Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Initial Values Method, create a Consolidated Income Statement. All I need is the final consolidated Income statement On January 1st 2019 The Voldomort

Using the Initial Values Method, create a Consolidated Income Statement. All I need is the final consolidated Income statement

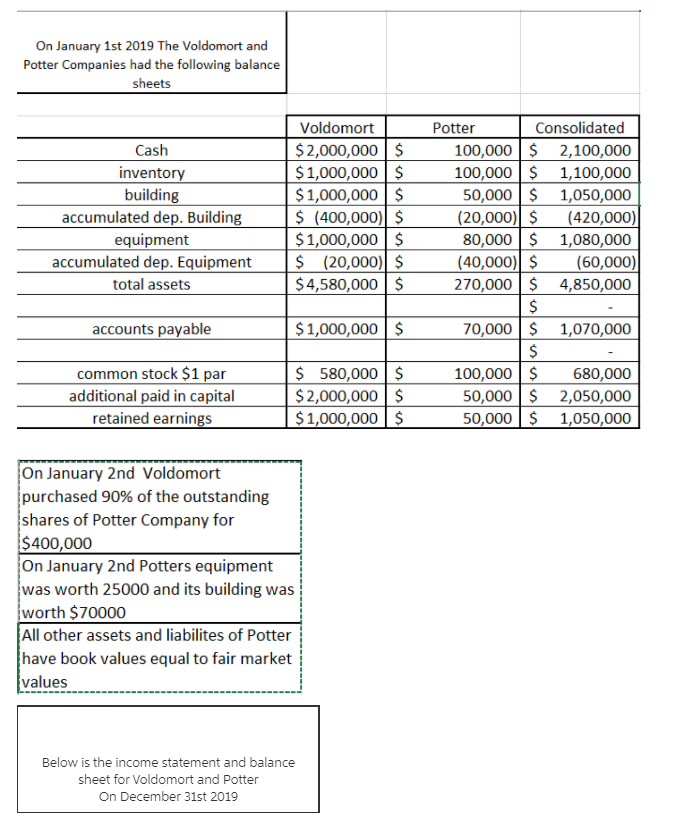

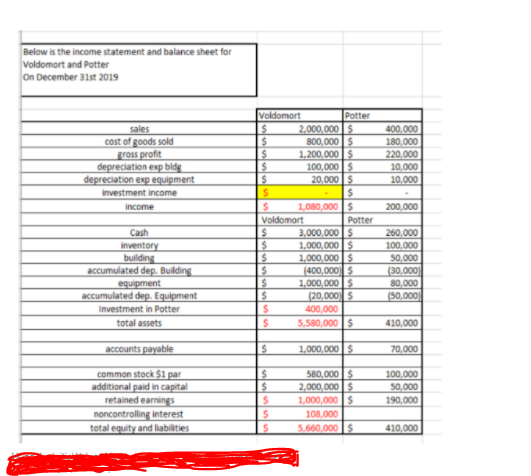

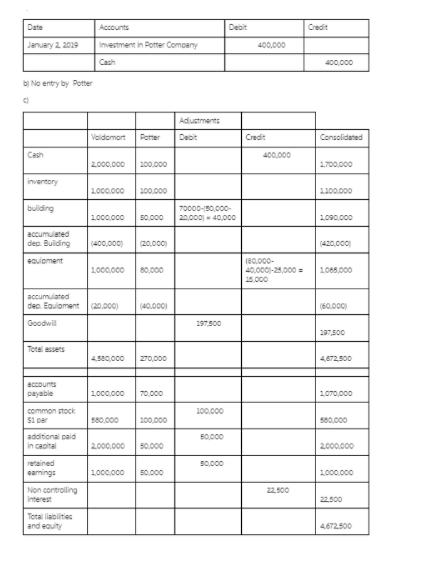

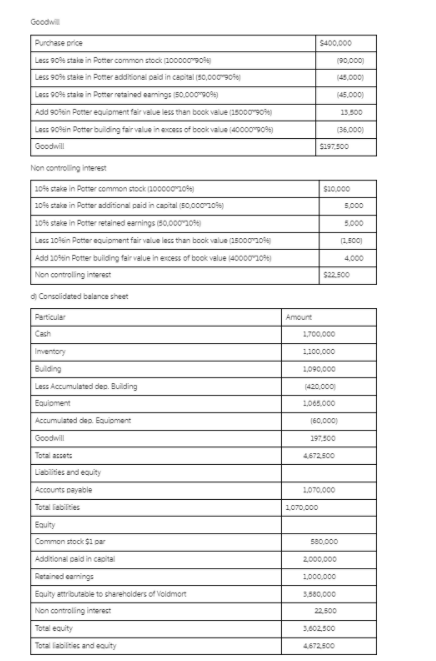

On January 1st 2019 The Voldomort and Potter Companies had the following balance sheets Cash inventory building accumulated dep. Building equipment accumulated dep. Equipment total assets Voldomort $ 2,000,000 $ $1,000,000 $ $1,000,000 $ $ (400,000) $ $1,000,000 $ $ (20,000) $ $4,580,000 $ Potter Consolidated 100,000 $ 2,100,000 100,000 $ 1,100,000 50,000 $1,050,000 (20,000) $ (420,000) 80,000$ 1,080,000 (40,000) $ (60,000) 270,000$ 4,850,000 $ 70,000 $1,070,000 $ 100,000 $ 680,000 50,000 $2,050,000 50,000$ 1,050,000 accounts payable $1,000,000 $ common stock $1 par additional paid in capital retained earnings $ 580,000 $ $ 2,000,000 $ $1,000,000 $ On January 2nd Voldomort purchased 90% of the outstanding shares of Potter Company for $400,000 On January 2nd Potters equipment was worth 25000 and its building was worth $70000 All other assets and liabilites of Potter have book values equal to fair market values Below is the income statement and balance sheet for voldomort and Potter On December 31st 2019 Below is the income statement and balance sheet for Voldomort and Potter On December 31st 2019 sales cost of goods sold gross profit depreciation exp bldg depreciation exp equipment Investment income income 400,000 180,000 220,000 10,000 10.000 200,000 Voldemort Potter $ 2,000,000 $ S 800,000 $ $ 1,200,000 $ $ 100,000 $ $ 20,000 $ $ $ $ 1,080,000 $ Voldomort Potter $ 3,000,000 $ $ 1,000,000 $ $ 1,000,000 $ $ 1400,000 $ $ 1,000,000 $ S (20,000 s 400,000 $ 5.580,000 $ Cash inventory building accumulated dep. Building equipment accumulated dep. Equipment Investment in Potter total assets 260,000 100.000 50,000 (30,000 80,000 (50,000 410.000 accounts payable $ 1,000,000 $ 70,000 common stock $1 par additional paid in capital retained earnings noncontrolling interest total equity and liabilities $ $ $ 580,000 $ 2,000,000 $ 1,000,000 $ 108,000 5,660,000 $ 100,000 50,000 190.000 $ 410.000 Date Debit Credit Accounts Investment in Potter Company January 2 2019 400,000 400.000 bi No entry by Potter Adjustments Debit Voldemort Potter Credit Consolidated Cash 400,000 2.000.000 200,000 1.700.000 inventory 2.000.000 200.000 1100.000 building 70000-50,000 20,000 - 40,000 1,000,000 50.000 1.090.000 accumulated dep. Building equipment (400,000 120,000 (420,000 1.000.000 80,000 180.000- 40,000 -25,000 = 25.000 1,065,000 accumulated de Eument (20.000) (40.000) (60.000) Goodwil 197.500 297,500 Total assets 4.500.000 270,000 4.672.500 1.000.000 70.000 1.070,000 accounts payable common stock Si par 100.000 580,000 100,000 580,000 50.000 additional paid In capital 2.000.000 50.000 2.000.000 50.000 retained caming 1.000.000 50.000 1.000.000 22.500 22.500 Non controlling interest Total liabilties and out 4.672.500 Goodwi Purchase price $400,000 190,000 45.000 45.000) Less 90% stake in Potter common stock 1000000 Less 90% stale in Potter additional paid in capital (90,000 900 Less 90% stal in Potter retained camins 150.000990) Adid 90n Potter equiment fair value less than book value (1500090 Less 90 in Potter building fair value in excess of book value (40000-90%) Goodwill 15.500 (35.000) $197.500 SIC.000 5.000 Non controlling interest 204 stake in Potter common stock (20000020 10 stal in Potter additional paid in capital (50,0000 10 stale in Potter retained earnings 50.000 20% Less 10in Potter equipment fair value less than book value (15000 Add 20in Potter building fair value in excess of book value 400000 Non controlling interest 5.000 1.500 4,000 $22.500 o Consolidated balance sheet Particular Cash Inventory Building Less Accumulated den Building Equipment Amount 1,700,000 1,100,000 1,090,000 420.000 Accumulated den. Eguiment 1.065.000 160,000 197.500 Goodwill 4.672.500 Liabilities and equity Accounts payable 1.070,000 Total abilities 1070.000 Equity Common stock $1 par 500 000 Additional aid in Catal 2.000.000 1,000,000 Retained coming Equity attributable to shareholders of voldmort Non controlling interest Total equity Total abilities and evity 3.580,000 22.500 3.602.500 4672.500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started