Answered step by step

Verified Expert Solution

Question

1 Approved Answer

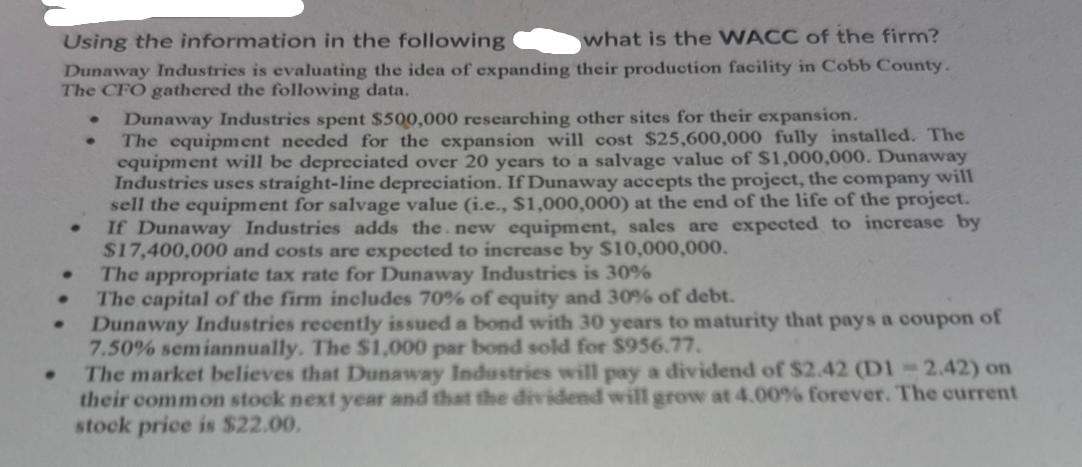

Using the information in the following what is the WACC of the firm? Dunaway Industries is evaluating the idea of expanding their production facility

Using the information in the following what is the WACC of the firm? Dunaway Industries is evaluating the idea of expanding their production facility in Cobb County. The CFO gathered the following data. . Dunaway Industries spent $500,000 researching other sites for their expansion. The equipment needed for the expansion will cost $25,600,000 fully installed. The equipment will be depreciated over 20 years to a salvage value of $1,000,000. Dunaway Industries uses straight-line depreciation. If Dunaway accepts the project, the company will sell the equipment for salvage value (i.e., $1,000,000) at the end of the life of the project. If Dunaway Industries adds the new equipment, sales are expected to increase by $17,400,000 and costs are expected to increase by $10,000,000. The appropriate tax rate for Dunaway Industries is 30% The capital of the firm includes 70% of equity and 30% of debt. Dunaway Industries recently issued a bond with 30 years to maturity that pays a coupon of 7.50% semiannually. The $1,000 par bond sold for $956.77. The market believes that Dunaway Industries will pay a dividend of $2.42 (D1 -2.42) on their common stock next year and that the dividend will grow at 4.00% forever. The current stock price is $22.00.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Weighted Average Cost of Capital WACC Calculation for Dunaway Industries 1 Cost of Debt Kd ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started