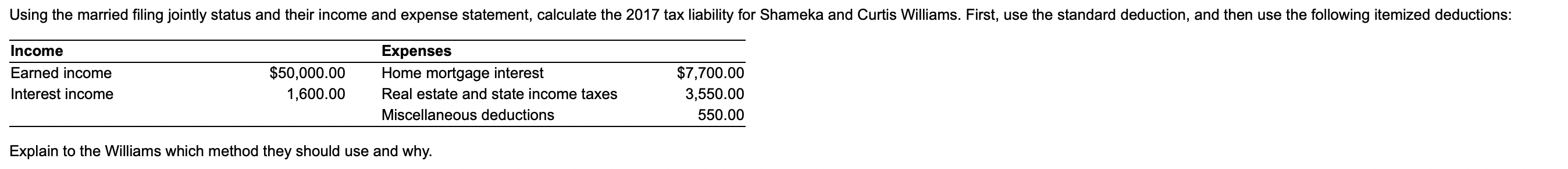

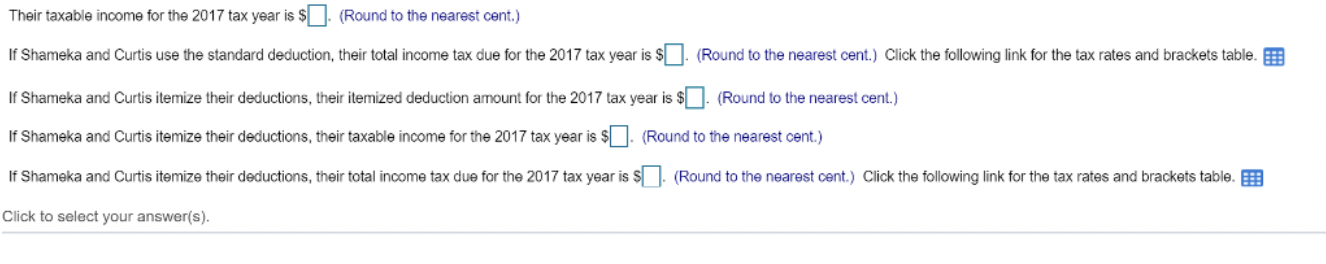

Using the married filing jointly status and their income and expense statement, calculate the 2017 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the following itemized deductions: Income Earned income Interest income $50,000.00 1,600.00 Expenses Home mortgage interest Real estate and state income taxes Miscellaneous deductions $7,700.00 3,550.00 550.00 Explain to the Williams which method they should use and why. Their taxable income for the 2017 tax year is $. (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their total income tax due for the 2017 tax year is $. (Round to the nearest cent.) Click the following link for the tax rates and brackets table. If Shameka and Curtis itemize their deductions, their itemized deduction amount for the 2017 tax year is $. (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their taxable income for the 2017 tax year is $0 (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their total income tax due for the 2017 tax year is $1. (Round to the nearest cont.) Click the following link for the tax rates and brackets table. B Click to select your answer(s). Using the married filing jointly status and their income and expense statement, calculate the 2017 tax liability for Shameka and Curtis Williams. First, use the standard deduction, and then use the following itemized deductions: Income Earned income Interest income $50,000.00 1,600.00 Expenses Home mortgage interest Real estate and state income taxes Miscellaneous deductions $7,700.00 3,550.00 550.00 Explain to the Williams which method they should use and why. Their taxable income for the 2017 tax year is $. (Round to the nearest cent.) If Shameka and Curtis use the standard deduction, their total income tax due for the 2017 tax year is $. (Round to the nearest cent.) Click the following link for the tax rates and brackets table. If Shameka and Curtis itemize their deductions, their itemized deduction amount for the 2017 tax year is $. (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their taxable income for the 2017 tax year is $0 (Round to the nearest cent.) If Shameka and Curtis itemize their deductions, their total income tax due for the 2017 tax year is $1. (Round to the nearest cont.) Click the following link for the tax rates and brackets table. B Click to select your answer(s)