Answered step by step

Verified Expert Solution

Question

1 Approved Answer

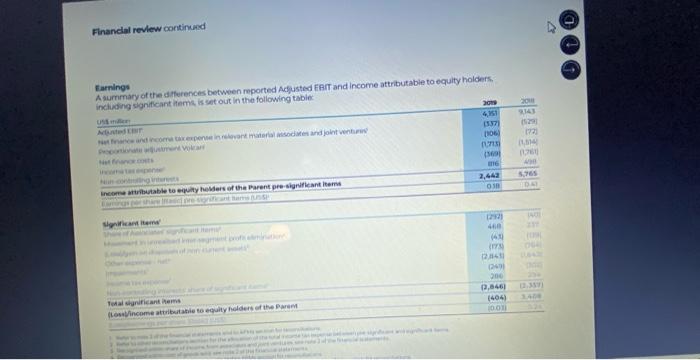

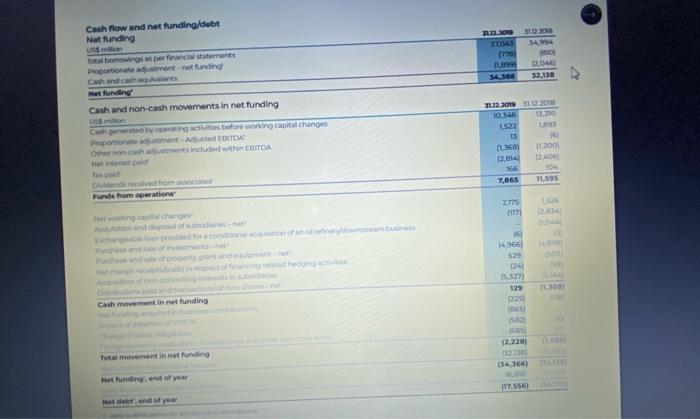

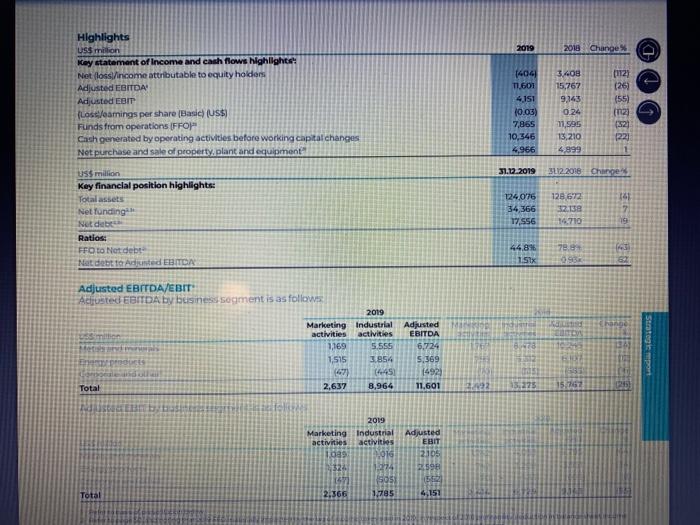

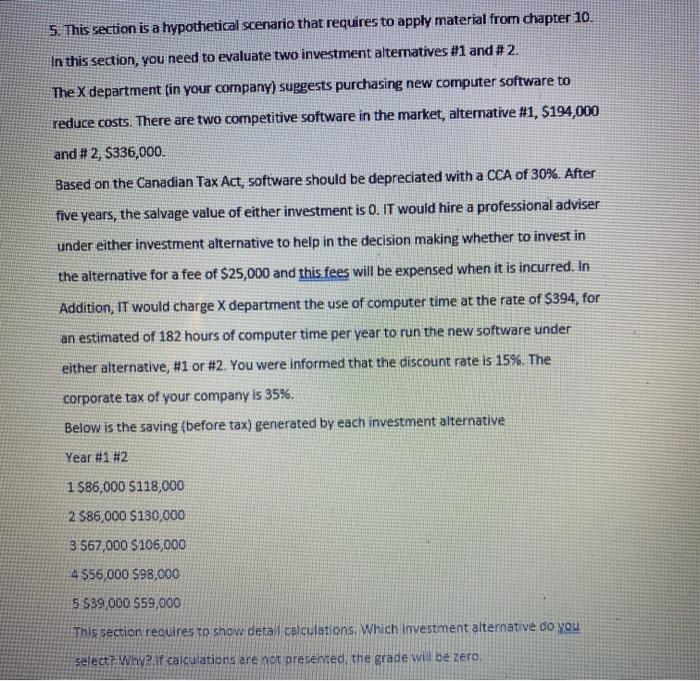

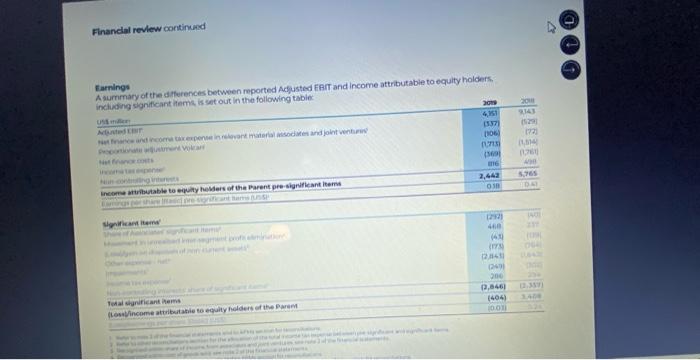

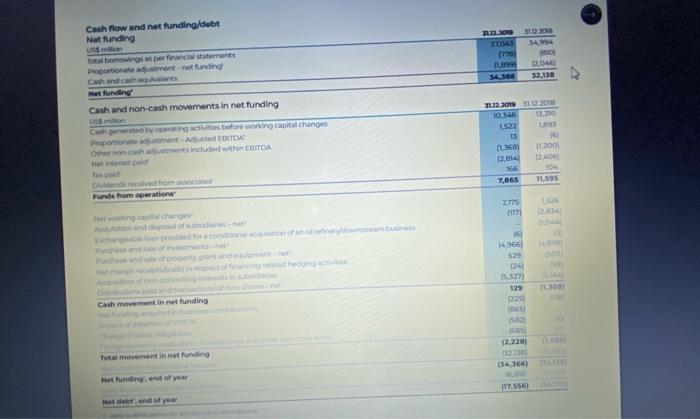

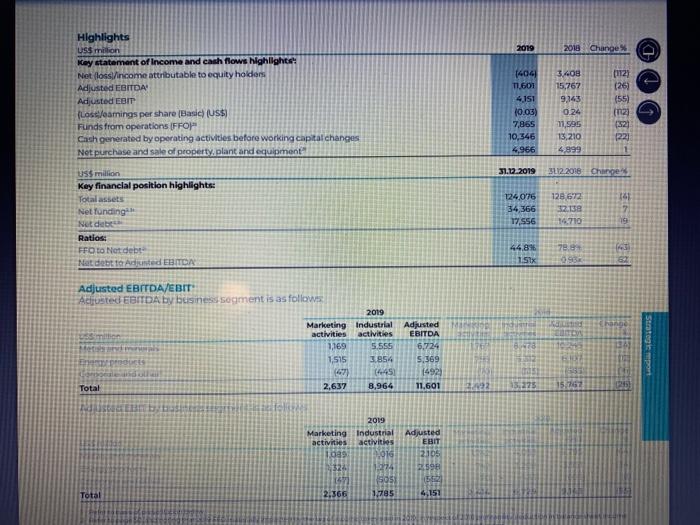

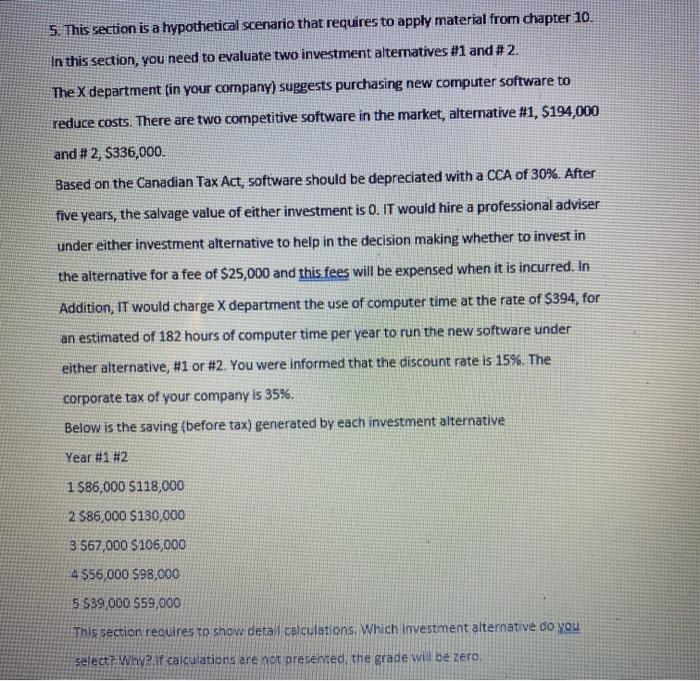

Using the information given, answrr the questions below Financial review continued Earnings A summary of the differences between reported Adjusted EBIT and income attributable to

Using the information given, answrr the questions below

Financial review continued Earnings A summary of the differences between reported Adjusted EBIT and income attributable to equity holders, including significant item is set out in the following table 20 137) 1106 om and component materiales and joint ventur now Os income table to holders of the Parent pre significantlar 460 144 12161 300 0,3461 Total significantiems Losincome tributable to equity holders of the Pro 1001 3494 Cm 24 Cash flow and not finding debt Not finding Un total borowings per financial statements Proportionsstartending Chand cash vos wet funding Cash and non-cash movements in net funding 14 ch by penting te before working capital changes proportionem adjusted EBITDA Other chants included within ITDA 12.2018 31.2018 10 54 11 16 16 1200 12.54 166 7,665 11,595 Funds from operatione 2.775 7 16 14366 0 024 129 225 DES Cash movement innet funding (2.220 Total movement in net funding Net funding, and of year Nadet.no 2019 2018 Change Highlights US$ million Key statement of Income and cash flows Highlight Netloss/income attributable to equity holders Adjusted EBITDA Adjusted EBIT (Losamnings per share (Basic) (US$) Funds from operations (FFOP Cash generated by operating activities before working capital changes Not purchase and sale of property.plant and equipment 1404 60 4.151 10.03) 7,865 10,346 4,966 3408 15,767 9343 024 11.595 13,210 4,899 (112) (26) (55) (12) 21 221 1 31.12.2019 3.12.2018 Change US$ million Key financial position highlights: Total assets Net fundinga Net dat Ratios FFO to Net debt Nat debt to Adunted EBITOR 124,076 34 366 17.556 128,672 372 138 14.710 181 7 19 78.8 44.87 1.5TX Adjusted EBITDA/EBIT Acusted EBITDA by business segment is as follows 2019 Marketing Industrial activities activities 1,169 5.555 1,515 1.854 67 (5) Total 2,637 8,964 Adjusted EBITDA 6,724 S.369 1492 11.601 Strategisport 122 15,278 15.12 12:45 EB 2019 Marketing Industrial activities activities 2016 328 224 50 2,366 1,795 Adjusted EBIT 2105 759 Total 4,151 5. This section is a hypothetical scenario that requires to apply material from Chapter 10. In this section, you need to evaluate two investment alternatives #1 and #2. The X department in your company) suggests purchasing new computer software to reduce costs. There are two competitive software in the market, altemative #1, $194,000 and# 2, $336,000. Based on the Canadian Tax Act, software should be depreciated with a CCA of 30%. After five years, the salvage value of either investment is O. IT would hire a professional adviser under either investment alternative to help in the decision making whether to invest in the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year #1 #2 1 586,000 $118,000 2 586,000 $130,000 3 567,000 $106,000 4 $56,000 $98,000 5 $39,000 $59.000 This section requires to show detail calculations. Which investment alternative do you select? Why calculations are not presented the grade will be zero. Financial review continued Earnings A summary of the differences between reported Adjusted EBIT and income attributable to equity holders, including significant item is set out in the following table 20 137) 1106 om and component materiales and joint ventur now Os income table to holders of the Parent pre significantlar 460 144 12161 300 0,3461 Total significantiems Losincome tributable to equity holders of the Pro 1001 3494 Cm 24 Cash flow and not finding debt Not finding Un total borowings per financial statements Proportionsstartending Chand cash vos wet funding Cash and non-cash movements in net funding 14 ch by penting te before working capital changes proportionem adjusted EBITDA Other chants included within ITDA 12.2018 31.2018 10 54 11 16 16 1200 12.54 166 7,665 11,595 Funds from operatione 2.775 7 16 14366 0 024 129 225 DES Cash movement innet funding (2.220 Total movement in net funding Net funding, and of year Nadet.no 2019 2018 Change Highlights US$ million Key statement of Income and cash flows Highlight Netloss/income attributable to equity holders Adjusted EBITDA Adjusted EBIT (Losamnings per share (Basic) (US$) Funds from operations (FFOP Cash generated by operating activities before working capital changes Not purchase and sale of property.plant and equipment 1404 60 4.151 10.03) 7,865 10,346 4,966 3408 15,767 9343 024 11.595 13,210 4,899 (112) (26) (55) (12) 21 221 1 31.12.2019 3.12.2018 Change US$ million Key financial position highlights: Total assets Net fundinga Net dat Ratios FFO to Net debt Nat debt to Adunted EBITOR 124,076 34 366 17.556 128,672 372 138 14.710 181 7 19 78.8 44.87 1.5TX Adjusted EBITDA/EBIT Acusted EBITDA by business segment is as follows 2019 Marketing Industrial activities activities 1,169 5.555 1,515 1.854 67 (5) Total 2,637 8,964 Adjusted EBITDA 6,724 S.369 1492 11.601 Strategisport 122 15,278 15.12 12:45 EB 2019 Marketing Industrial activities activities 2016 328 224 50 2,366 1,795 Adjusted EBIT 2105 759 Total 4,151 5. This section is a hypothetical scenario that requires to apply material from Chapter 10. In this section, you need to evaluate two investment alternatives #1 and #2. The X department in your company) suggests purchasing new computer software to reduce costs. There are two competitive software in the market, altemative #1, $194,000 and# 2, $336,000. Based on the Canadian Tax Act, software should be depreciated with a CCA of 30%. After five years, the salvage value of either investment is O. IT would hire a professional adviser under either investment alternative to help in the decision making whether to invest in the alternative for a fee of $25,000 and this fees will be expensed when it is incurred. In Addition, IT would charge X department the use of computer time at the rate of $394, for an estimated of 182 hours of computer time per year to run the new software under either alternative, #1 or #2. You were informed that the discount rate is 15%. The corporate tax of your company is 35%. Below is the saving (before tax) generated by each investment alternative Year #1 #2 1 586,000 $118,000 2 586,000 $130,000 3 567,000 $106,000 4 $56,000 $98,000 5 $39,000 $59.000 This section requires to show detail calculations. Which investment alternative do you select? Why calculations are not presented the grade will be zero

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started