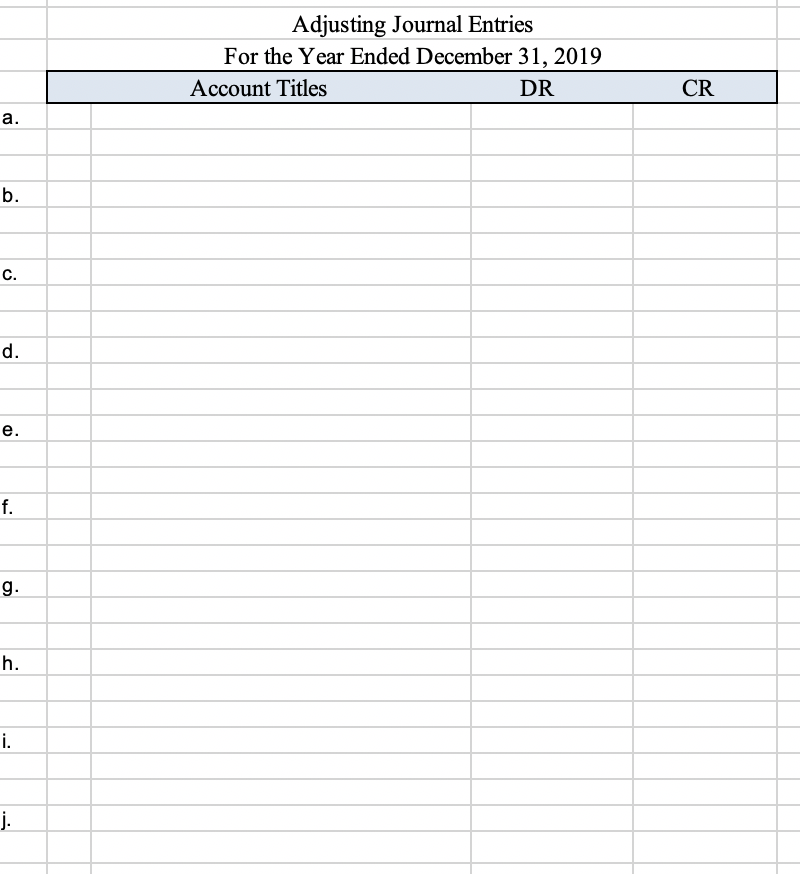

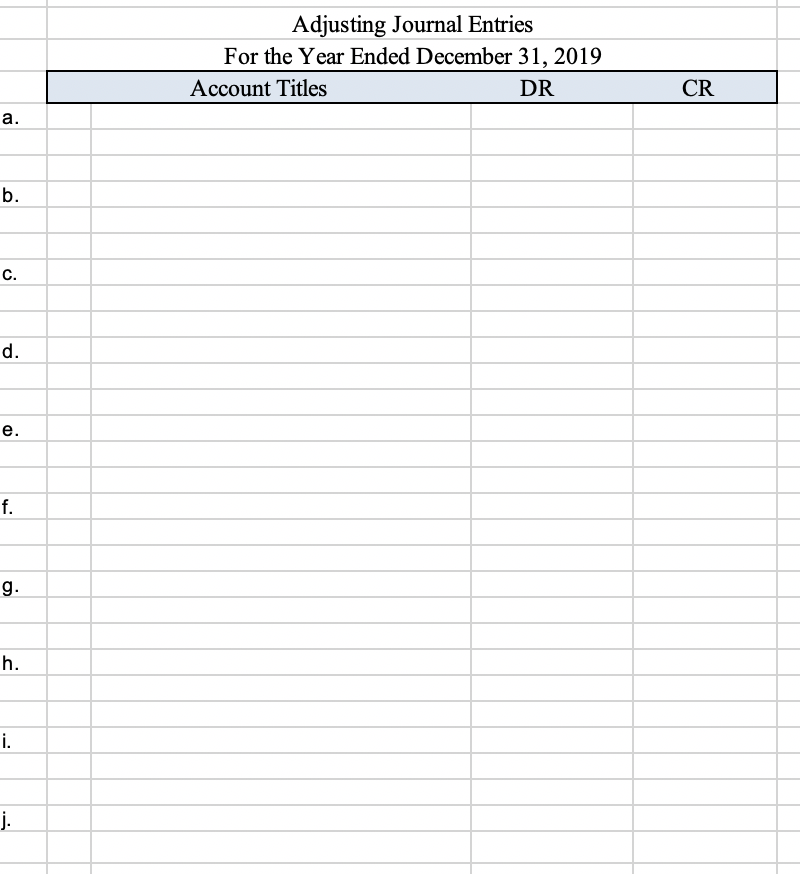

- Using the information in the Worksheet (1) tab, Aging Analysis (2) tab, and Adjustments (3) tab, prepare the adjusting journal entries for the period. Record the entries in the Adjusting Journal Entries (4) tab. (Round all numbers to the nearest dollar.) SHOW YOUR WORK FOR THE ADJUSTMENT IN THE CELL OR YOU WILL NOT RECEIVE CREDIT FOR THE ENTRY. Use formulas and link the values to the adjustment.

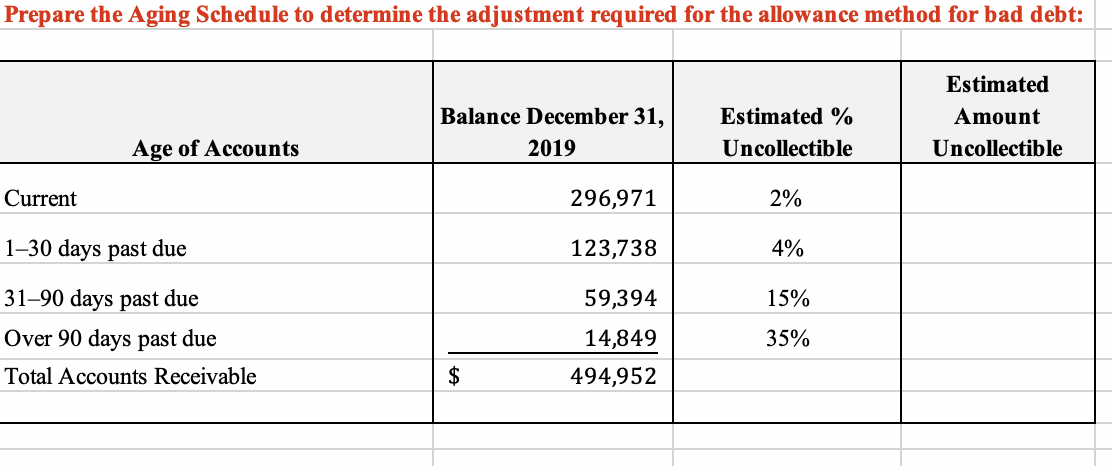

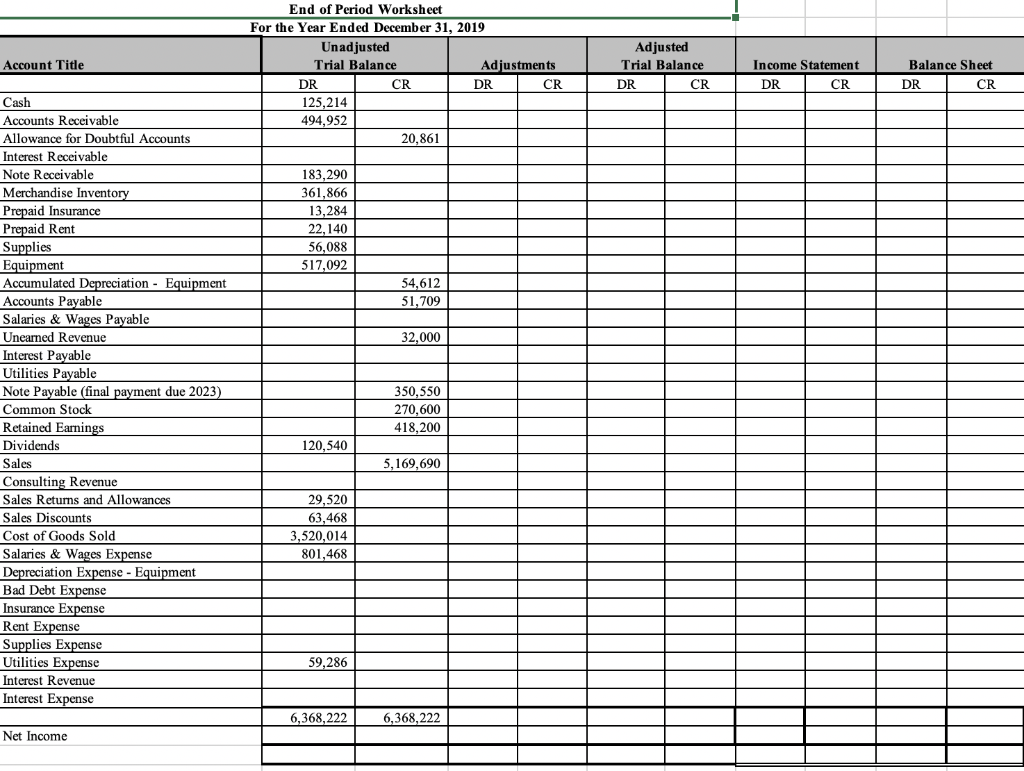

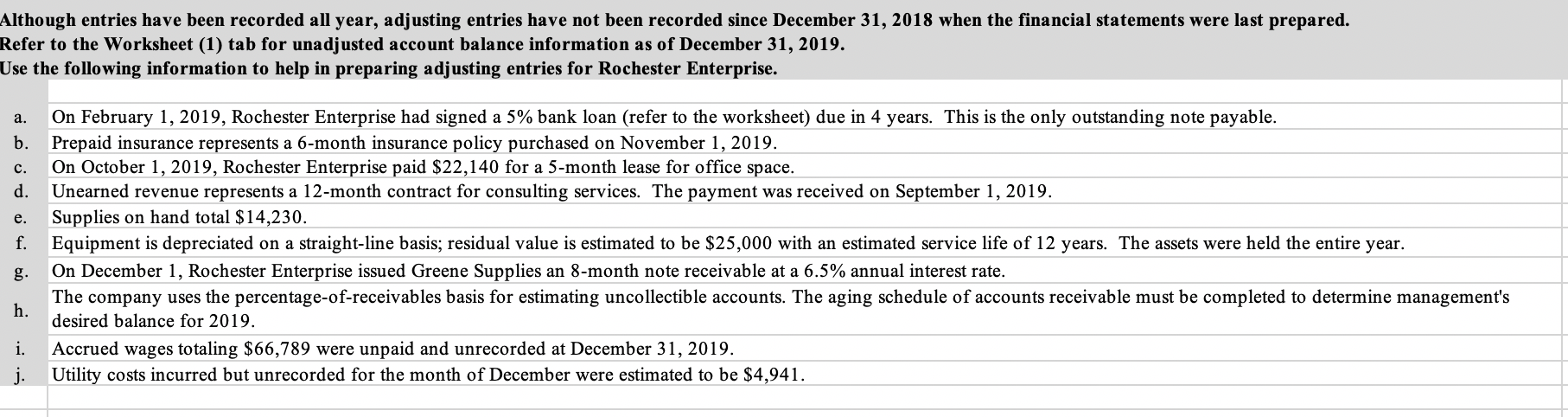

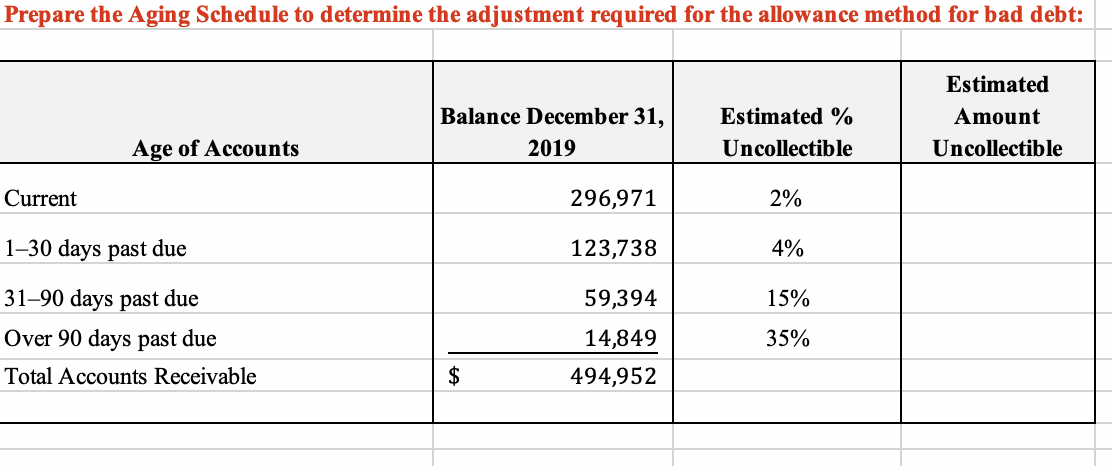

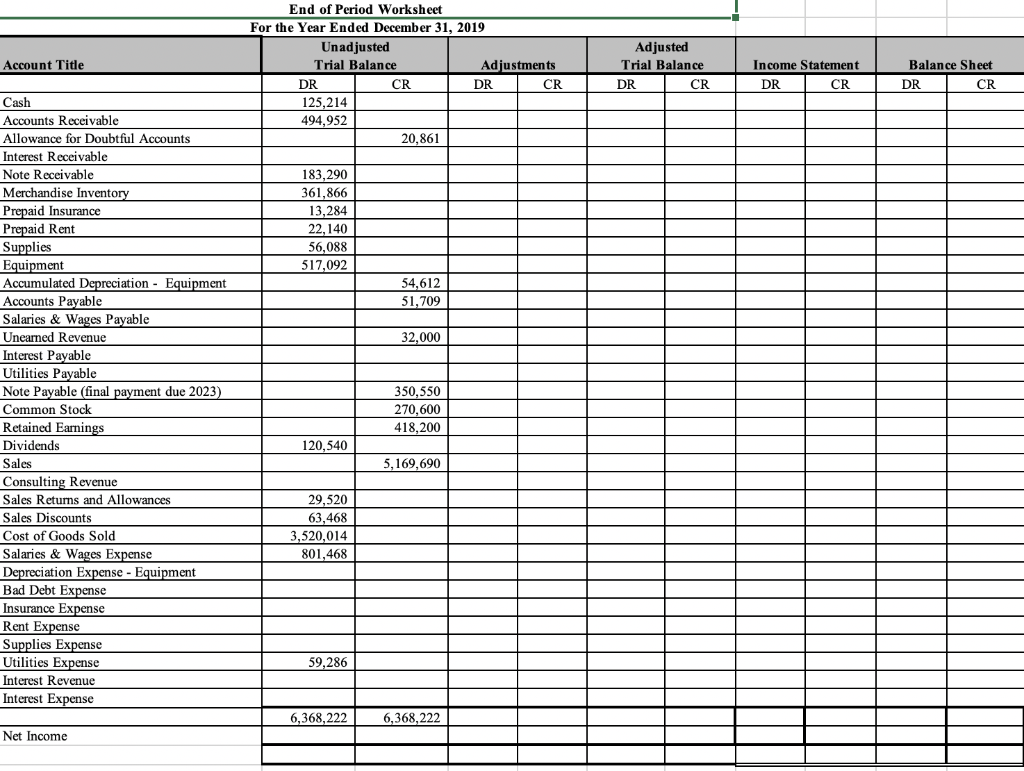

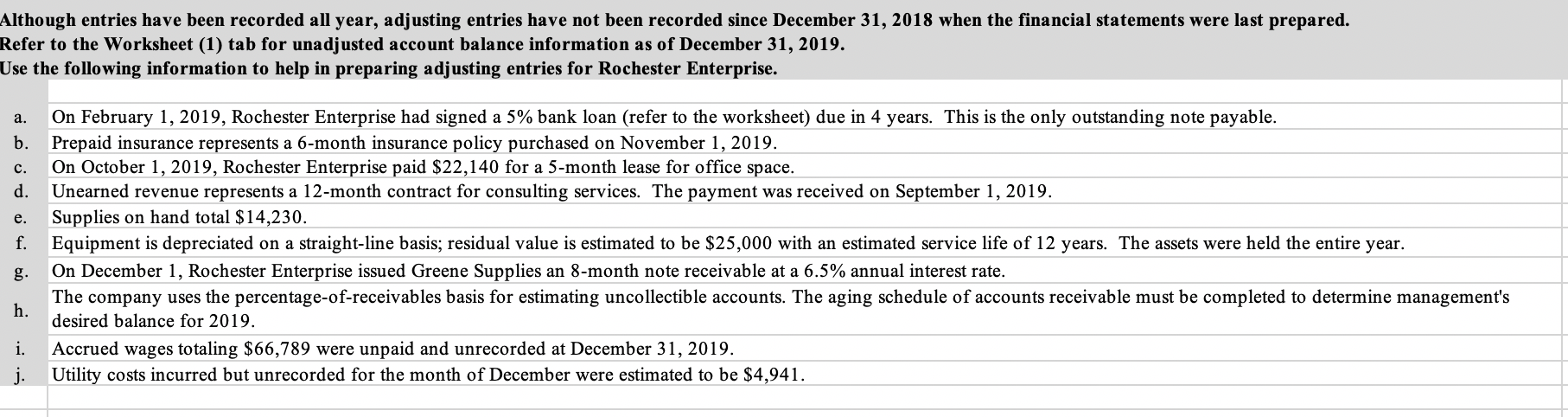

Adjusting Journal Entries For the Year Ended December 31,2019 Account Titles DR CR . b. . d. . f. g. h. j. Prepare the Aging Schedule to determine the adjustment required for the allowance method for bad debt: Estimated Balance December 31, Estimated % Amount 2019 Uncollectib le Uncollectible Age of Accounts Current 296,971 2% 1-30 days past due 4% 123,738 31-90 days past due 59,394 15% Over 90 days past due 35% 14,849 $ Total Accounts Receivable 494,952 End of Period Worksheet For the Year Ended December 31, 2019 Unadjusted Adjusted Adjustmen ts Account Title Trial Balance Trial Balance Income Statement Balance Sheet DR CR DR CR DR. CR DR CR DR CR 125,214 Cash 494,952 Accounts Receivable 20,861 Allowance for Doubtful Accounts Interest Receivable Note Receivable 183,290 Merchandise Inventory Prepaid Insurance Prepaid Rent Supplies Equipment Accumulated Depreciation - Equipment 361,866 13,284 22,140 56,088 517,092 54,612 51,709 Accounts Payable Salaries & Wages Payable Unearned Revenue Interest Payable Utilities Payable Note Payable (final payment due 2023) 32,000 350,550 Common Stock 270.600 Retained Earmings 418,200 Dividends 120,540 Sales 5,169,690 Consulting Revenue Sales Returns and Allowances 29,520 63,468 3,520,014 Sales Discounts Cost of Goods Sold Salaries &Wages Expense Depreciation Expense - Equipment 801,468 Bad Debt Expense Insurance Expense Rent Expense Supplies Expense Utilities Expense 59,286 Interest Revenue Interest Expense 6,368,222 6,368,222 Net Income Although entries have been recorded all year, adjusting entries have not been recorded since December 31, 2018 when the financial statements were last prepared. Refer to the Worksheet (1) tab for unadjusted account balance information as of December 31, 2019. Use the following information to help in preparing adjusting entries for Rochester Enterprise. On February 1, 2019, Rochester Enterprise had signed a 5% bank loan (refer to the worksheet) due in 4 years. This is the only outstanding note payable Prepaid insurance represents a 6-month insurance policy purchased on November 1, 2019 On October 1, 2019, Rochester Enterprise paid $22,140 for a 5-month lease for office space Unearned revenue represents a 12-month contract for consulting services. The payment was received on September 1, 2019 Supplies on hand total $14,230 Equipment is depreciated on a straight-line basis; residual value is estimated to be $25,000 with an estimated service life of 12 years. The assets were held the entire year. On December 1, Rochester Enterprise issued Greene Supplies an 8-month note receivable at a 6.5% annual interest rate . b. . d. . f. g. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The aging schedule of accounts receivable must be completed to determine management's h. desired balance for 2019. Accrued wages totaling $66,789 were unpaid and unrecorded at December 31, 2019 i. Utility costs incurred but unrecorded for the month of December were estimated to be $4,941 j