Answered step by step

Verified Expert Solution

Question

1 Approved Answer

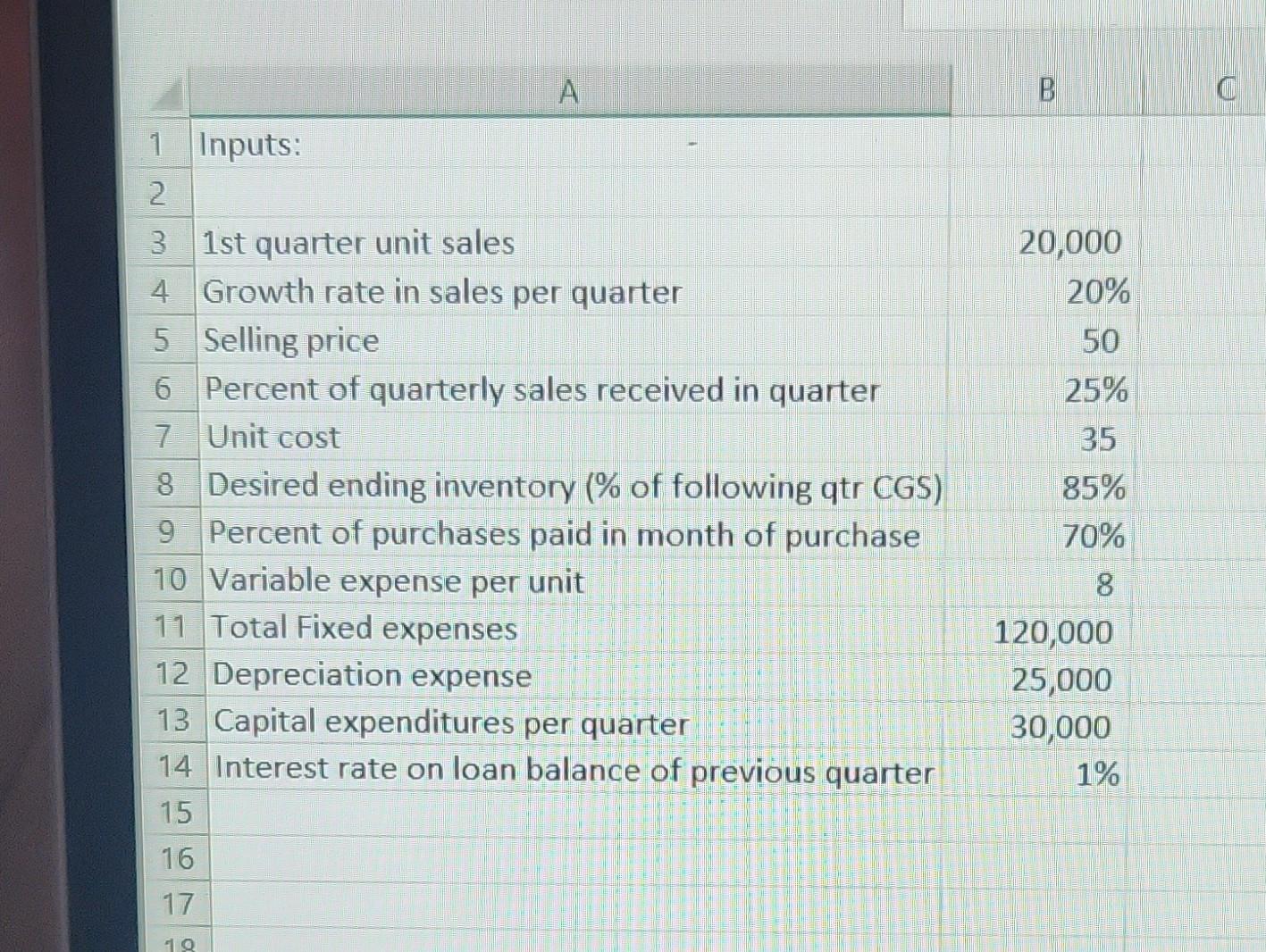

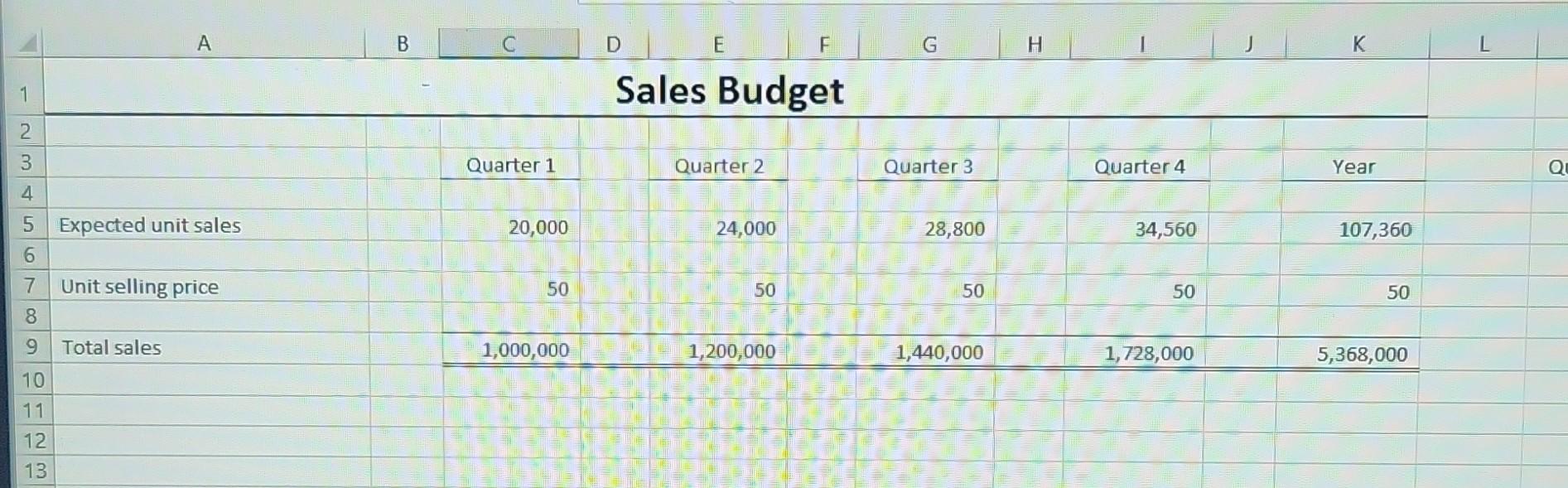

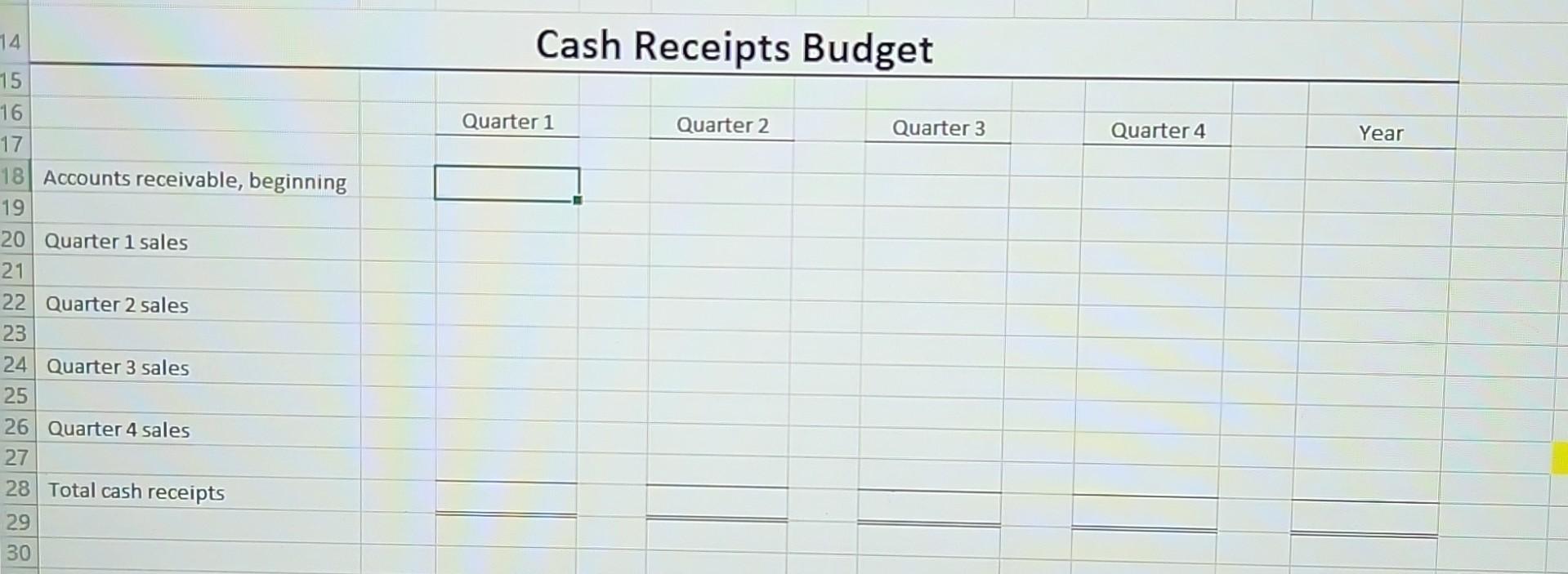

using the inputs in the first tab, please help me figure out this cash receipts budget (3rd photo). please show work . as you can

using the "inputs" in the first tab, please help me figure out this cash receipts budget (3rd photo). please show work . as you can see, I got the sales budget (2nd photo) finished. just need help with the cash receipts budget

use first photo to answer third photo please

\begin{tabular}{|c|c|c|} \hline & A & B \\ \hline & \multirow{2}{*}{\multicolumn{2}{|c|}{ Inputs: }} \\ \hline & & \\ \hline & 1st quarter unit sales & 20,000 \\ \hline & Growth rate in sales per quarter & 20% \\ \hline & Selling price & 50 \\ \hline & Percent of quarterly sales received in quarter & 25% \\ \hline & Unit cost & 35 \\ \hline & Desired ending inventory (\% of following qtr CGS) & 85% \\ \hline & Percent of purchases paid in month of purchase & 70% \\ \hline 0 & Variable expense per unit & 8 \\ \hline 1 & Total Fixed expenses & 120,000 \\ \hline 2 & Depreciation expense & 25,000 \\ \hline 3 & Capital expenditures per quarter & 30,000 \\ \hline 4 & Interest rate on loan balance of previous quarter & 1% \\ \hline 15 & & \\ \hline 16 & & \\ \hline 17 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 4 & A & B & C & D & E & F & G & H & 1 & J & K \\ \hline 1 & & & & & les Bud & et & & & = & & \\ \hline 2 & & & & & & & & & & & \\ \hline 3 & & & Quarter 1 & & Quarter 2 & & Quarter 3 & & Quarter 4 & & Year \\ \hline 4 & & & & & & =1 & & & & & \\ \hline 5 & Expected unit sales & - & 20,000 & & 24,000 & E= & 28,800 & 1= & 34,560 & & 107,360 \\ \hline 6 & & & & & 1 & & & - & & & \\ \hline 7 & Unit selling price & & 50 & & 50 & & 50 & & 50 & & 50 \\ \hline 8 & & & & & & & & & +1 & & \\ \hline 9 & Total sales & & 1,000,000 & & 1,200,000 & & 1,440,000 & & 1,728,000 & & 5,368,000 \\ \hline 10 & & & & & & & & = & & & \\ \hline 11 & & & & & & & & & & & \\ \hline 12 & & & & & & & & = & & & \\ \hline 13 & & & & & & & & & & & \\ \hline \end{tabular} Cach Danainta D...dan \begin{tabular}{|c|c|c|} \hline & A & B \\ \hline & \multirow{2}{*}{\multicolumn{2}{|c|}{ Inputs: }} \\ \hline & & \\ \hline & 1st quarter unit sales & 20,000 \\ \hline & Growth rate in sales per quarter & 20% \\ \hline & Selling price & 50 \\ \hline & Percent of quarterly sales received in quarter & 25% \\ \hline & Unit cost & 35 \\ \hline & Desired ending inventory (\% of following qtr CGS) & 85% \\ \hline & Percent of purchases paid in month of purchase & 70% \\ \hline 0 & Variable expense per unit & 8 \\ \hline 1 & Total Fixed expenses & 120,000 \\ \hline 2 & Depreciation expense & 25,000 \\ \hline 3 & Capital expenditures per quarter & 30,000 \\ \hline 4 & Interest rate on loan balance of previous quarter & 1% \\ \hline 15 & & \\ \hline 16 & & \\ \hline 17 & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline 4 & A & B & C & D & E & F & G & H & 1 & J & K \\ \hline 1 & & & & & les Bud & et & & & = & & \\ \hline 2 & & & & & & & & & & & \\ \hline 3 & & & Quarter 1 & & Quarter 2 & & Quarter 3 & & Quarter 4 & & Year \\ \hline 4 & & & & & & =1 & & & & & \\ \hline 5 & Expected unit sales & - & 20,000 & & 24,000 & E= & 28,800 & 1= & 34,560 & & 107,360 \\ \hline 6 & & & & & 1 & & & - & & & \\ \hline 7 & Unit selling price & & 50 & & 50 & & 50 & & 50 & & 50 \\ \hline 8 & & & & & & & & & +1 & & \\ \hline 9 & Total sales & & 1,000,000 & & 1,200,000 & & 1,440,000 & & 1,728,000 & & 5,368,000 \\ \hline 10 & & & & & & & & = & & & \\ \hline 11 & & & & & & & & & & & \\ \hline 12 & & & & & & & & = & & & \\ \hline 13 & & & & & & & & & & & \\ \hline \end{tabular} Cach Danainta D...danStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started