Question

Using the information provided, answer the following questions. 1. Christy's Cookie Company gives you the following information so that you can help them perform a

Using the information provided, answer the following questions.

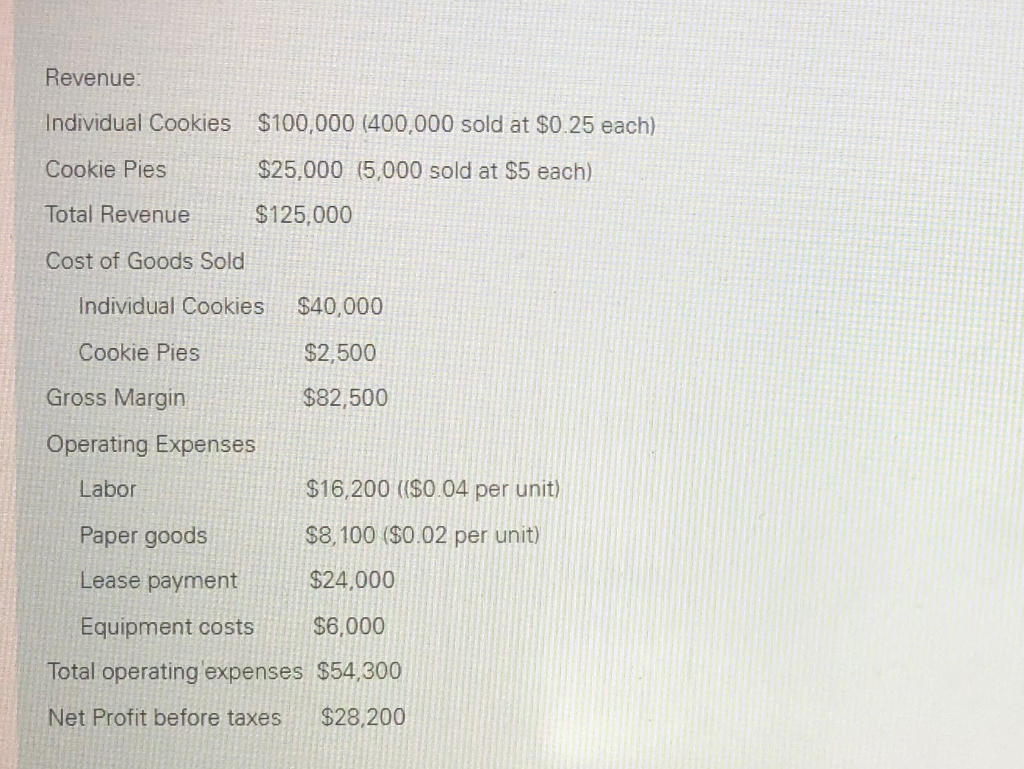

1. Christy's Cookie Company gives you the following information so that you can help them perform a volume cost analysis. Use the following information to calculate the contribution margin for cookie pies only.

select one:

a. $700

b. $6,300

c. $4.44

d. $0.56

2. Christy's Cookie Company gives you the following information so that you can help them perform a volume cost analysis. Assume Christy wants to make a profit of 10% of total revenue for cookie pies only. Calculate the volume she needs to sell to achieve this goal.

select one:

a. 3,604

b. 369,231

c. 1,352

d. 1,523

3. Christy's Cookie Company gives you the following information so that you can help them perform a volume cost analysis. Suppose Christy wants to make a profit of $10,000 from cookies only (not cookie pies). Calculate the volume she needs to sell to achieve this goal.

a. 3,604

b. 266,667

c. 377,778

d. 400,000

e. 4,055

4. Christy's Cookie Company gives you the following information so that you can help them perform a volume cost analysis. Christy has to buy a new piece of equipment (all attributed to cookie pies) that will increase her equipment cost to $12,000. What is her break even volume of cookie pies?

a. 4,055

b. 400,000

c. 3,604

d. 1,523

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started