c|}{ Common Stock (311) } \\ \hline 1-Mar & & 22,500 \\ \hline Balance & & 22,500 \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} \hline \multicolumn{1}{c|}{} & \multicolumn{2}{c|}{ Electric Expense (517) } \\ \hline 31-Mar & 300 & \\ \hline Balance & & \\ \hline & 300 & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline & \multicolumn{2}{|c|}{ Retained Earnings (312) } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|l|r|l|} & \multicolumn{2}{|c|}{ Dividends (313) } \\ \hline & 1,000 & \\ \hline 31-Mar & & \\ \hline Balance & 1,000 & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started