Answered step by step

Verified Expert Solution

Question

1 Approved Answer

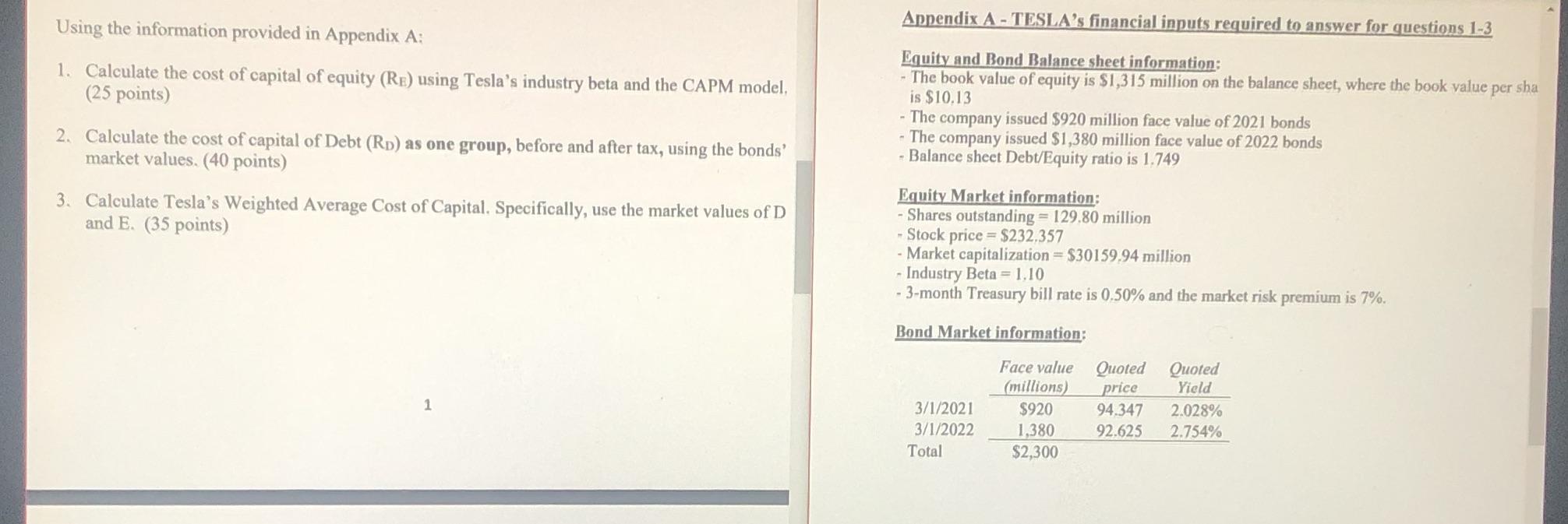

Using the information provided in Appendix A: 1. Calculate the cost of capital of equity (RE) using Tesla's industry beta and the CAPM model.

Using the information provided in Appendix A: 1. Calculate the cost of capital of equity (RE) using Tesla's industry beta and the CAPM model. (25 points) 2. Calculate the cost of capital of Debt (RD) as one group, before and after tax, using the bonds' market values. (40 points) 3. Calculate Tesla's Weighted Average Cost of Capital. Specifically, use the market values of D and E. (35 points) 1 Appendix A-TESLA's financial inputs required to answer for questions 1-3 Equity and Bond Balance sheet information: - The book value of equity is $1,315 million on the balance sheet, where the book value per sha is $10.13 - The company issued $920 million face value of 2021 bonds The company issued $1,380 million face value of 2022 bonds - Balance sheet Debt/Equity ratio is 1.749 Equity Market information: - Shares outstanding = 129.80 million - Stock price = $232,357 - Market capitalization = $30159.94 million - Industry Beta = 1,10 - 3-month Treasury bill rate is 0.50% and the market risk premium is 7%. Bond Market information: 3/1/2021 3/1/2022 Total Face value Quoted Quoted (millions) $920 1,380 $2,300 price Yield 94.347 2.028% 92.625 2.754%

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the cost of capital of equity Re using Teslas industry beta and the CAPM model First cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started