Answered step by step

Verified Expert Solution

Question

1 Approved Answer

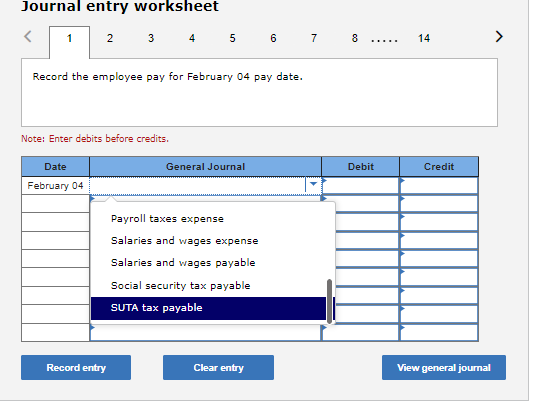

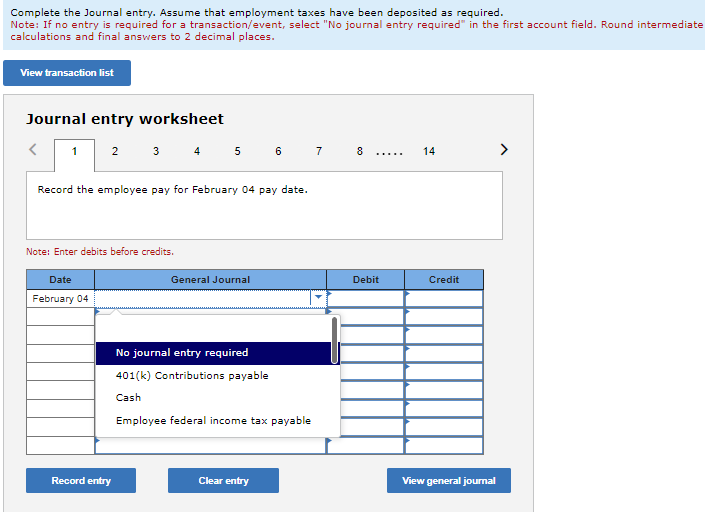

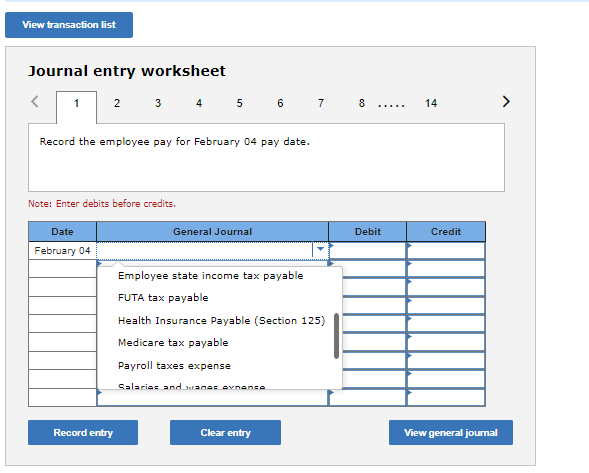

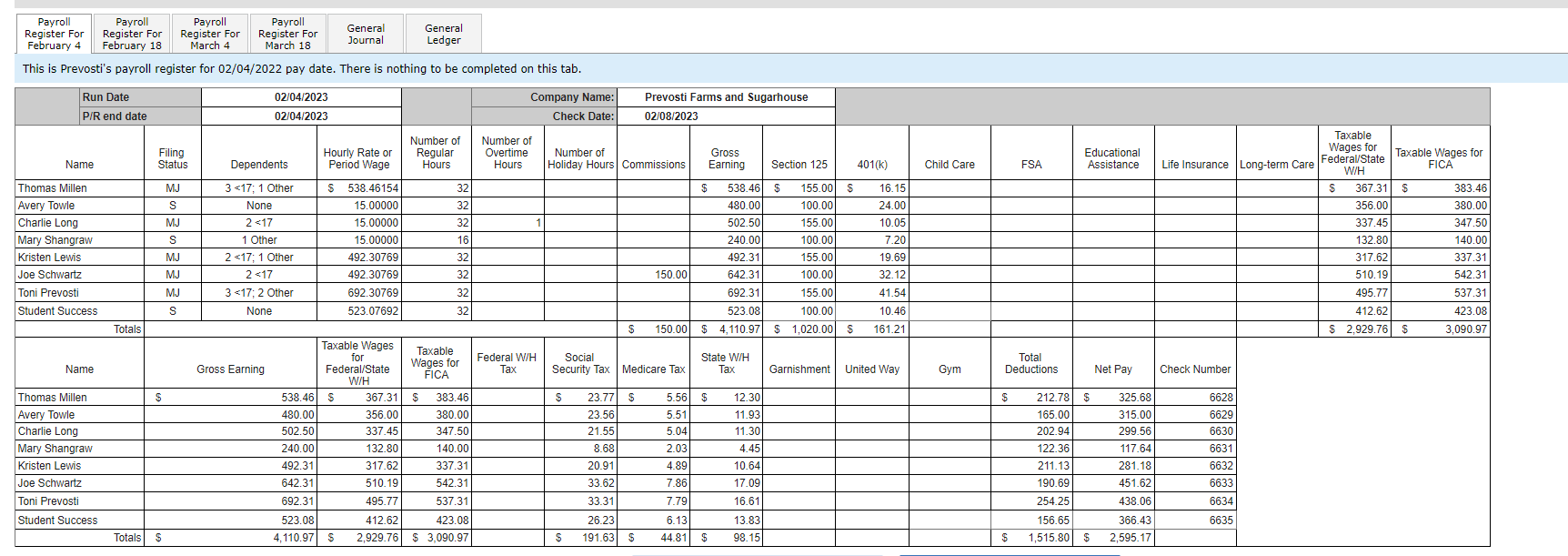

Using the payroll registers, complete the General Journal entries as follows: February 4 Journalize the employee pay. February 4 Journalize the employer payroll tax for

Using the payroll registers, complete the General Journal entries as follows:

| February 4 | Journalize the employee pay. |

|---|---|

| February 4 | Journalize the employer payroll tax for the February 4 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| February 8 | Issue the employee pay. |

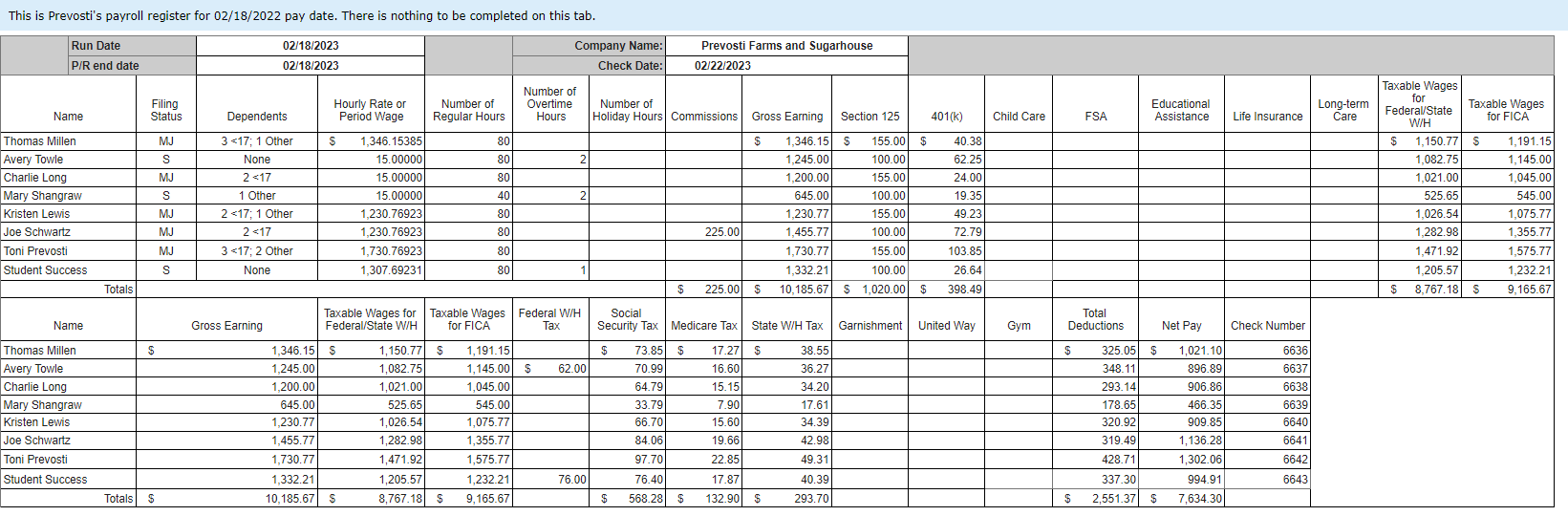

| February 18 | Journalize the employee pay. |

| February 18 | Journalize the employer payroll tax for the February 18 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. |

| February 22 | Issue the employee pay. |

| February 22 | Issue payment for the payroll liabilities. |

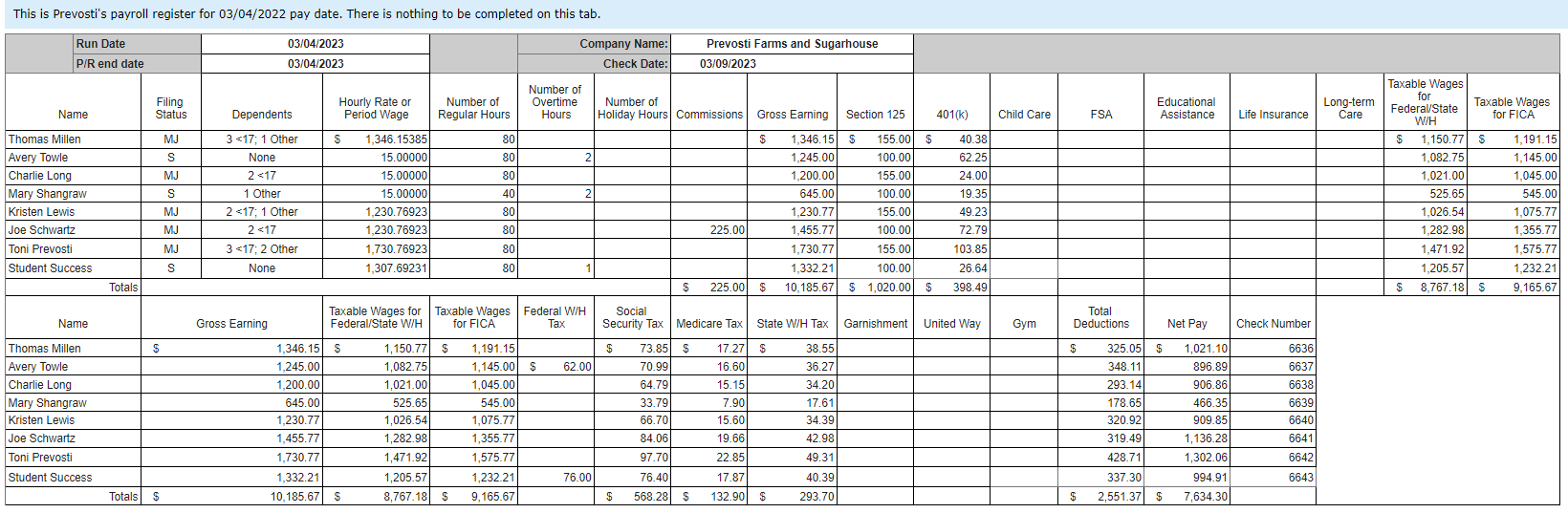

| March 4 | Journalize the employee pay. |

| March 4 | Journalize the employer payroll tax for the March 4 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| March 9 | Issue the employee pay. |

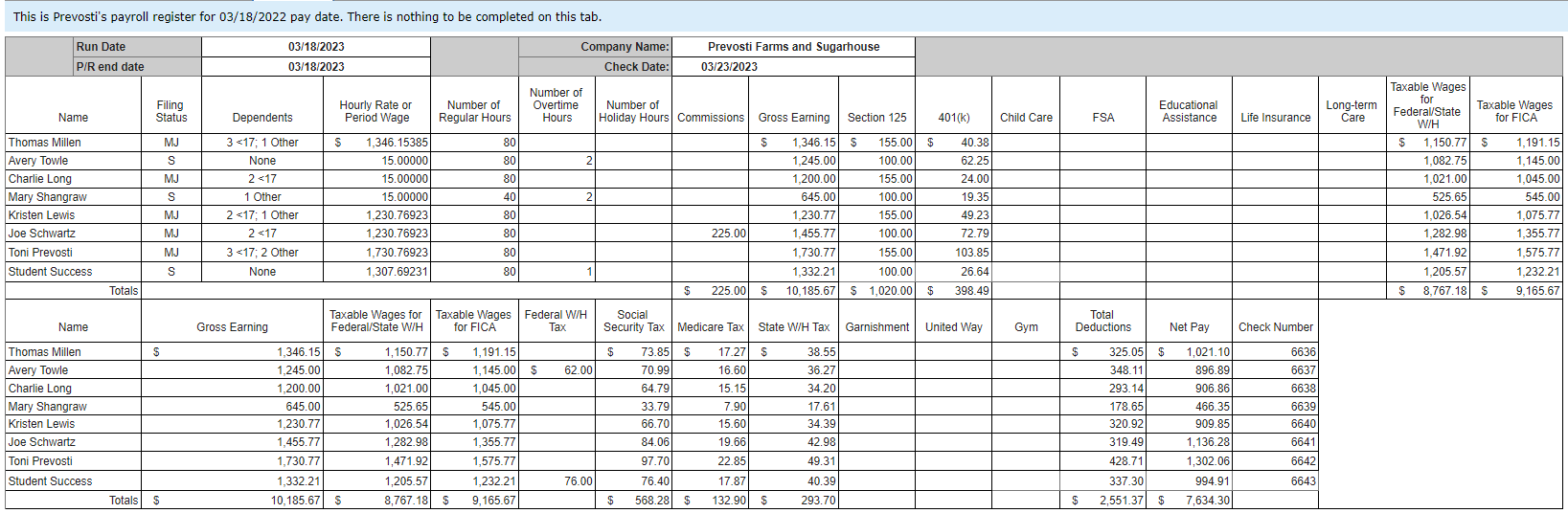

| March 18 | Journalize the employee pay. |

| March 18 | Journalize the employer payroll tax for the March 18 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. |

| March 23 | Issue the employee pay. |

| March 23 | Issue payment for the payroll liabilities. |

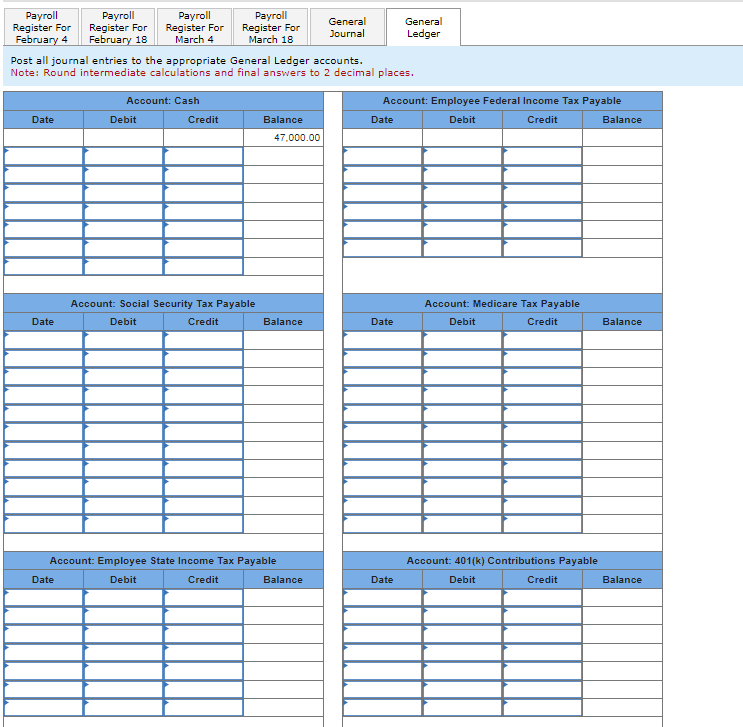

Post all journal entries to the appropriate General Ledger accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started