Using the information in the first picture, can you please me how to do Question 2 in the second picture.

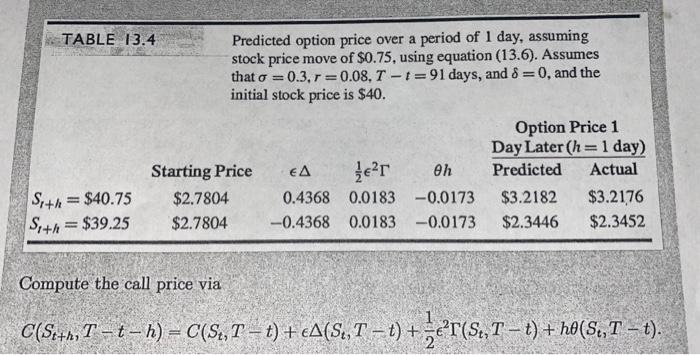

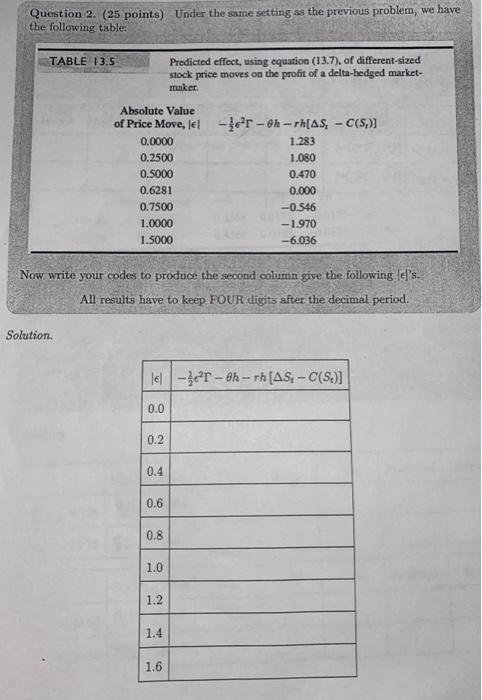

that o = TABLE 13.4 Predicted option price over a period of 1 day, assuming stock price move of $0.75, using equation (13.6). Assumes 0.3.r=0.08, T - t=91 days, and 8 =0, and the initial stock price is $40. Option Price 1 Day Later (h=1 day) Starting Price EA er oh Predicted Actual Site = $40.75 $2.7804 0.4368 0.0183 -0.0173 $3.2182 $3.2176 Sith = $39.25 $2.7804 -0.4368 0.0183 -0.0173 $2.3446 $2.3452 Compute the call price via C(S:+,, T e h) = C(S, 1 t) + A(S, T t) + 2T(S., T t) + h(,T t). Question 2. (25 points) Under the same setting as the previous problem, we have the following table TABLE 13.5 Predicted effect, using equation (13.7), of different sized stock price moves on the profit of a delta-hedged market- maker. Absolute Value of Price Move, lel 0.0000 0.2500 0.5000 0.6281 0.7500 1.0000 1.5000 -er -oh-rh[AS, - C(s)] 1.283 1.080 0.470 0.000 -0.546 -1.970 -6.036 Now write your codes to produce the second column give the following lel's. All results have to keep FOUR digits after the decimal period. Solution lel -er-eh- rh[AS, -C(S.)] 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 that o = TABLE 13.4 Predicted option price over a period of 1 day, assuming stock price move of $0.75, using equation (13.6). Assumes 0.3.r=0.08, T - t=91 days, and 8 =0, and the initial stock price is $40. Option Price 1 Day Later (h=1 day) Starting Price EA er oh Predicted Actual Site = $40.75 $2.7804 0.4368 0.0183 -0.0173 $3.2182 $3.2176 Sith = $39.25 $2.7804 -0.4368 0.0183 -0.0173 $2.3446 $2.3452 Compute the call price via C(S:+,, T e h) = C(S, 1 t) + A(S, T t) + 2T(S., T t) + h(,T t). Question 2. (25 points) Under the same setting as the previous problem, we have the following table TABLE 13.5 Predicted effect, using equation (13.7), of different sized stock price moves on the profit of a delta-hedged market- maker. Absolute Value of Price Move, lel 0.0000 0.2500 0.5000 0.6281 0.7500 1.0000 1.5000 -er -oh-rh[AS, - C(s)] 1.283 1.080 0.470 0.000 -0.546 -1.970 -6.036 Now write your codes to produce the second column give the following lel's. All results have to keep FOUR digits after the decimal period. Solution lel -er-eh- rh[AS, -C(S.)] 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6