Answered step by step

Verified Expert Solution

Question

1 Approved Answer

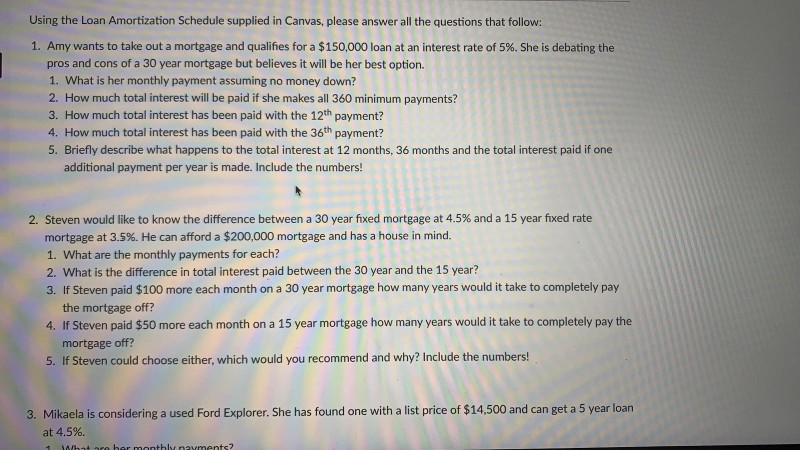

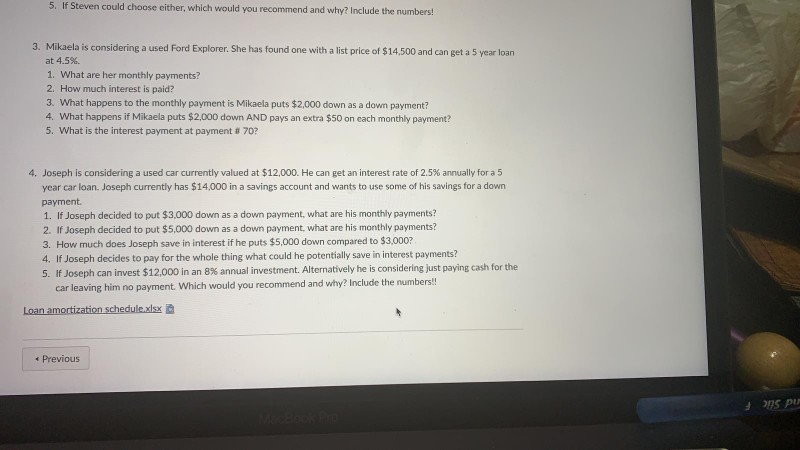

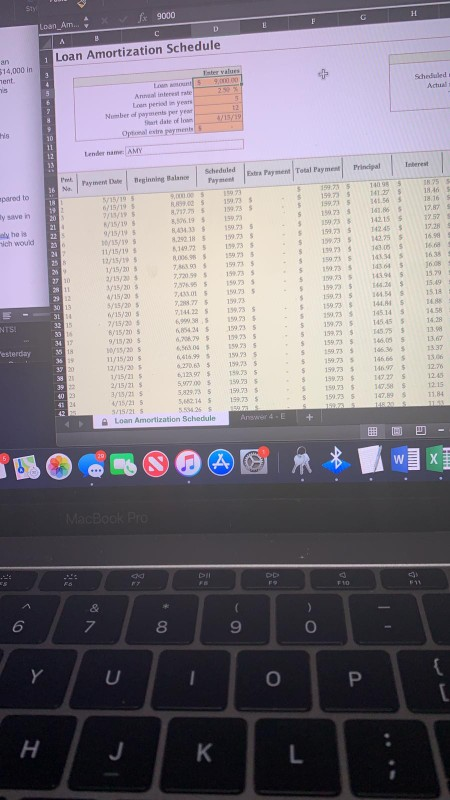

Using the Loan Amortization Schedule supplied in Canvas, please answer all the questions that follow: Amy wants to take out a mortgage and qualifies for

Using the Loan Amortization Schedule supplied in Canvas, please answer all the questions that follow: Amy wants to take out a mortgage and qualifies for a $150,000 loan at an interest rate of 5%. She is debating the pros and cons of a 30 year mortgage but believes it will be her best option. 1. What is her monthly payment assuming no money down? 2. How much total interest will be paid if she makes all 360 minimum payments? 3. How much total interest has been paid with the 12th payment? 4. How much total interest has been paid with the 36th payment? 5. Briefly describe what happens to the total interest at 12 months, 36 months and the total interest paid if one 1, additional payment per year is made. Include the numbers! Steven would like to know the difference between a 30 year fixed mortgage at 4.5% and a 15 year fixed rate mortgage at 3.5%. He can afford a $200,000 mortgage and has a house in mind. 1. What are the monthly payments for each? 2. What is the difference in total interest paid between the 30 year and the 15 year? 3. If Steven paid $100 more each month on a 30 year mortgage how many years would it take to completely pay 2, the mortgage off? 4. If Steven paid $50 more each month on a 15 year mortgage how many years would it take to completely pay the mortgage off? 5. If Steven could choose either, which would you recommend and why? Include the numbers! 3. Mikaela is considering a used Ford Explorer. She has found one with a list price of $14,500 and can get a 5 year loan at 4.5%. 5. If Steven could choose either, which would you recommend and why? Include the numbers! 3. Mikaela is considering a used Ford Explorer. She has found one with a list price of $14,500 and can get a 5 year loan at 4.5%. 1. What are her monthly payments? 2. How much interest is paid? 3. What happens to the monthly payment is Mikaela puts $2,000 down as a down payment? 4. What happens if Mikaela puts $2,000 down AND pays an extra $50 on each monthly payment? 5, what is the interest payment at payment # 70? 4, Joseph is considering a used car currently valued at $12,000. He can get an interest rate of 2.5% annually for a 5 year car loan. Joseph currently has $14,000 in a savings account and wants to use some of his savings for a down payment 1. If Joseph decided to put $3,000 down as a down payment, what are his monthly payments? 2. If Joseph decided to put $5,000 down as a down payment, what are his monthly payments? 3. How much does Joseph save in interest if he puts $5,000 down compared to $3,000? 4. If Joseph decides to pay for the whole thing what could he potentially save in interest payments? 5. If Joseph can invest $12,000 in an 8% annual investment. Alternatively he is considering just paying cash for the car leaving him no payment. Which would you recommend and why? Include the numbers Previous fx 9000 Loan Amortization Schedule Scheduled ts Anrveal interest rale Loom peried im years Number of payments per yean art date of losn Lender name: AMY Payment Du Beginnine Baeduld Extra Payment Total Payment Princdipal parod to y save in aly ho is 18 75 1218.46 8899.02 159 73 8,717.$ 159.73 ,50%.19 5 159.7 8434.33 15973 ,292 18 1973 8,149.72 199.73 S 8,006.96 $ 159.735 86 93 1597 72059 37695 159.73 743301 15 73 ,2879.3 144.22 139.73 s 6999 58 1593 6854 24 193 6,706.79 15973 $ 656304 5973 6,416.99 19979 S 6.27063 515973 632897 % 19873 S S199 5 615/19 141.27s 341.56 199.73 15/19 s 9/15/19 17.87 s 159 73 14215$1757 ich wouid 159.73S 1424517.28 199.73 14275 1698 11/15/19 12/15/19 5 1520 /15/20 15/20s /15/20 /15/20 s 615/20 /15/20 s 6y15/20 S 9/13/20 5 15971441638 S1597314364$ 16.08 $ 15.79 159.73 109.735 14394s ,1597)$ 14.24s 15.49 15973 5 144.54 15973144.84 188 S 19.73$ 14514 S 458 15973 S 1393 $145.75 13.9 S15973$ 46.06 13,6 1/15/20 12/15/20 1/15/23 2/15/21 s /13/21 15/21 S /15/21 s Loan Amortization Schedule S15973163 13.37 13.06 $ 199.73% 146975 1276 199.73 % 146.66 159.731472 829,73 5 15973 5,68214 159.73 553426 S 150.73 $ 147812.15 159.73 147.89 11.8 a 6 7 8 9 Using the Loan Amortization Schedule supplied in Canvas, please answer all the questions that follow: Amy wants to take out a mortgage and qualifies for a $150,000 loan at an interest rate of 5%. She is debating the pros and cons of a 30 year mortgage but believes it will be her best option. 1. What is her monthly payment assuming no money down? 2. How much total interest will be paid if she makes all 360 minimum payments? 3. How much total interest has been paid with the 12th payment? 4. How much total interest has been paid with the 36th payment? 5. Briefly describe what happens to the total interest at 12 months, 36 months and the total interest paid if one 1, additional payment per year is made. Include the numbers! Steven would like to know the difference between a 30 year fixed mortgage at 4.5% and a 15 year fixed rate mortgage at 3.5%. He can afford a $200,000 mortgage and has a house in mind. 1. What are the monthly payments for each? 2. What is the difference in total interest paid between the 30 year and the 15 year? 3. If Steven paid $100 more each month on a 30 year mortgage how many years would it take to completely pay 2, the mortgage off? 4. If Steven paid $50 more each month on a 15 year mortgage how many years would it take to completely pay the mortgage off? 5. If Steven could choose either, which would you recommend and why? Include the numbers! 3. Mikaela is considering a used Ford Explorer. She has found one with a list price of $14,500 and can get a 5 year loan at 4.5%. 5. If Steven could choose either, which would you recommend and why? Include the numbers! 3. Mikaela is considering a used Ford Explorer. She has found one with a list price of $14,500 and can get a 5 year loan at 4.5%. 1. What are her monthly payments? 2. How much interest is paid? 3. What happens to the monthly payment is Mikaela puts $2,000 down as a down payment? 4. What happens if Mikaela puts $2,000 down AND pays an extra $50 on each monthly payment? 5, what is the interest payment at payment # 70? 4, Joseph is considering a used car currently valued at $12,000. He can get an interest rate of 2.5% annually for a 5 year car loan. Joseph currently has $14,000 in a savings account and wants to use some of his savings for a down payment 1. If Joseph decided to put $3,000 down as a down payment, what are his monthly payments? 2. If Joseph decided to put $5,000 down as a down payment, what are his monthly payments? 3. How much does Joseph save in interest if he puts $5,000 down compared to $3,000? 4. If Joseph decides to pay for the whole thing what could he potentially save in interest payments? 5. If Joseph can invest $12,000 in an 8% annual investment. Alternatively he is considering just paying cash for the car leaving him no payment. Which would you recommend and why? Include the numbers Previous fx 9000 Loan Amortization Schedule Scheduled ts Anrveal interest rale Loom peried im years Number of payments per yean art date of losn Lender name: AMY Payment Du Beginnine Baeduld Extra Payment Total Payment Princdipal parod to y save in aly ho is 18 75 1218.46 8899.02 159 73 8,717.$ 159.73 ,50%.19 5 159.7 8434.33 15973 ,292 18 1973 8,149.72 199.73 S 8,006.96 $ 159.735 86 93 1597 72059 37695 159.73 743301 15 73 ,2879.3 144.22 139.73 s 6999 58 1593 6854 24 193 6,706.79 15973 $ 656304 5973 6,416.99 19979 S 6.27063 515973 632897 % 19873 S S199 5 615/19 141.27s 341.56 199.73 15/19 s 9/15/19 17.87 s 159 73 14215$1757 ich wouid 159.73S 1424517.28 199.73 14275 1698 11/15/19 12/15/19 5 1520 /15/20 15/20s /15/20 /15/20 s 615/20 /15/20 s 6y15/20 S 9/13/20 5 15971441638 S1597314364$ 16.08 $ 15.79 159.73 109.735 14394s ,1597)$ 14.24s 15.49 15973 5 144.54 15973144.84 188 S 19.73$ 14514 S 458 15973 S 1393 $145.75 13.9 S15973$ 46.06 13,6 1/15/20 12/15/20 1/15/23 2/15/21 s /13/21 15/21 S /15/21 s Loan Amortization Schedule S15973163 13.37 13.06 $ 199.73% 146975 1276 199.73 % 146.66 159.731472 829,73 5 15973 5,68214 159.73 553426 S 150.73 $ 147812.15 159.73 147.89 11.8 a 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started