Using the information given, you are to determine whether this information suggests that Tesla should have relatively (% of assets or % of capital) more or less debt in its financing mix than is the case for the average firm in the industry. Point to specifics that provide support for your recommendation. Industry Life Cycle & Company Growth While the auto industry was very much in the mature stage of the life cycle in 2017, Tesla was closer in character to that of a growth company. Tesla had rapid sales growth from 2014 through 2017, with average sales growth of 55% per year. This growth was somewhat hampered by manufacturing capacity and inefficient production processes. To alleviate this problem, Tesla was in the middle of an even more rapid capital investment phase, building new production plants in China and Europe, and expanding production capacity at its existing plant. Industry Dynamics and Competitive Positioning By the nature of its product, an expensive, discretionary item, the auto industry is highly cyclical. Historically, auto sales and profitability move with the business cycle, with auto firms typically doing well during economic expansions and poorly during recessions. The industry is characterized by high fixed operating costs, and relatively high use of debt by many firms in the industry. While competition is high in the auto industry, all participants try to differentiate their product from that of the competition in order to increase sales and profit margins. This is a characteristic of the industry structure commonly referred to as monopolistic competition (not monopoly). Teslas product is further differentiated from its competition. Unlike its competition, Tesla was in the process of building an entire ecosystem of charging stations, a repair network bringing the mechanic to the owner, and a home delivery system. If EVs were to take hold in a nation built around the combustion engine, then this would give Tesla an initial advantage against competition. In fact, industry analysts and auto engineers estimated at the time that Tesla had a ten year head start on the competition. Information/Signaling By virtue of their stage in the industry life cycle, and the nature of their product, the value of most automotive manufacturers is a function of assets in place, whereas Teslas value was much more a function of its growth opportunities. This makes Teslas value harder to determine than other firms in the industry, and places a greater importance on insider information.

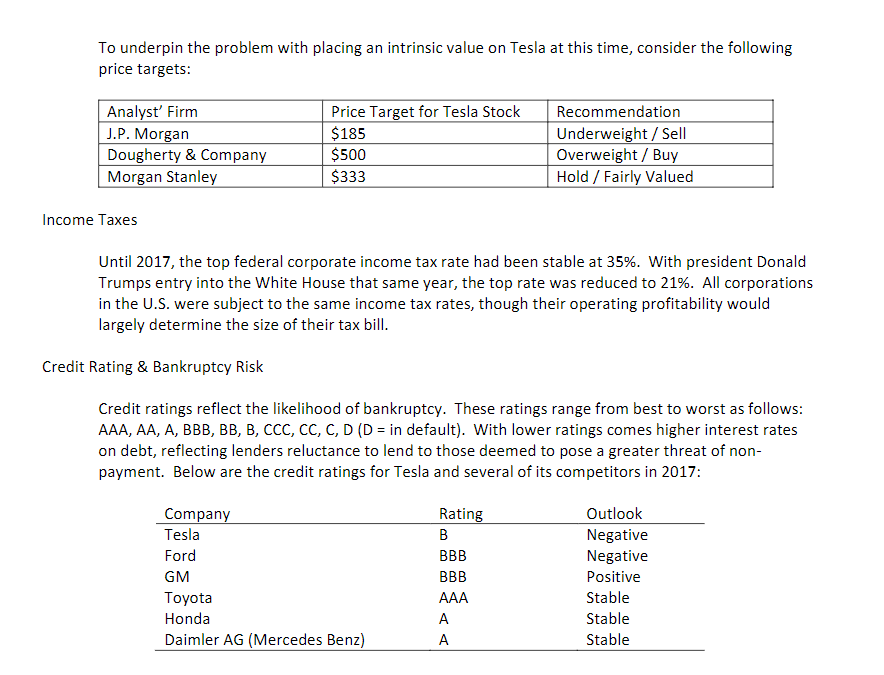

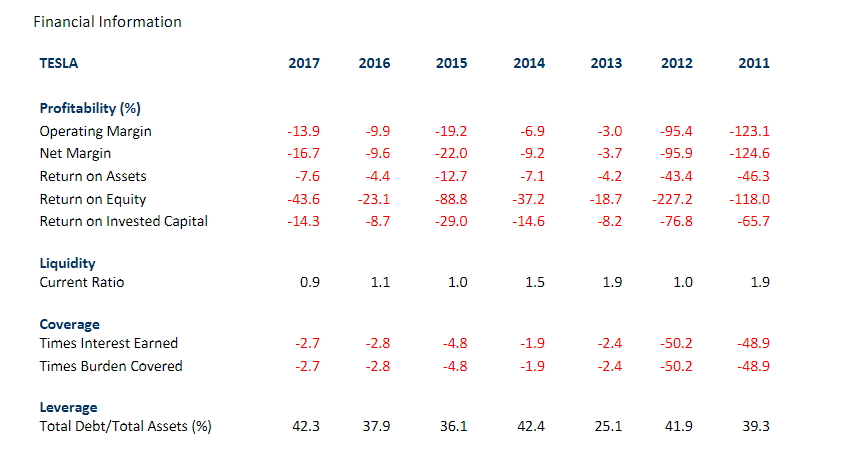

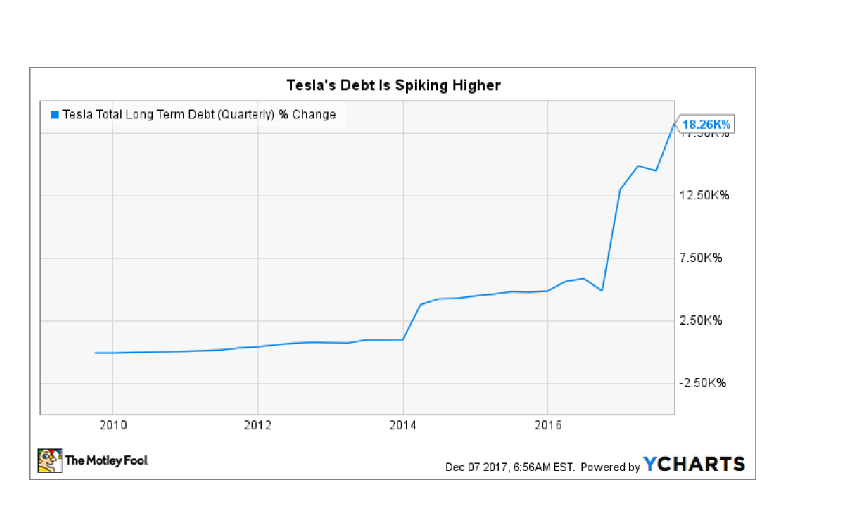

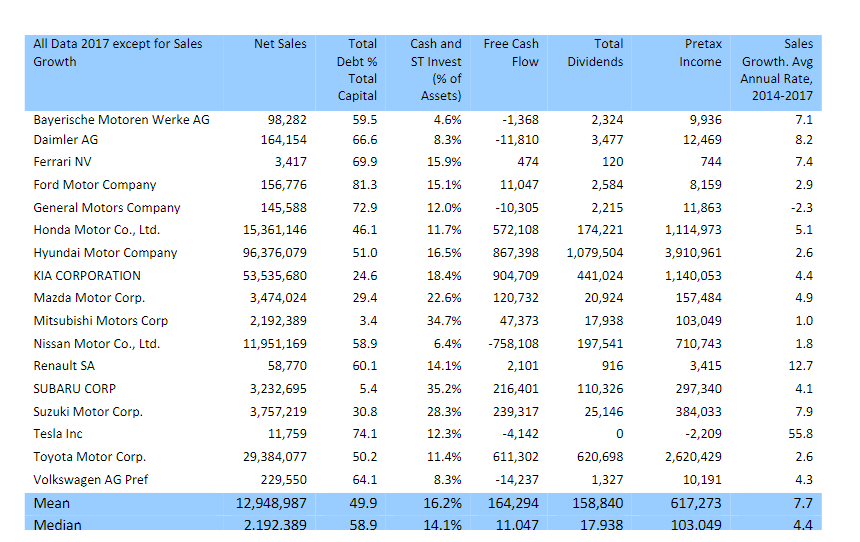

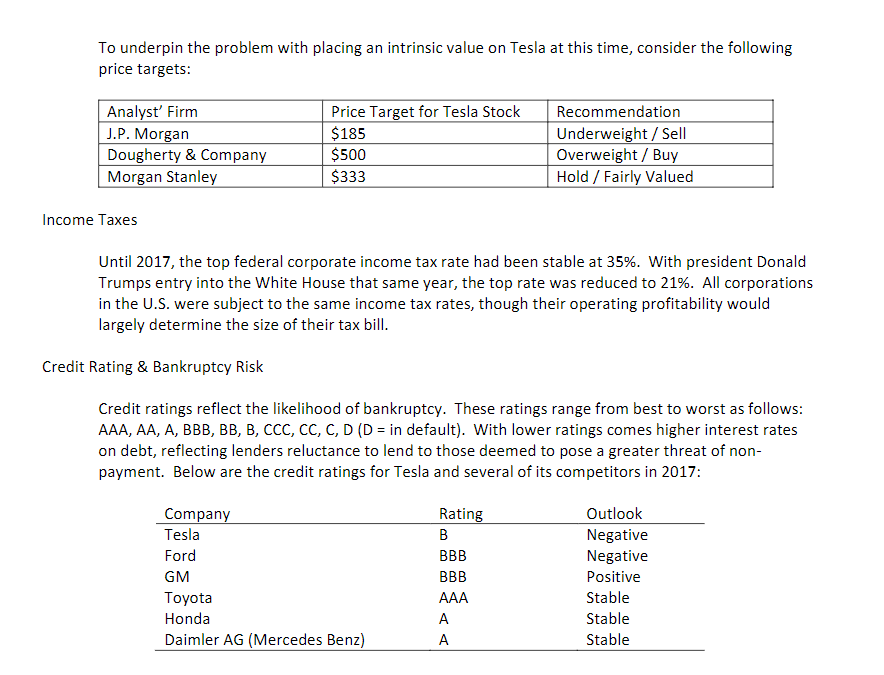

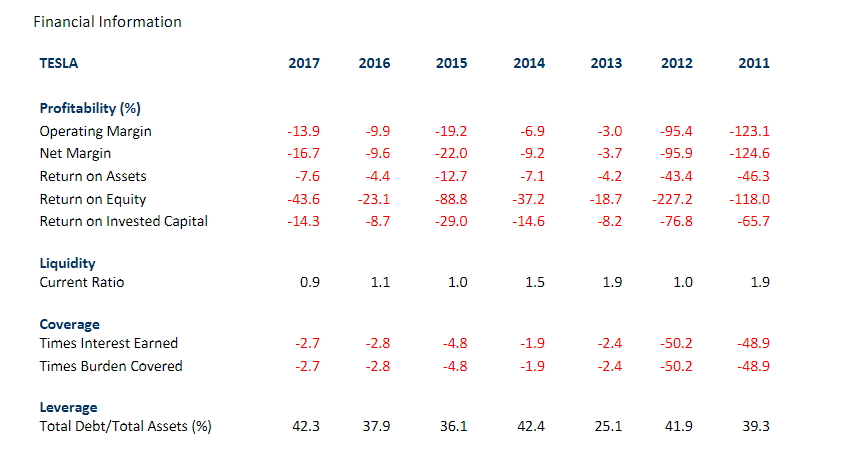

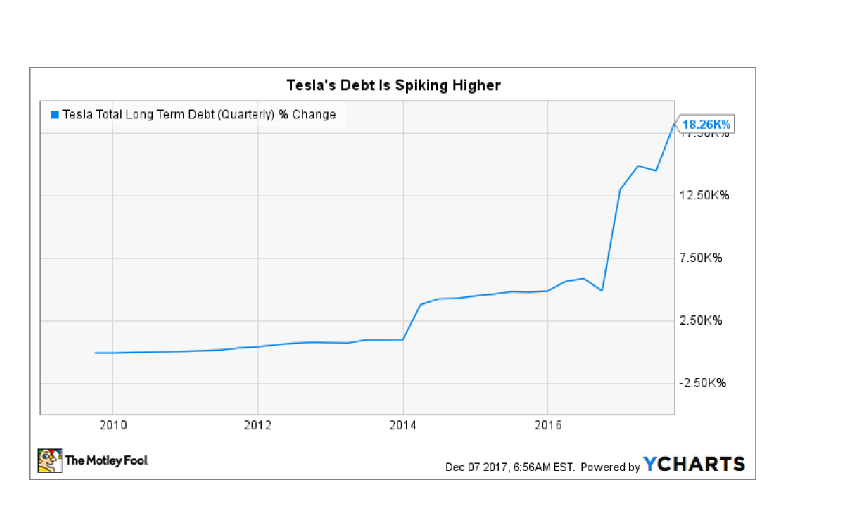

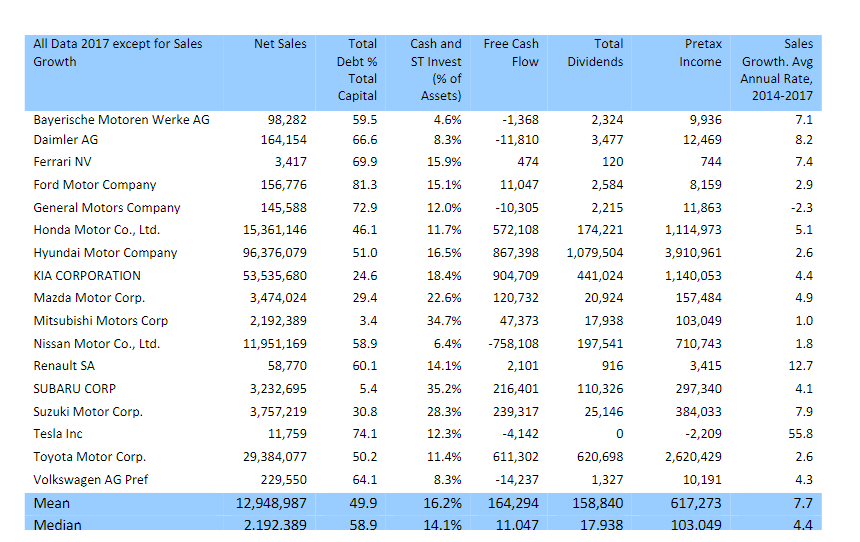

To underpin the problem with placing an intrinsic value on Tesla at this time, consider the following price targets: Analyst' Firm J.P. Morgan Dougherty & Company Morgan Stanley Price Target for Tesla Stock $185 $500 $333 Recommendation Underweight / Sell Overweight / Buy Hold / Fairly Valued Income Taxes Until 2017, the top federal corporate income tax rate had been stable at 35%. With president Donald Trumps entry into the White House that same year, the top rate was reduced to 21%. All corporations in the U.S. were subject to the same income tax rates, though their operating profitability would largely determine the size of their tax bill. Credit Rating & Bankruptcy Risk Credit ratings reflect the likelihood of bankruptcy. These ratings range from best to worst as follows: AAA, AA, A, BBB, BB, B, CCC, CC, C, D (D = in default). With lower ratings comes higher interest rates on debt, reflecting lenders reluctance to lend to those deemed to pose a greater threat of non- payment. Below are the credit ratings for Tesla and several of its competitors in 2017: Company Tesla Ford GM Toyota Honda Daimler AG (Mercedes Benz) Rating B BBB BBB AAA A A Outlook Negative Negative Positive Stable Stable Stable Financial Information TESLA 2017 2016 2015 2014 2013 2012 2011 Profitability (%) Operating Margin Net Margin Return on Assets Return on Equity Return on invested Capital -13.9 -16.7 -7.6 -43.6 -14.3 -9.9 -9.6 -4.4 -23.1 -8.7 -19.2 -22.0 -12.7 -88.8 -29.0 -6.9 -9.2 -7.1 -37.2 -14.6 -3.0 -3.7 -4.2 -18.7 -8.2 -95.4 -95.9 -43.4 -227.2 -76.8 -123.1 -124.6 -46.3 -118.0 -65.7 Liquidity Current Ratio 0.9 1.1 1.0 1.5 1.9 1.0 1.9 Coverage Times Interest Earned Times Burden Covered -4.8 -1.9 -2.4 -2.7 -2.7 -2.8 -2.8 -50.2 -50.2 -48.9 -48.9 -4.8 -1.9 -2.4 Leverage Total Debt/Total Assets (%) 42.3 37.9 36.1 42.4 25.1 41.9 39.3 Tesla's Debt Is Spiking Higher Tesla Total Long Term Debt (Quarterly) % Change 18.26K% TT.JUro 12.50K% 7.50K% 2.50K% -250K% 2010 2012 2014 2016 The Motley Fool Dec 07 2017, 6:56AM EST. Powered by YCHARTS Net Sales Total All Data 2017 except for Sales Growth Free Cash Flow Dividends Total Debt % Total Capital Cash and ST Invest (% of Assets) 59.5 4.6% 8.3% 66.6 -1,368 -11,810 474 69.9 15.9% 81.3 15.1% 72.9 12.0% 46.1 11.7% 51.0 16.5% 24.6 18.4% 2,324 3,477 120 2,584 2,215 174,221 1,079,504 441,024 20,924 17,938 197,541 916 110,326 25,146 Bayerische Motoren Werke AG Daimler AG Ferrari NV Ford Motor Company General Motors Company Honda Motor Co., Ltd. Hyundai Motor Company KIA CORPORATION Mazda Motor Corp. Mitsubishi Motors Corp Nissan Motor Co., Ltd. Renault SA SUBARU CORP Suzuki Motor Corp. Tesla Inc Toyota Motor Corp. Volkswagen AG Pref Mean Median 29.4 98,282 164,154 3,417 156,776 145,588 15,361,146 96,376,079 53,535,680 3,474,024 2,192,389 11,951,169 58,770 3,232,695 3,757,219 11,759 29,384,077 229,550 12,948,987 2.192.389 22.6% Pretax Sales Income Growth. Avg Annual Rate, 2014-2017 9,936 7.1 12,469 8.2 744 7.4 8,159 2.9 11,863 -2.3 1,114,973 5.1 3,910,961 2.6 1,140,053 4.4 157,484 4.9 103,049 1.0 710,743 1.8 3,415 12.7 297,340 4.1 384,033 7.9 -2,209 55.8 2,620,429 2.6 10,191 4.3 617,273 7.7 103.049 4.4 3.4 34.7% 11,047 -10,305 572,108 867,398 904,709 120,732 47,373 -758,108 2,101 216,401 239,317 -4,142 611,302 -14,237 164,294 11.047 58.9 6.4% 60.1 14.1% 5.4 35.2% 30.8 28.3% 74.1 12.3% 0 50.2 11.4% 64.1 8.3% 620,698 1,327 158,840 17.938 49.9 58.9 16.2% 14.1% To underpin the problem with placing an intrinsic value on Tesla at this time, consider the following price targets: Analyst' Firm J.P. Morgan Dougherty & Company Morgan Stanley Price Target for Tesla Stock $185 $500 $333 Recommendation Underweight / Sell Overweight / Buy Hold / Fairly Valued Income Taxes Until 2017, the top federal corporate income tax rate had been stable at 35%. With president Donald Trumps entry into the White House that same year, the top rate was reduced to 21%. All corporations in the U.S. were subject to the same income tax rates, though their operating profitability would largely determine the size of their tax bill. Credit Rating & Bankruptcy Risk Credit ratings reflect the likelihood of bankruptcy. These ratings range from best to worst as follows: AAA, AA, A, BBB, BB, B, CCC, CC, C, D (D = in default). With lower ratings comes higher interest rates on debt, reflecting lenders reluctance to lend to those deemed to pose a greater threat of non- payment. Below are the credit ratings for Tesla and several of its competitors in 2017: Company Tesla Ford GM Toyota Honda Daimler AG (Mercedes Benz) Rating B BBB BBB AAA A A Outlook Negative Negative Positive Stable Stable Stable Financial Information TESLA 2017 2016 2015 2014 2013 2012 2011 Profitability (%) Operating Margin Net Margin Return on Assets Return on Equity Return on invested Capital -13.9 -16.7 -7.6 -43.6 -14.3 -9.9 -9.6 -4.4 -23.1 -8.7 -19.2 -22.0 -12.7 -88.8 -29.0 -6.9 -9.2 -7.1 -37.2 -14.6 -3.0 -3.7 -4.2 -18.7 -8.2 -95.4 -95.9 -43.4 -227.2 -76.8 -123.1 -124.6 -46.3 -118.0 -65.7 Liquidity Current Ratio 0.9 1.1 1.0 1.5 1.9 1.0 1.9 Coverage Times Interest Earned Times Burden Covered -4.8 -1.9 -2.4 -2.7 -2.7 -2.8 -2.8 -50.2 -50.2 -48.9 -48.9 -4.8 -1.9 -2.4 Leverage Total Debt/Total Assets (%) 42.3 37.9 36.1 42.4 25.1 41.9 39.3 Tesla's Debt Is Spiking Higher Tesla Total Long Term Debt (Quarterly) % Change 18.26K% TT.JUro 12.50K% 7.50K% 2.50K% -250K% 2010 2012 2014 2016 The Motley Fool Dec 07 2017, 6:56AM EST. Powered by YCHARTS Net Sales Total All Data 2017 except for Sales Growth Free Cash Flow Dividends Total Debt % Total Capital Cash and ST Invest (% of Assets) 59.5 4.6% 8.3% 66.6 -1,368 -11,810 474 69.9 15.9% 81.3 15.1% 72.9 12.0% 46.1 11.7% 51.0 16.5% 24.6 18.4% 2,324 3,477 120 2,584 2,215 174,221 1,079,504 441,024 20,924 17,938 197,541 916 110,326 25,146 Bayerische Motoren Werke AG Daimler AG Ferrari NV Ford Motor Company General Motors Company Honda Motor Co., Ltd. Hyundai Motor Company KIA CORPORATION Mazda Motor Corp. Mitsubishi Motors Corp Nissan Motor Co., Ltd. Renault SA SUBARU CORP Suzuki Motor Corp. Tesla Inc Toyota Motor Corp. Volkswagen AG Pref Mean Median 29.4 98,282 164,154 3,417 156,776 145,588 15,361,146 96,376,079 53,535,680 3,474,024 2,192,389 11,951,169 58,770 3,232,695 3,757,219 11,759 29,384,077 229,550 12,948,987 2.192.389 22.6% Pretax Sales Income Growth. Avg Annual Rate, 2014-2017 9,936 7.1 12,469 8.2 744 7.4 8,159 2.9 11,863 -2.3 1,114,973 5.1 3,910,961 2.6 1,140,053 4.4 157,484 4.9 103,049 1.0 710,743 1.8 3,415 12.7 297,340 4.1 384,033 7.9 -2,209 55.8 2,620,429 2.6 10,191 4.3 617,273 7.7 103.049 4.4 3.4 34.7% 11,047 -10,305 572,108 867,398 904,709 120,732 47,373 -758,108 2,101 216,401 239,317 -4,142 611,302 -14,237 164,294 11.047 58.9 6.4% 60.1 14.1% 5.4 35.2% 30.8 28.3% 74.1 12.3% 0 50.2 11.4% 64.1 8.3% 620,698 1,327 158,840 17.938 49.9 58.9 16.2% 14.1%