Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the information provided in the case, develop a two-stage DDM model for Harley Davidson. Consider the appropriate sensitivities to your model inputs. What is

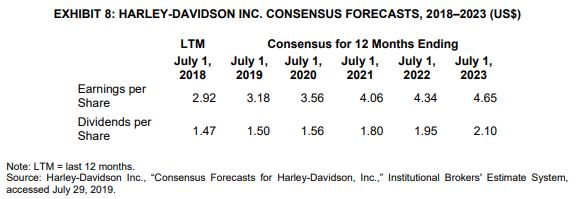

Using the information provided in the case, develop a two-stage DDM model for Harley Davidson. Consider the appropriate sensitivities to your model inputs. What is your target price for Harley-Davidson stock?

-For the two-stage DDM model, you may consider using 6% for the growth rate. After that use a 3% growth rate for the terminal year

EXHIBIT 8:HARLEY-DAVIDSON INC. CONSENSUS FORECASTS, 2018-2023 (US$) Consensus for 12 Months Ending July 1, 2020 Earnings per Share Dividends per Share LTM July 1, 2018 2.92 1.47 July 1, 2019 3.18 1.50 3.56 1.56 July 1, July 1, July 1, 2021 2022 2023 4.06 1.80 4.34 1.95 4.65 2.10 Note: LTM = last 12 months. Source: Harley-Davidson Inc., "Consensus Forecasts for Harley-Davidson, Inc.," Institutional Brokers' Estimate System, accessed July 29, 2019.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To develop a twostage DDM model for HarleyDavidson we can use the following steps Estimate the stage 1 growth rate This can be done by looking at the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started