Question

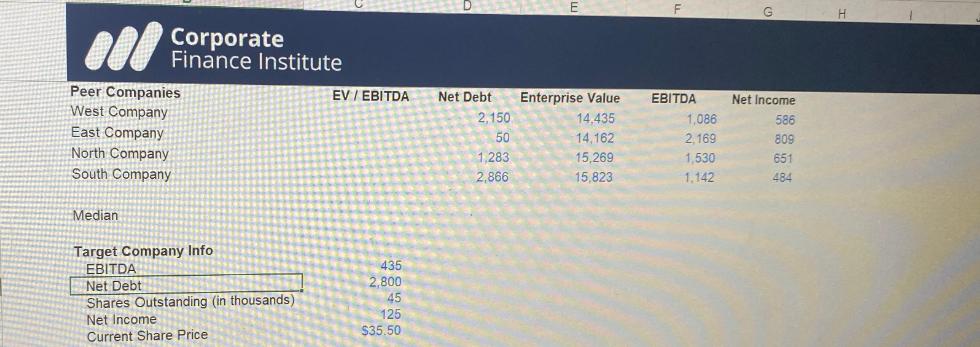

Using the Median EV/EBITDA multiple, what is the hypothetical control premium for the Target Company's stock? Ill Corporate Finance Institute Peer Companies West Company

Using the Median EV/EBITDA multiple, what is the hypothetical control premium for the Target Company's stock? Ill Corporate Finance Institute Peer Companies West Company East Company North Company South Company Median Target Company Info EBITDA Net Debt Shares Outstanding (in thousands) Net Income Current Share Price EV / EBITDA 435 2,800 45 125 $35.50 Net Debt 2,150 50 1,283 2,866 Enterprise Value 14.435 14,162 15,269 15,823 EBITDA 1,086 2,169 1,530 1,142 G Net Income 586 809 651 484 H

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Contemporary Auditing

Authors: Michael C Knapp

12th Edition

357515404, 978-0357515402

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App