Question

Using the information provided below, complete Kate Kleibers Schedule K-1 First Place Inc. (FPI) was formed as a corporation on January 5, 2017, by its

Using the information provided below, complete Kate Kleiber’s Schedule K-1

First Place Inc. (FPI) was formed as a corporation on January 5, 2017, by its two owners Kate

Kleiber and James Chandler. FPI immediately elected to be taxed as an S corporation for federal

income tax purposes. FPI sells mountain climbing gear to retailers throughout the Rocky

Mountain region. Kate owns 70 percent of the FPI common stock (the only class of stock

outstanding) and James owns 30 percent, and both devote 100% of their working time to FPI.

FPI is located at 4200 West 400 North, Salt Lake City, Utah 84116.

FPI’s Employer Identification Number is 87-5467544.

FPI’s business activity is wholesale sales. Its business activity code is 423910.

Both shareholders work as employees of the corporation.

Kate is the president of FPI (Social Security number 312-89-4567). Kate’s address is

1842 East 8400 South, Sandy, Utah 84094.

James is the vice president of FPI (Social Security number 321-98-7645). James’s

address is 2002 East 8145 South, Sandy, Utah 84094.

FPI uses the accrual method of accounting and has a calendar year-end.

The following is FPI’s 2020 income statement:

FPI Income Statement

For year ending December 31, 2020

Revenue from sales $ 980,000

Sales returns and allowances (10,000)

Cost of goods sold (110,000)

Gross profit from operations $ 860,000

Other income:

Dividend income $ 15,000

Interest income 5,000

Gross income $ 880,000

Expenses:

Compensation $(600,000)

Depreciation (10,000)

Bad debt expense (14,000)

Meals (2,000)

Maintenance (8,000)

Business interest (1,000)

Property taxes (7,000)

Charitable contributions (10,000)

Other taxes (30,000)

Rent (28,000)

Advertising (14,000)

Professional services (11,000)

Employee benefits (12,000)

Supplies (3,000)

Other expenses (21,000)

Total expenses (771,000)

Net income $ 109,000

Notes:

1. FPI’s purchases during 2020 were $115,000. It values its inventory based on cost using

the FIFO inventory cost flow method. Assume the rules of §263A do not apply to FPI,

and that the company did not make any changes in the way it measures or tracks

inventory during 2020.

2. Of the $5,000 interest income, $2,000 was from a West Jordan city bond used to fund

public activities (issued in 2017) and $3,000 was from a money market account.

3. FPI’s dividend income comes from publicly traded stocks that FPI has owned for two

years.

4. FPI’s compensation is as follows

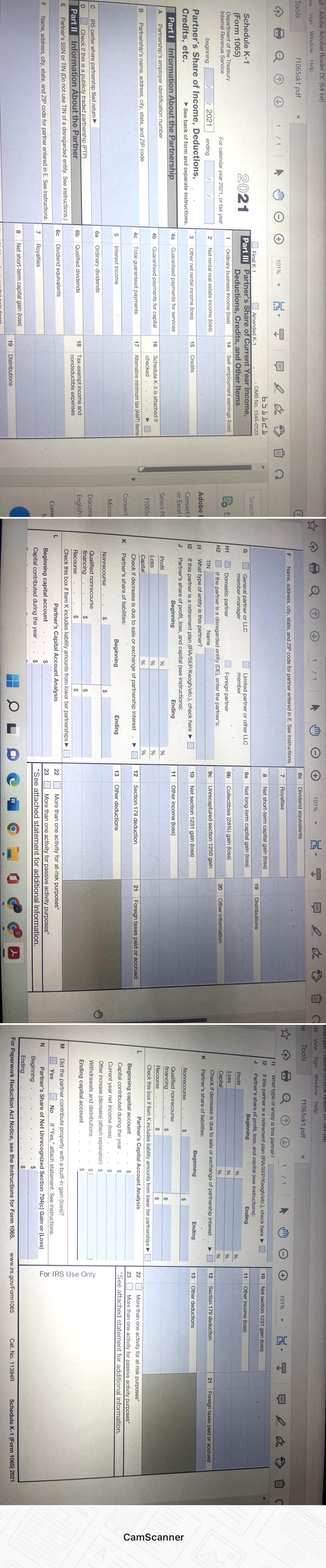

df-Adobe Acrobat Reader DC (64-bit) ew Sign Window Help Tools F Schedule K-1 (Form 1065) Department of the Treasury Internal Revenue Service A B C D f1065sk1.pdf For calendar year 2021, or tax year / 2021 ending Partner's Share of Income, Deductions, Credits, etc. X beginning 1 / 1 2021 See back of form and separate instructions. IRS center where partnership filed return Check if this is a publicly traded partnership (PTP) Part II Information About the Partner E Partner's SSN or TIN (Do not use TIN of a disregarded entity. See instructions.) Part I Information About the Partnership Partnership's employer identification number Partnership's name, address, city, state, and ZIP code Name, address, city, state, and ZIP code for partner entered in E. See instructions. 1 2 4a 3 4b 4c 5 7 6a 6b 8 Final K-1 Amended K-1 Part III Partner's Share of Current Year Income, Deductions, Credits, and Other Items Ordinary business income (loss) 101% Y Net rental real estate income (loss) Other net rental income (loss) Guaranteed payments for services Guaranteed payments for capital Total guaranteed payments Interest income Ordinary dividends 6c Dividend equivalents Qualified dividends **** Royalties Net short-term capital gain (loss) 15 14 Self-employment earnings (loss) 16 7. D 17 18 556626 OMB No. 1545-0123 Credits Schedule K-3 is attached if checked. Alternative minimum tax (AMT) items Tax-exempt income and nondeductible expenses 19 Distributions Search PE Adobe E Convert or Excel Select P f1065s Convert Micros Docume English Conv f K L G H1 H2 11 12 J F General partner or LLC member-manager Name, address, city, state, and ZIP code for partner entered in E. See instructions. Domestic partner Foreign partner If the partner is a disregarded entity (DE), enter the partner's: Nonrecourse 1 TIN Name What type of entity is this partner? If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here Partner's share of profit, loss, and capital (see instructions): Beginning Qualified nonrecourse financing Recourse $ $ /1 Profit Loss % Capital % Check if decrease is due to sale or exchange of partnership interest Partner's share of liabilities: % Beginning capital account Capital contributed during the year Limited partner or other LLC member Beginning $ Ending $ $ Ending $ Check this box if Item K includes liability amounts from lower tier partnerships Partner's Capital Account Analysis $ $ % % % 6c 7 8 9a 9b 9c 10 11 101% 13 Dividend equivalents Royalties Net short-term capital gain (loss) Net long-term capital gain (loss) Collectibles (28%) gain (loss) Unrecaptured section 1250 gain Net section 1231 gain (loss) Other income (loss) 12 Section 179 deduction Other deductions COCO 22 23 More than one activity *See attached statement W 19 Distributions 20 21 Other information More than one activity for at-risk purposes* Foreign taxes paid or accrued for passive activity purposes* for additional information. 49 d 65sk1.pdl - Adobe Acrobat Reader DC (64-Bit) dit View Sign Window Help f1065sk1.pdf Tools he M L N K Profit Loss Capital Check if Partner's share of liabilities: 11 What type of entity is this partner? 12 If this partner is a retirement plan (IRA/SEP/Keogh/etc.), check here J Partner's share of profit, loss, and capital (see instructions): Beginning Nonrecourse X $ 1 $ decrease is due to sale or exchange of partnership interest Qualified nonrecourse financing Recourse Check this box if Item K includes $ Partner's Beginning capital account Capital contributed during the year. Current year net income (loss). Other increase (decrease) (attach explanation) Withdrawals and distributions. Ending capital account /1 % % % Beginning $ $ $ $( $ Ending $ $ $ liability amounts from lower tier partnerships Capital Account Analysis $ $ $ Ending property with a built-in gain (loss)? No If "Yes," attach statement. Share of Net Unrecognized Section % % % See instructions. 704(c) Gain or (Loss) 10 12 101% 11 Other income (loss) Did the partner contribute Yes Partner's Beginning Ending. For Paperwork Reduction Act Notice, see the Instructions for Form 1065. www.irs.gov/Form1065 Net section 1231 gain (loss) For IRS Use Only Section 179 deduction 13 Other deductions 4 22 one More than 23 More than one activity *See attached statement mxxx 21 activity for at-risk for passive for 0 Cat. No. 11394R Foreign taxes paid or accrued purposes activity purposes additional information. Schedule K-1 (Form 1065) 2021 CamScanner

Step by Step Solution

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

STEP 1 You will need to gather the following information in order to complete Kate Kleibers Schedule ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started