Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the percentage of sales method, what will be the net income next year (in $ million)? Using the percentage of sales method, what will

Using the percentage of sales method, what will be the net income next year (in $ million)?

Using the percentage of sales method, what will be the net income next year (in $ million)?

Using the percentage of sales method, what will be the book value of equity next year (in $ million)?

What is the external funding required (EFR) for next year (in $ million)?

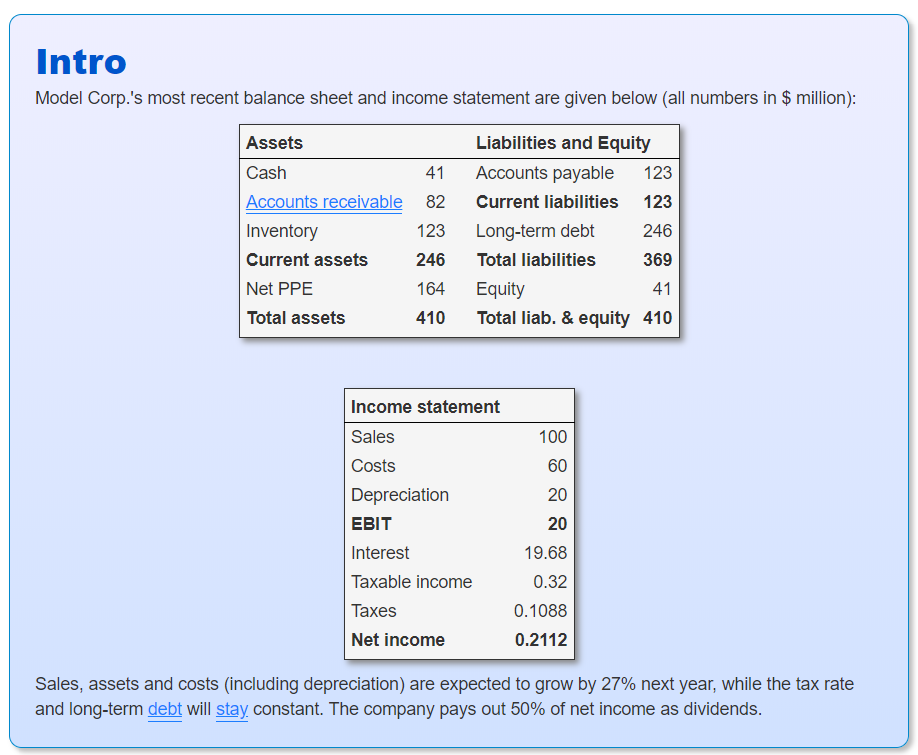

Intro Model Corp.'s most recent balance sheet and income statement are given below (all numbers in $ million): 41 Assets Cash Accounts receivable Inventory Current assets Net PPE Total assets Liabilities and Equity Accounts payable 123 Current liabilities 123 Long-term debt Total liabilities 369 Equity 41 Total liab. & equity 410 82 123 246 164 410 246 Income statement Sales Costs Depreciation EBIT Interest Taxable income 19.68 0.32 0.1088 0.2112 Taxes Net income Sales, assets and costs (including depreciation) are expected to grow by 27% next year, while the tax rate and long-term debt will stay constant. The company pays out 50% of net income as dividendsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started