Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Lambert's strategic profit model forms below, calculate the ROA for each case. Refer to the strategic profit model from your notes to

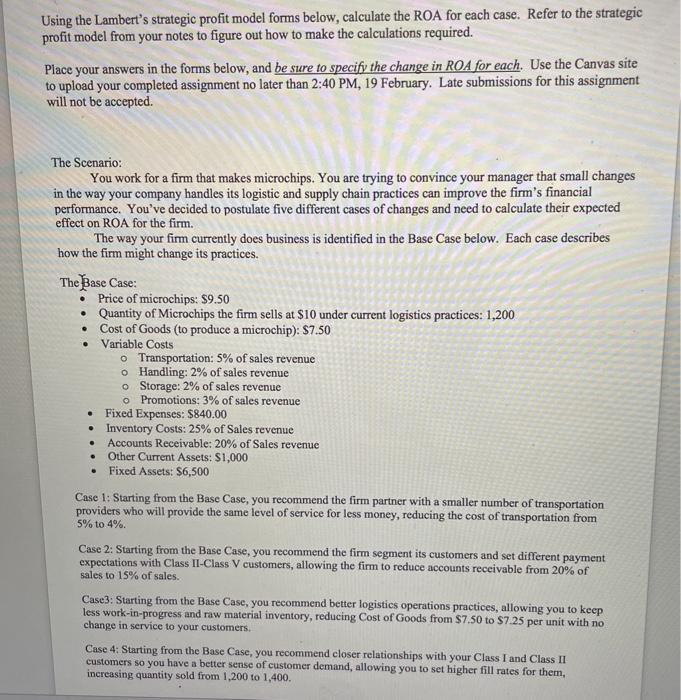

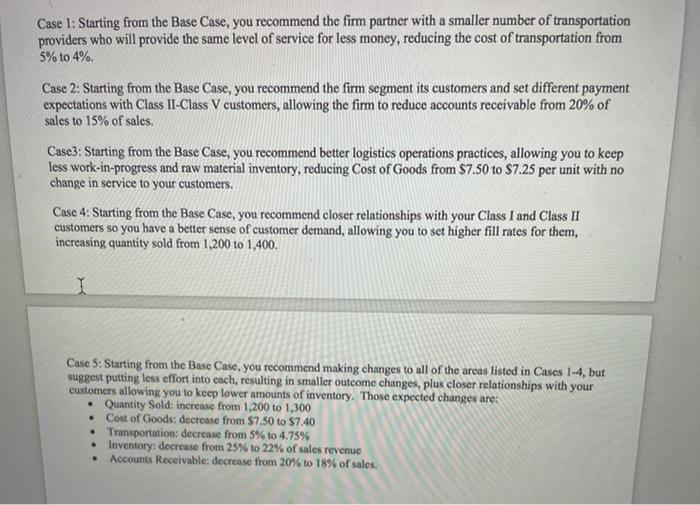

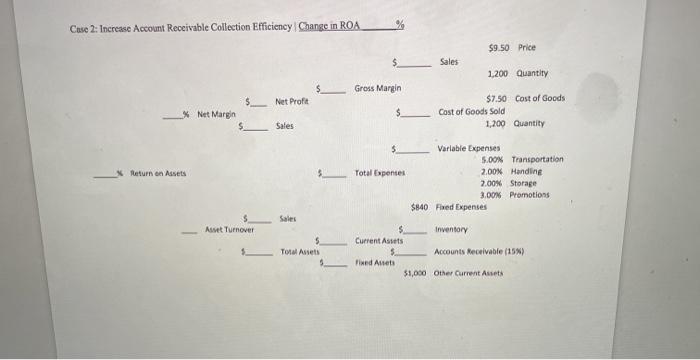

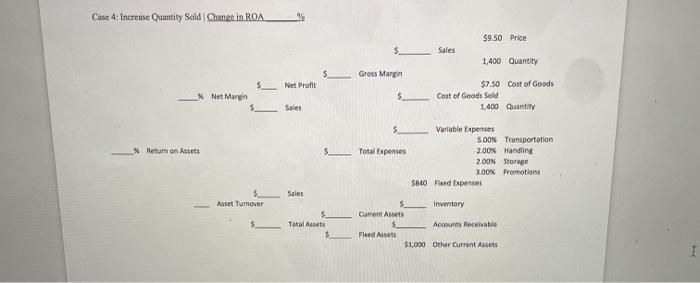

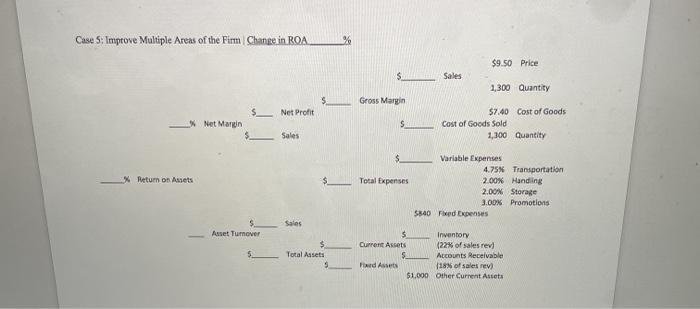

Using the Lambert's strategic profit model forms below, calculate the ROA for each case. Refer to the strategic profit model from your notes to figure out how to make the calculations required. Place your answers in the forms below, and be sure to specify the change in ROA for each. Use the Canvas site to upload your completed assignment no later than 2:40 PM, 19 February. Late submissions for this assignment will not be accepted. The Scenario: You work for a firm that makes microchips. You are trying to convince your manager that small changes in the way your company handles its logistic and supply chain practices can improve the firm's financial performance. You've decided to postulate five different cases of changes and need to calculate their expected effect on ROA for the firm. The way your firm currently does business is identified in the Base Case below. Each case describes how the firm might change its practices. The Base Case: Price of microchips: $9.50 Quantity of Microchips the firm sells at $10 under current logistics practices: 1,200 Cost of Goods (to produce a microchip): $7.50 . Variable Costs . o Transportation: 5% of sales revenue o Handling: 2% of sales revenue o Storage: 2% of sales revenue o Promotions: 3% of sales revenue . Inventory Costs: 25% of Sales revenue Accounts Receivable: 20% of Sales revenue Other Current Assets: $1,000 Fixed Assets: $6,500 Fixed Expenses: $840.00 Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. I Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 . Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. The Base Case % Net Margin % Return on Assets $ Asset Tumover Net Profit Sales Sales $ $ Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 1: Increase Transportation Efficiency | Change in ROA % Net Margin % Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ Gross Margin $ Total Assets $ Sales $ S $ Total Expenses 5 Current Assets $ Fixed Assets $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 4.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency | Change in ROA % Net Margin Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ $ Total Expenses $ Current Assets $ Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable (15%) $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold | Change in ROA Return on Assets Net Margin Asset Turnover Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ 5. $ Total Expenses Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.25 Cost of Goods Cost of Goods Sold Inventory 1,200 Quantity Variable Expenses $840 Fixed Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Accounts Receivable $1,000 Other Current Assets Case 4: Increase Quantity Sold | Change in ROA Return on Assets Net Margin $ Asset Turnover Net Profit Sales Sales $ 5 Gross Margin $ Total Assets $ $ Total Expenses Current Assets Fleed Assets Sales $9.50 Price 1,400 Quantity $7.50 Cost of Goods Sold 1,400 Quantity Variable Expenses $840 Fixed Expenses Cost of Goods 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory Accounts Receivable $1,000 Other Current Assets ber Case 5: Improve Multiple Areas of the Firm Change in ROA % Net Margin % Return on Assets Asset Turnover Net Profit Sales Sales S Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets Fixed Assets Sales $1,000 $9.50 Price 1,300 Quantity $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Variable Expenses 5840 Fixed Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory (22% of sales rev) Accounts Receivable (18% of sales rev) Other Current Assets Using the Lambert's strategic profit model forms below, calculate the ROA for each case. Refer to the strategic profit model from your notes to figure out how to make the calculations required. Place your answers in the forms below, and be sure to specify the change in ROA for each. Use the Canvas site to upload your completed assignment no later than 2:40 PM, 19 February. Late submissions for this assignment will not be accepted. The Scenario: You work for a firm that makes microchips. You are trying to convince your manager that small changes in the way your company handles its logistic and supply chain practices can improve the firm's financial performance. You've decided to postulate five different cases of changes and need to calculate their expected effect on ROA for the firm. The way your firm currently does business is identified in the Base Case below. Each case describes how the firm might change its practices. The Base Case: Price of microchips: $9.50 Quantity of Microchips the firm sells at $10 under current logistics practices: 1,200 Cost of Goods (to produce a microchip): $7.50 . Variable Costs . o Transportation: 5% of sales revenue o Handling: 2% of sales revenue o Storage: 2% of sales revenue o Promotions: 3% of sales revenue . Inventory Costs: 25% of Sales revenue Accounts Receivable: 20% of Sales revenue Other Current Assets: $1,000 Fixed Assets: $6,500 Fixed Expenses: $840.00 Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. I Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 . Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. The Base Case % Net Margin % Return on Assets $ Asset Tumover Net Profit Sales Sales $ $ Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 1: Increase Transportation Efficiency | Change in ROA % Net Margin % Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ Gross Margin $ Total Assets $ Sales $ S $ Total Expenses 5 Current Assets $ Fixed Assets $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 4.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency | Change in ROA % Net Margin Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ $ Total Expenses $ Current Assets $ Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable (15%) $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold | Change in ROA Return on Assets Net Margin Asset Turnover Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ 5. $ Total Expenses Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.25 Cost of Goods Cost of Goods Sold Inventory 1,200 Quantity Variable Expenses $840 Fixed Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Accounts Receivable $1,000 Other Current Assets Case 4: Increase Quantity Sold | Change in ROA Return on Assets Net Margin $ Asset Turnover Net Profit Sales Sales $ 5 Gross Margin $ Total Assets $ $ Total Expenses Current Assets Fleed Assets Sales $9.50 Price 1,400 Quantity $7.50 Cost of Goods Sold 1,400 Quantity Variable Expenses $840 Fixed Expenses Cost of Goods 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory Accounts Receivable $1,000 Other Current Assets ber Case 5: Improve Multiple Areas of the Firm Change in ROA % Net Margin % Return on Assets Asset Turnover Net Profit Sales Sales S Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets Fixed Assets Sales $1,000 $9.50 Price 1,300 Quantity $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Variable Expenses 5840 Fixed Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory (22% of sales rev) Accounts Receivable (18% of sales rev) Other Current Assets Using the Lambert's strategic profit model forms below, calculate the ROA for each case. Refer to the strategic profit model from your notes to figure out how to make the calculations required. Place your answers in the forms below, and be sure to specify the change in ROA for each. Use the Canvas site to upload your completed assignment no later than 2:40 PM, 19 February. Late submissions for this assignment will not be accepted. The Scenario: You work for a firm that makes microchips. You are trying to convince your manager that small changes in the way your company handles its logistic and supply chain practices can improve the firm's financial performance. You've decided to postulate five different cases of changes and need to calculate their expected effect on ROA for the firm. The way your firm currently does business is identified in the Base Case below. Each case describes how the firm might change its practices. The Base Case: Price of microchips: $9.50 Quantity of Microchips the firm sells at $10 under current logistics practices: 1,200 Cost of Goods (to produce a microchip): $7.50 . Variable Costs . o Transportation: 5% of sales revenue o Handling: 2% of sales revenue o Storage: 2% of sales revenue o Promotions: 3% of sales revenue . Inventory Costs: 25% of Sales revenue Accounts Receivable: 20% of Sales revenue Other Current Assets: $1,000 Fixed Assets: $6,500 Fixed Expenses: $840.00 Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. I Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 . Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. The Base Case % Net Margin % Return on Assets $ Asset Tumover Net Profit Sales Sales $ $ Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 1: Increase Transportation Efficiency | Change in ROA % Net Margin % Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ Gross Margin $ Total Assets $ Sales $ S $ Total Expenses 5 Current Assets $ Fixed Assets $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 4.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency | Change in ROA % Net Margin Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ $ Total Expenses $ Current Assets $ Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable (15%) $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold | Change in ROA Return on Assets Net Margin Asset Turnover Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ 5. $ Total Expenses Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.25 Cost of Goods Cost of Goods Sold Inventory 1,200 Quantity Variable Expenses $840 Fixed Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Accounts Receivable $1,000 Other Current Assets Case 4: Increase Quantity Sold | Change in ROA Return on Assets Net Margin $ Asset Turnover Net Profit Sales Sales $ 5 Gross Margin $ Total Assets $ $ Total Expenses Current Assets Fleed Assets Sales $9.50 Price 1,400 Quantity $7.50 Cost of Goods Sold 1,400 Quantity Variable Expenses $840 Fixed Expenses Cost of Goods 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory Accounts Receivable $1,000 Other Current Assets ber Case 5: Improve Multiple Areas of the Firm Change in ROA % Net Margin % Return on Assets Asset Turnover Net Profit Sales Sales S Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets Fixed Assets Sales $1,000 $9.50 Price 1,300 Quantity $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Variable Expenses 5840 Fixed Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory (22% of sales rev) Accounts Receivable (18% of sales rev) Other Current Assets Using the Lambert's strategic profit model forms below, calculate the ROA for each case. Refer to the strategic profit model from your notes to figure out how to make the calculations required. Place your answers in the forms below, and be sure to specify the change in ROA for each. Use the Canvas site to upload your completed assignment no later than 2:40 PM, 19 February. Late submissions for this assignment will not be accepted. The Scenario: You work for a firm that makes microchips. You are trying to convince your manager that small changes in the way your company handles its logistic and supply chain practices can improve the firm's financial performance. You've decided to postulate five different cases of changes and need to calculate their expected effect on ROA for the firm. The way your firm currently does business is identified in the Base Case below. Each case describes how the firm might change its practices. The Base Case: Price of microchips: $9.50 Quantity of Microchips the firm sells at $10 under current logistics practices: 1,200 Cost of Goods (to produce a microchip): $7.50 . Variable Costs . o Transportation: 5% of sales revenue o Handling: 2% of sales revenue o Storage: 2% of sales revenue o Promotions: 3% of sales revenue . Inventory Costs: 25% of Sales revenue Accounts Receivable: 20% of Sales revenue Other Current Assets: $1,000 Fixed Assets: $6,500 Fixed Expenses: $840.00 Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. Case 1: Starting from the Base Case, you recommend the firm partner with a smaller number of transportation providers who will provide the same level of service for less money, reducing the cost of transportation from 5% to 4%. Case 2: Starting from the Base Case, you recommend the firm segment its customers and set different payment expectations with Class II-Class V customers, allowing the firm to reduce accounts receivable from 20% of sales to 15% of sales. Case3: Starting from the Base Case, you recommend better logistics operations practices, allowing you to keep less work-in-progress and raw material inventory, reducing Cost of Goods from $7.50 to $7.25 per unit with no change in service to your customers. Case 4: Starting from the Base Case, you recommend closer relationships with your Class I and Class II customers so you have a better sense of customer demand, allowing you to set higher fill rates for them, increasing quantity sold from 1,200 to 1,400. I Case 5: Starting from the Base Case, you recommend making changes to all of the areas listed in Cases 1-4, but suggest putting less effort into each, resulting in smaller outcome changes, plus closer relationships with your customers allowing you to keep lower amounts of inventory. Those expected changes are: Quantity Sold: increase from 1,200 to 1,300 Cost of Goods: decrease from $7.50 to $7.40 . Transportation: decrease from 5% to 4.75% Inventory: decrease from 25% to 22% of sales revenue Accounts Receivable: decrease from 20% to 18% of sales. The Base Case % Net Margin % Return on Assets $ Asset Tumover Net Profit Sales Sales $ $ Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 1: Increase Transportation Efficiency | Change in ROA % Net Margin % Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ Gross Margin $ Total Assets $ Sales $ S $ Total Expenses 5 Current Assets $ Fixed Assets $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 4.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable $1,000 Other Current Assets Case 2: Increase Account Receivable Collection Efficiency | Change in ROA % Net Margin Return on Assets $ Asset Turnover $ Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ $ Total Expenses $ Current Assets $ Fixed Assets Sales $9.50 Price 1,200 Quantity $7.50 Cost of Goods Cost of Goods Sold 1,200 Quantity Variable Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions $840 Fixed Expenses Inventory Accounts Receivable (15%) $1,000 Other Current Assets Case 3: Reduce Cost of Goods Sold | Change in ROA Return on Assets Net Margin Asset Turnover Net Profit Sales Sales $ $ 5 Total Assets Gross Margin $ 5. $ Total Expenses Current Assets 5 Fixed Assets Sales $9.50 Price 1,200 Quantity $7.25 Cost of Goods Cost of Goods Sold Inventory 1,200 Quantity Variable Expenses $840 Fixed Expenses 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Accounts Receivable $1,000 Other Current Assets Case 4: Increase Quantity Sold | Change in ROA Return on Assets Net Margin $ Asset Turnover Net Profit Sales Sales $ 5 Gross Margin $ Total Assets $ $ Total Expenses Current Assets Fleed Assets Sales $9.50 Price 1,400 Quantity $7.50 Cost of Goods Sold 1,400 Quantity Variable Expenses $840 Fixed Expenses Cost of Goods 5.00% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory Accounts Receivable $1,000 Other Current Assets ber Case 5: Improve Multiple Areas of the Firm Change in ROA % Net Margin % Return on Assets Asset Turnover Net Profit Sales Sales S Total Assets $ Gross Margin $ $ Total Expenses $ Current Assets Fixed Assets Sales $1,000 $9.50 Price 1,300 Quantity $7.40 Cost of Goods Cost of Goods Sold 1,300 Quantity Variable Expenses 5840 Fixed Expenses 4.75% Transportation 2.00% Handling 2.00% Storage 3.00% Promotions Inventory (22% of sales rev) Accounts Receivable (18% of sales rev) Other Current Assets

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started