Answered step by step

Verified Expert Solution

Question

1 Approved Answer

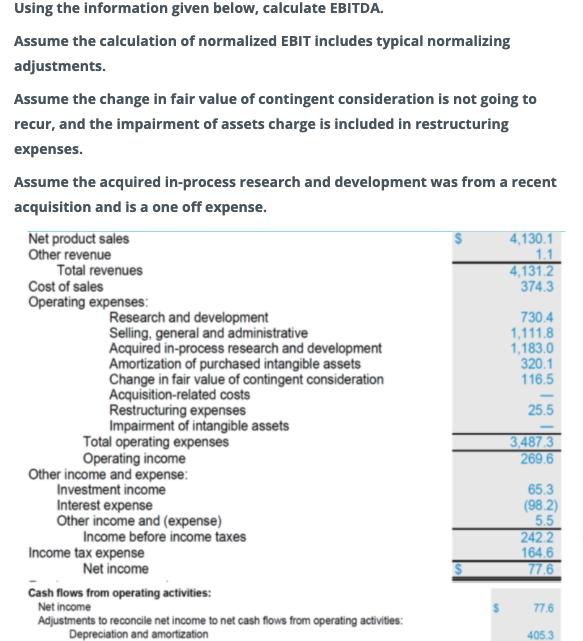

Using the information given below, calculate EBITDA. Assume the calculation of normalized EBIT includes typical normalizing adjustments. Assume the change in fair value of

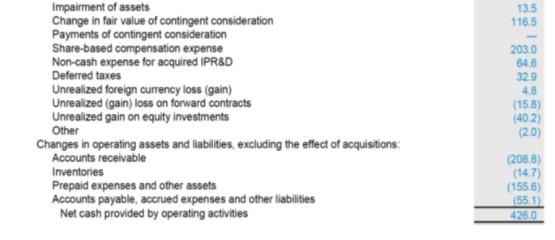

Using the information given below, calculate EBITDA. Assume the calculation of normalized EBIT includes typical normalizing adjustments. Assume the change in fair value of contingent consideration is not going to recur, and the impairment of assets charge is included in restructuring expenses. Assume the acquired in-process research and development was from a recent acquisition and is a one off expense. Net product sales Other revenue Total revenues Cost of sales Operating expenses: 4,130.1 1.1 4,131.2 374.3 730.4 1,111.8 1,183.0 320.1 116.5 Research and development Selling, general and administrative Acquired in-process research and development Amortization of purchased intangible assets Change in fair value of contingent consideration Acquisition-related costs Restructuring expenses Impairment of intangible assets Total operating expenses Operating income 25.5 3.487.3 269.6 Other income and expense: Investment income Interest expense Other income and (expense) 65.3 (98 2) 5.5 242.2 164.6 77.6 Income before income taxes Income tax expense Net income Cash flows from operating activities: Net income 77.6 Adjustments to reconcile net income to net cash flows from operating activities: Depreciation and amortization 405.3 Impairment of assets Change in fair value of contingent consideration Payments of contingent consideration Share-based compensation expense Non-cash expense for acquired IPR&D Deferred taxes 13.5 116.5 203.0 64.6 32.9 Unrealized foreign currency loss (gain) Unrealized (gain) loss on forward contracts Unrealized gain on equity investments 4.8 (15.8) (40.2) (2.0) Other Changes in operating assets and liabiltes, excluding the effect of acquisitions: Accounts receivable (208.8) (14.7) (155.6) (55 1) 426.0 Inventories Prepaid expenses and other assets Accounts payable, accrued expenses and other liabilities Net cash provided by operating activities

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Reported operating income 2696 Add non recurring and abnormal expenses Acquired inpro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started