Answered step by step

Verified Expert Solution

Question

1 Approved Answer

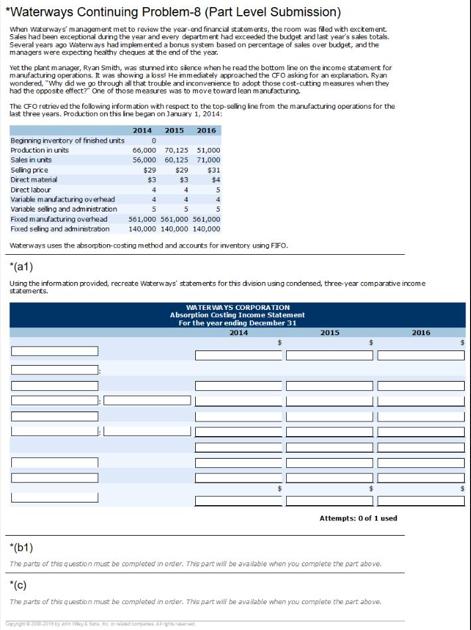

Using the information provided, recreate Waterways statements for this division using condensed, three-year comparative income statements. Using the information provided, prepare condensed, three-year comparative income

Using the information provided, recreate Waterways’ statements for this division using condensed, three-year comparative income statements.

Using the information provided, prepare condensed, three-year comparative income statements using the variable-costing method (SEE ATTACHED TEMPLATE)

Reconcile the variable-costing income with the absorption-costing income calculated in part (a1)

*Waterways Continuing Problem-8 (Part Level Submission) When waterways management met to review the year and financial statements, the room was filled with excitement Sales had been exceptional during the year and every department had exceeded the budget and last year's sales totals. Several years ago Waterways had implemented a bonus system based on percentage of sales over budget, and the managers were expecting healthy cheques at the end of the year. Yet the plant manager, Ryan Smith, was sturned into sience when he read the bottom line on the income statement for manufacturing operations. It was showing a loss He immediately approached the CFO asking for an explanation Ryan wondered, "Why did we go through all that trouble and inconvenience to adopt those cost-cutting measures when they had the opposite effect? One of those measures was to move toward lean manufacturing The CFO retrieved the following information with respect to the top-selling line from the manufacturing operations for the last three years. Production on this line began on January 1, 2014: 2014 2015 2016 Beginning inventory of finished units 0 Production in units 66,000 70,125 51,000 Sales in units 56,000 60,125 71,000 $29 $29 $31 Selling price Direct material $3 $3 $4 Direct labour 4 4 4 4 5 5 5 Variable manufacturing overhead Variable selling and administration Foxed manufacturing overhead Foxed selling and administration 561,000 561,000 561,000 140,000 140,000 140,000 Waterways uses the absorption-costing method and accounts for inventory using FIFO. *(a1) Using the information provided, recreate Waterways statements for this division using condensed, three-year comparative income statements. WATERWAYS CORPORATION Absorption Costing Income Statement For the year ending December 31 2014 2015 2016 Attempts: 0 of 1 used *(b1) The parts of this question must be completed in order. This part will be available when you complete the part above *(c) The parts of this question must be completed in order. This part will be available when you complete the part above, 5 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A1 Absorption Costing Income Statement 2014 2014 2015 2015 2016 2016 Sales 162400000 174362500 220100000 Less cost of goods Sold Opening Inventory 195...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started