Question

Using the notations , , w, and e defined in class, an alternative way to maximize the risk-adjusted return is a max w- wEw

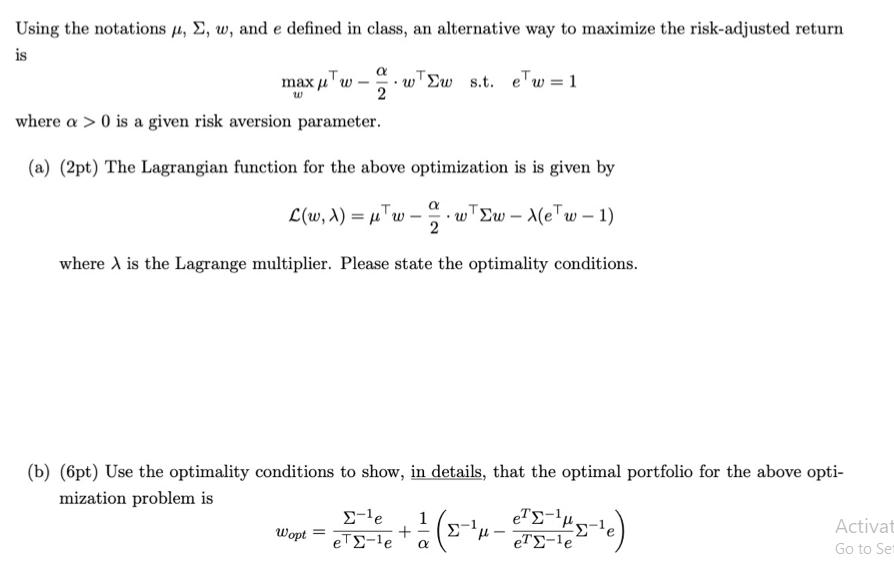

Using the notations , , w, and e defined in class, an alternative way to maximize the risk-adjusted return is a max w- wEw s.t. ew=1 W where a > 0 is a given risk aversion parameter. (a) (2pt) The Lagrangian function for the above optimization is is given by L(w, x) = w-27 ww - X(ew -1) where X is the Lagrange multiplier. Please state the optimality conditions. (b) (6pt) Use the optimality conditions to show, in details, that the optimal portfolio for the above opti- mization problem is -1 eTe Wopt -e 1 + eT-le eT-le Activat Go to Set

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Numerical Analysis

Authors: Richard L. Burden, J. Douglas Faires

9th edition

538733519, 978-1133169338, 1133169333, 978-0538733519

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App