Answered step by step

Verified Expert Solution

Question

1 Approved Answer

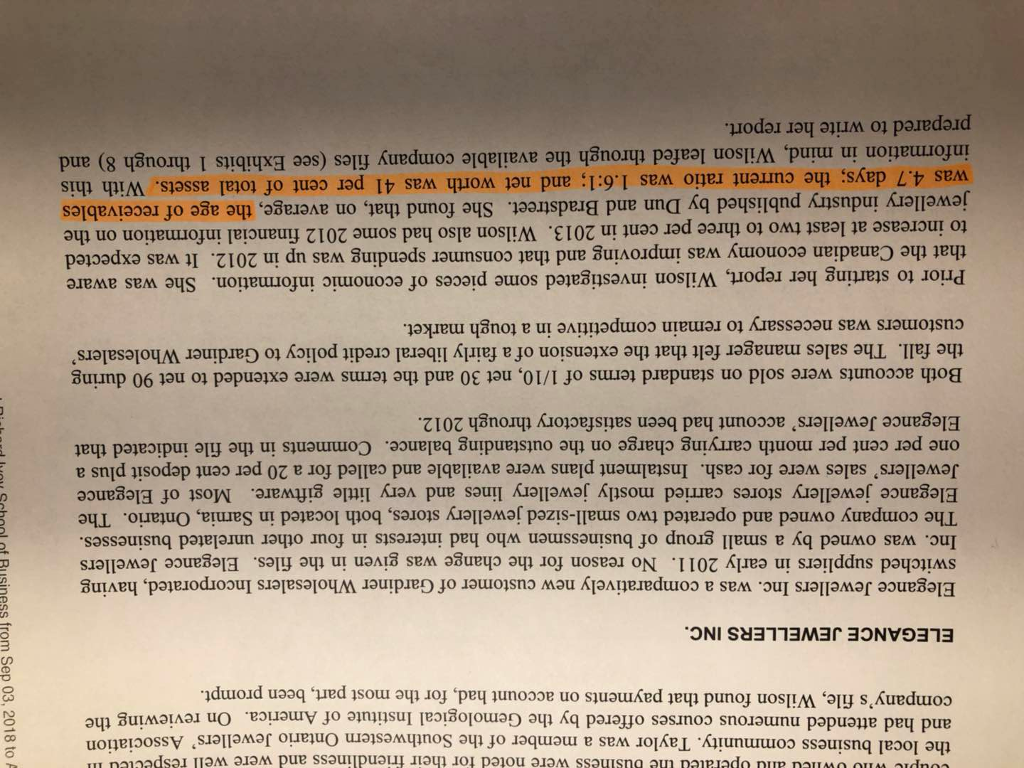

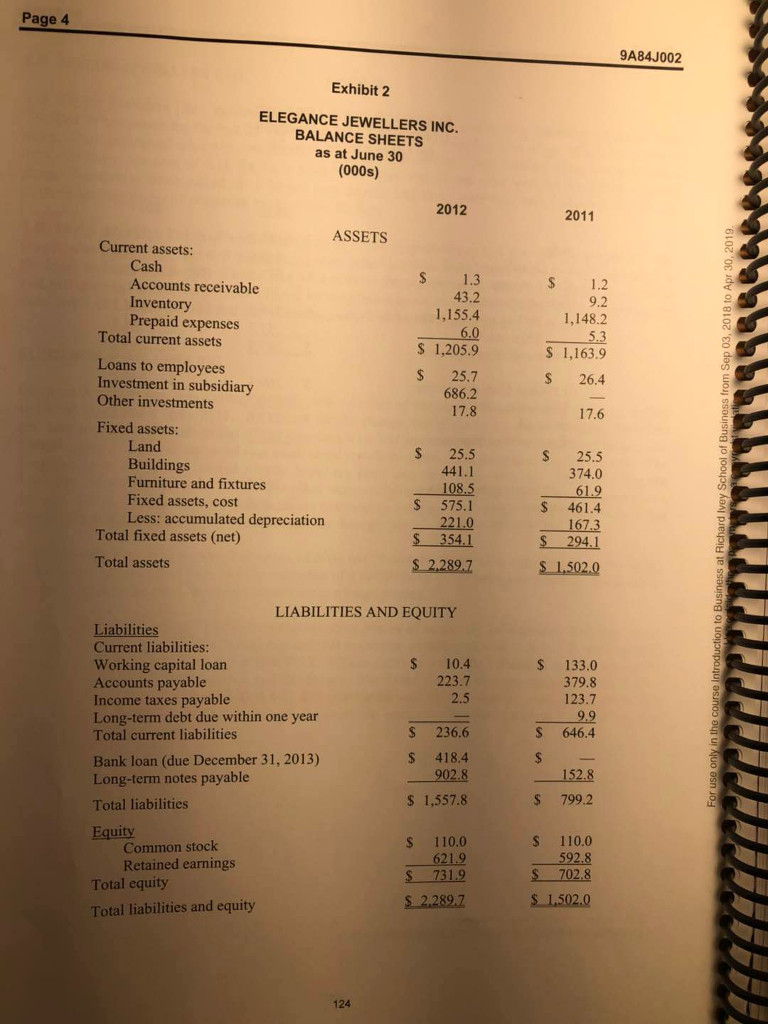

Using the information given about Elegance Jewellers Inc., analyze the company's financial position in detail (include the causes for the data listed) ELEGANCE JEWELLERS INCORPORATED

Using the information given about Elegance Jewellers Inc., analyze the company's financial position in detail (include the causes for the data listed)

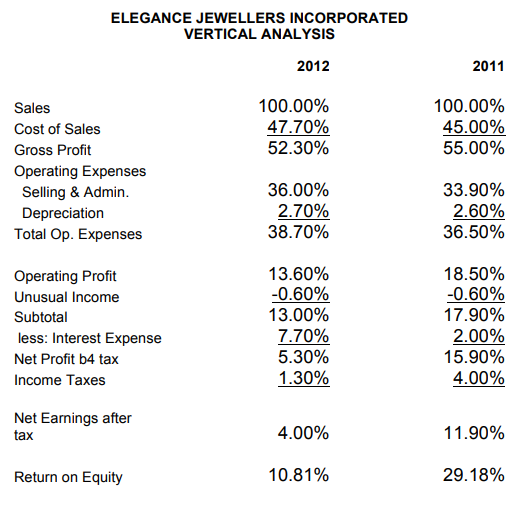

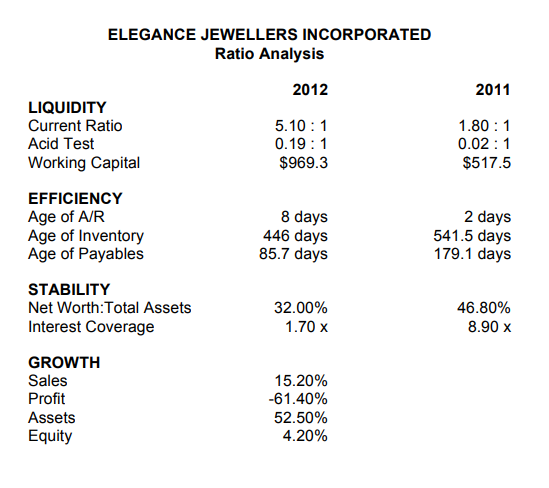

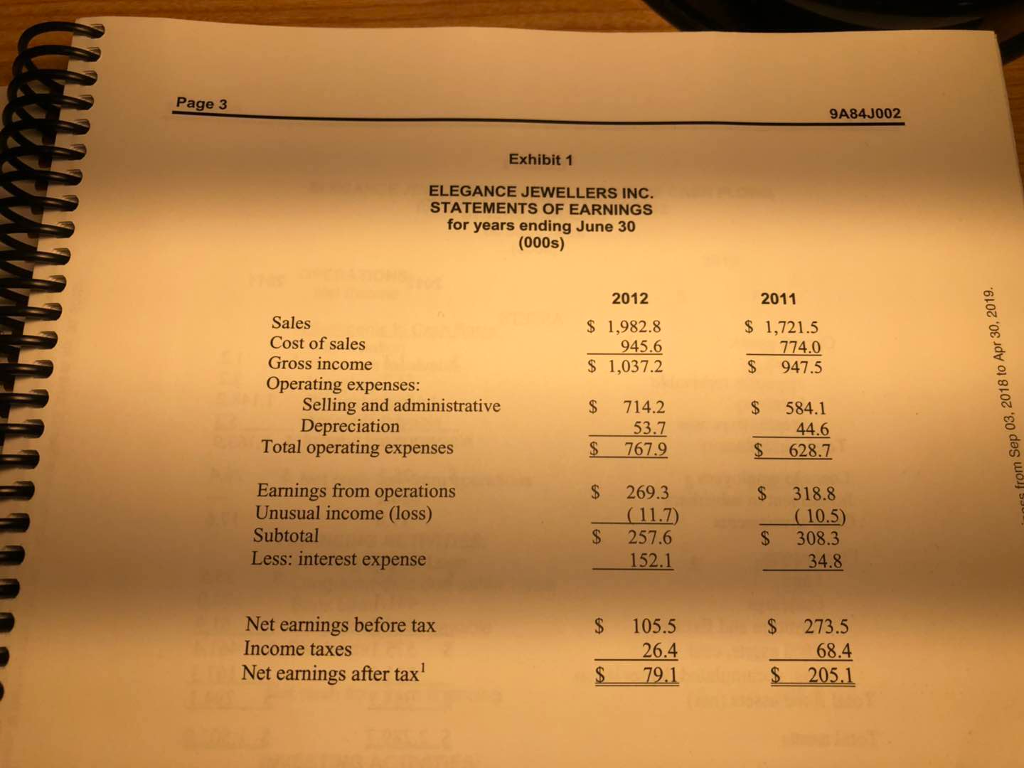

ELEGANCE JEWELLERS INCORPORATED VERTICAL ANALYSIS 2012 2011 Sales Cost of Sales Gross Profit Operating Expenses 100.00% 47 70% 52.30% 100.00% 45.00% 55.00% 36.00% 270% 38.70% 33.90% 2.60% 36.50% Selling & Admin Depreciation Total Op. Expenses Operating Profit Unusual Income Subtotal less: Interest Expense Net Profit b4 tax Income Taxes 13.60% -0,60% 13.00% 7.70% 5.30% 1.30% 18.50% -0.60% 17.90% 2.00% 15.90% 4,00% Net Eanings after tax 4.00% 11 .90% Return on Equity 10.81% 29.18%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started