Answered step by step

Verified Expert Solution

Question

1 Approved Answer

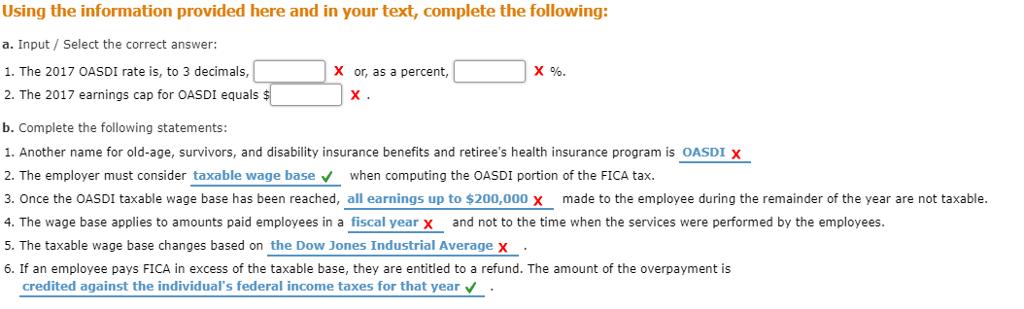

Using the information provided here and in your text, complete the following: a. Input / Select the correct answer: 1. The 2017 OASDI rate

Using the information provided here and in your text, complete the following: a. Input / Select the correct answer: 1. The 2017 OASDI rate is, to 3 decimals, 2. The 2017 earnings cap for OASDI equals $ X or, as a percent, X. X %. b. Complete the following statements: 1. Another name for old-age, survivors, and disability insurance benefits and retiree's health insurance program is OASDI X 2. The employer must consider taxable wage base when computing the OASDI portion of the FICA tax. 3. Once the OASDI taxable wage base has been reached, all earnings up to $200,000 x made to the employee during the remainder of the year are not taxable. 4. The wage base applies to amounts paid employees in a fiscal year x and not to the time when the services were performed by the employees. 5. The taxable wage base changes based on the Dow Jones Industrial Average x 6. If an employee pays FICA in excess of the taxable base, they are entitled to a refund. The amount of the overpayment is credited against the individual's federal income taxes for that year .

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a Input Select the correct answer 1 The 2017 OASDI rate is to 3 decimals 620 2 The 2017 earnings ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started