Answered step by step

Verified Expert Solution

Question

1 Approved Answer

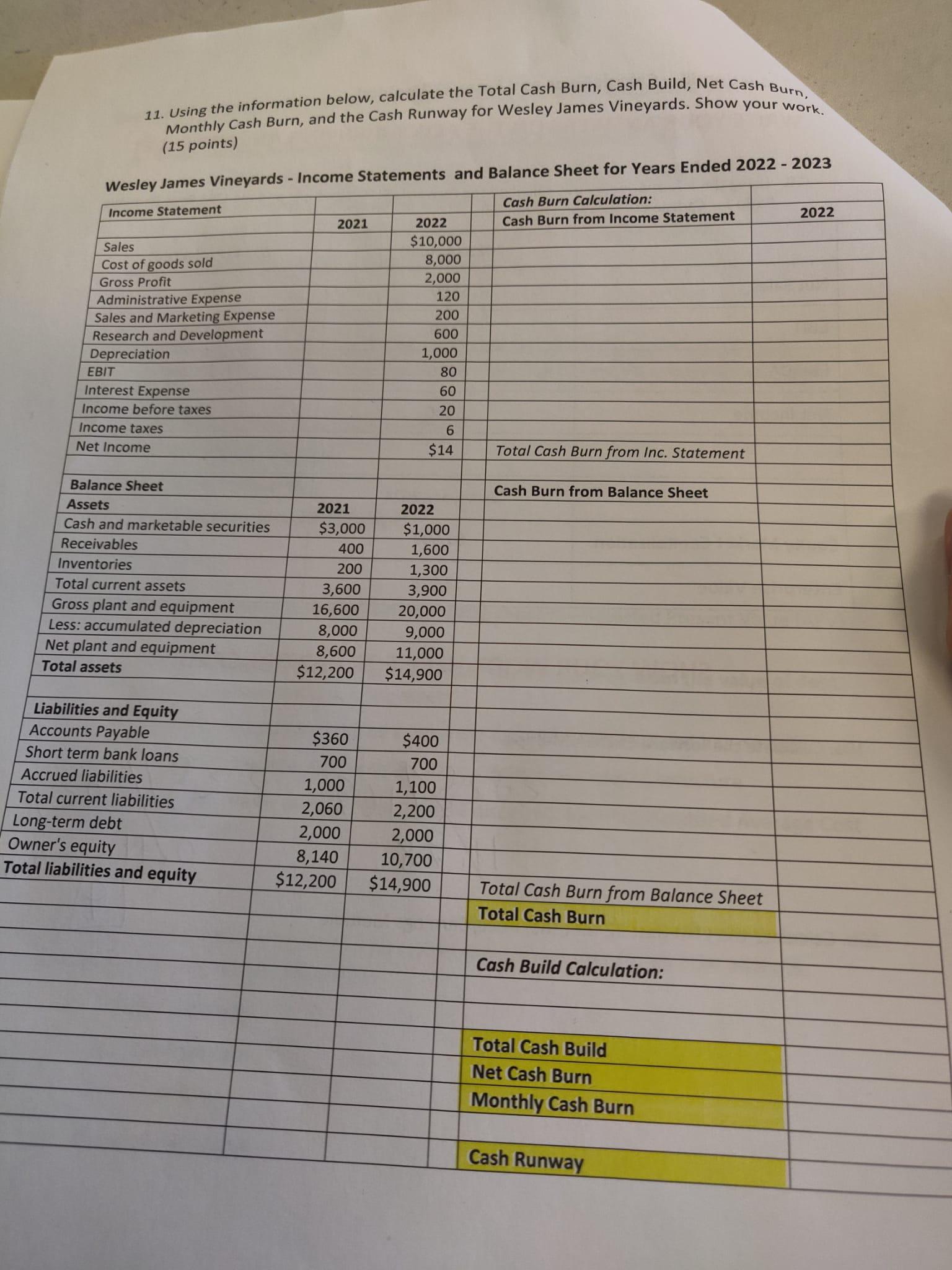

using the information provided in the picture calculate the cash conversion cycle for Wesley James Vineyard 11. Using the information below, calculate the Total Cash

using the information provided in the picture calculate the cash conversion cycle for Wesley James Vineyard

11. Using the information below, calculate the Total Cash Burn, Cash Build, Net Cash Burn, Monthly Cash Burn, and the Cash Runway for Wesley James Vineyards. Show your work. (15 points) Wesley James Vineyards - Income Statements and Balance Sheet for Years Ended 2022 - 2023 Income Statement Cash Burn Calculation: 2021 2022 $10,000 Cash Burn from Income Statement Sales 8,000 Cost of goods sold 2,000 Gross Profit 120 Administrative Expense Sales and Marketing Expense 200 Research and Development 600 Assets Depreciation EBIT Interest Expense Income before taxes Income taxes Net Income Balance Sheet Cash and marketable securities Receivables 1,000 80 60 20 6 $14 Total Cash Burn from Inc. Statement Cash Burn from Balance Sheet 2021 2022 $3,000 $1,000 400 1,600 Inventories 200 1,300 Total current assets 3,600 3,900 Gross plant and equipment 16,600 20,000 Less: accumulated depreciation 8,000 9,000 Net plant and equipment 8,600 11,000 Total assets $12,200 $14,900 Liabilities and Equity Accounts Payable $360 $400 Short term bank loans 700 700 Accrued liabilities 1,000 1,100 Total current liabilities 2,060 2,200 Long-term debt 2,000 2,000 Owner's equity 8,140 10,700 Total liabilities and equity $12,200 $14,900 Total Cash Burn from Balance Sheet Total Cash Burn Cash Build Calculation: Total Cash Build Net Cash Burn Monthly Cash Burn Cash Runway 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started