Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the prompt, create a trial balance, journal entry and t accounts using excel and template BIG NOTE: Start your journal entries with Debits, as

Using the prompt, create a trial balance, journal entry and t accounts using excel and template

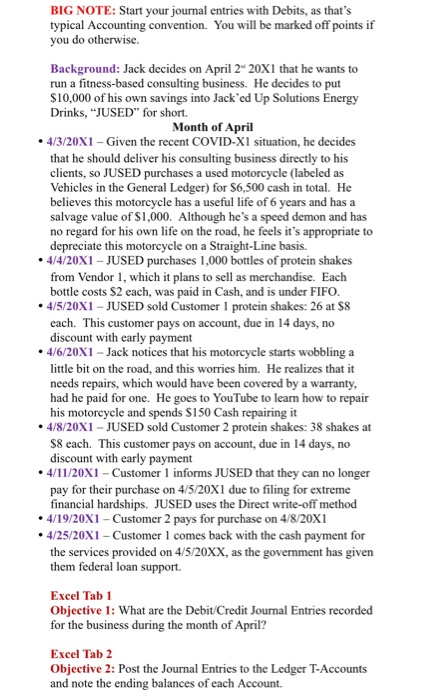

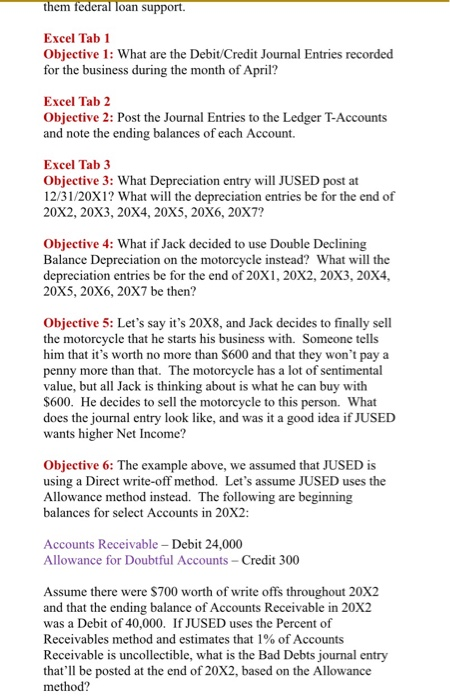

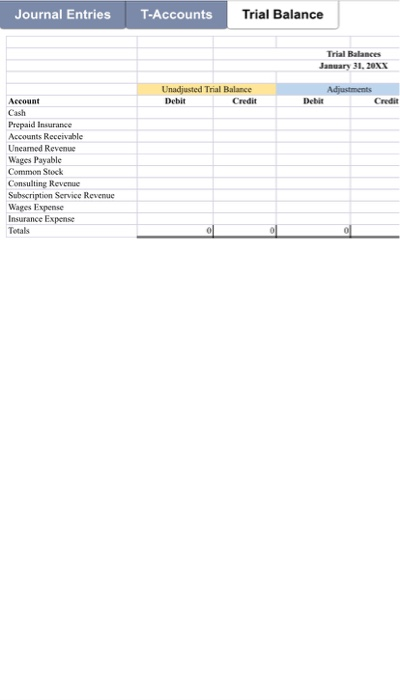

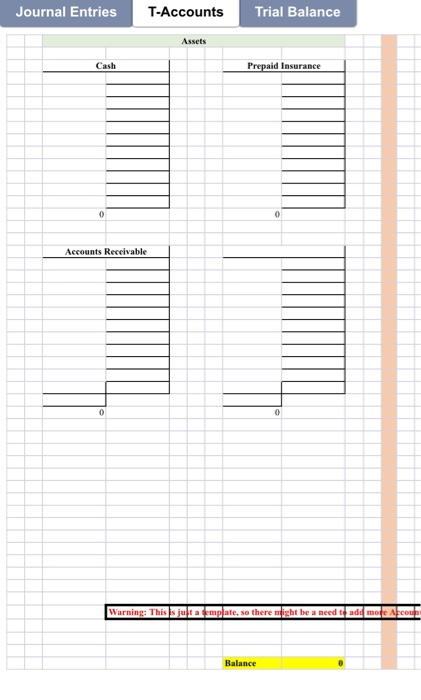

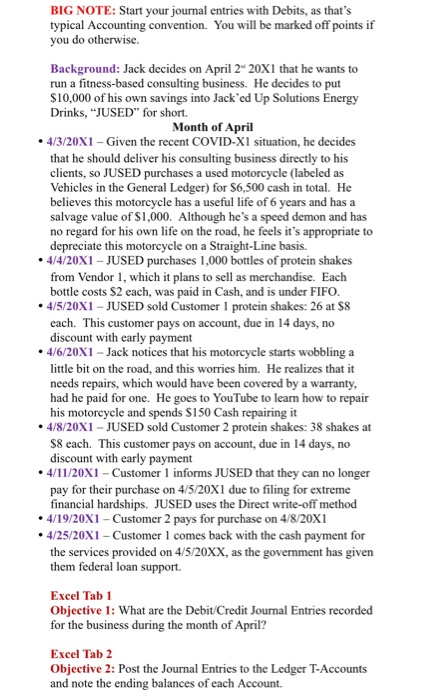

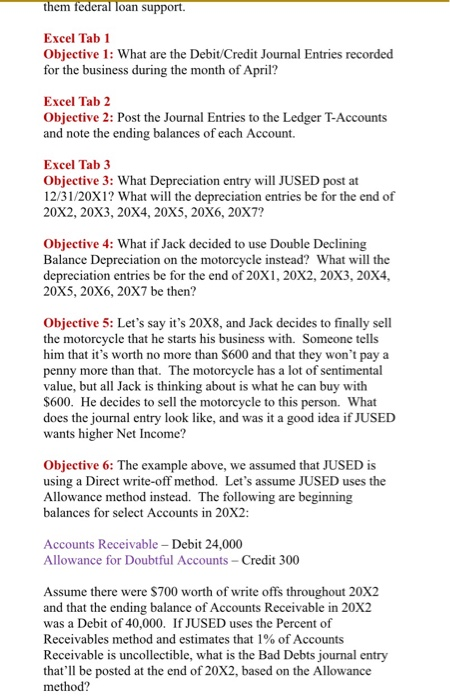

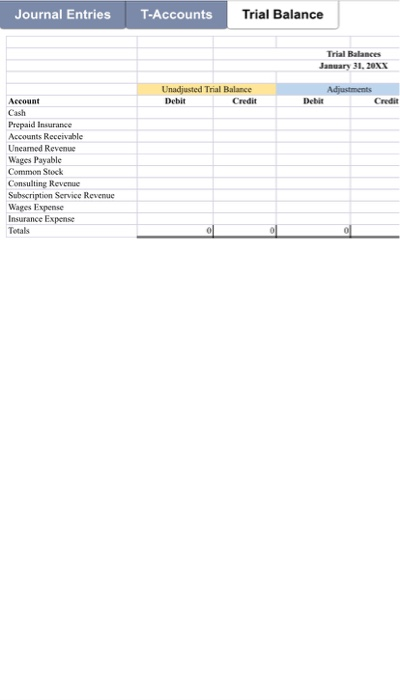

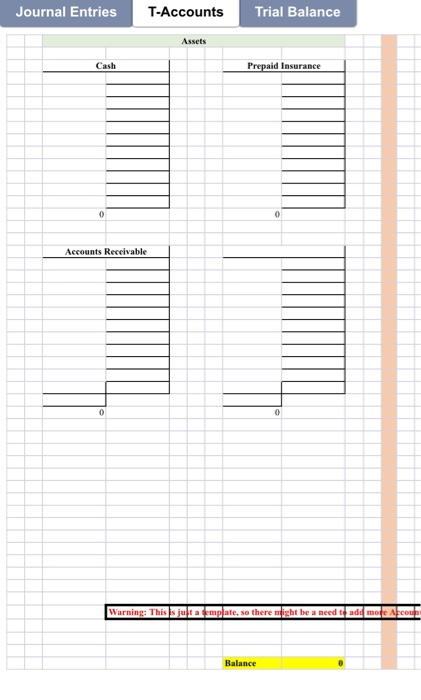

BIG NOTE: Start your journal entries with Debits, as that's typical Accounting convention. You will be marked off points if you do otherwise. Background: Jack decides on April 220X1 that he wants to run a fitness-based consulting business. He decides to put $10,000 of his own savings into Jack'ed Up Solutions Energy Drinks, "JUSED" for short. Month of April . 4/3/20X1-Given the recent COVID-XI situation, he decides that he should deliver his consulting business directly to his clients, so JUSED purchases a used motorcycle (labeled as Vehicles in the General Ledger) for $6,500 cash in total. He believes this motorcycle has a useful life of 6 years and has a salvage value of $1,000. Although he's a speed demon and has no regard for his own life on the road, he feels it's appropriate to depreciate this motorcycle on a Straight-Line basis. . 4/4/20X1 - JUSED purchases 1,000 bottles of protein shakes from Vendor 1, which it plans to sell as merchandise. Each bottle costs $2 each, was paid in Cash, and is under FIFO. 4/5/20X1 - JUSED sold Customer 1 protein shakes: 26 at $8 each. This customer pays on account, due in 14 days, no discount with early payment 4/6/20X1 - Jack notices that his motorcycle starts wobbling a little bit on the road, and this worries him. He realizes that it needs repairs, which would have been covered by a warranty, his motorcycle and spends $150 Cash repairing it 4/8/20X1 - JUSED sold Customer 2 protein shakes: 38 shakes at $8 each. This customer pays on account, due in 14 days, no discount with early payment 4/11/20X1 - Customer 1 informs JUSED that they can no longer pay for their purchase on 4/5/20X1 due to filing for extreme financial hardships. JUSED uses the Direct write-off method . 4/19/20X1 - Customer 2 pays for purchase on 4/8/20X1 4/25/20X1 - Customer 1 comes back with the cash payment for the services provided on 4/5/20XX, as the government has given them federal loan support. Excel Tab 1 Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of April? Excel Tab 2 Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. them federal loan support. Excel Tab 1 Objective 1: What are the Debit/Credit Journal Entries recorded for the business during the month of April? Excel Tab 2 Objective 2: Post the Journal Entries to the Ledger T-Accounts and note the ending balances of each Account. Excel Tab 3 Objective 3: What Depreciation entry will JUSED post at 12/31/20X1? What will the depreciation entries be for the end of 20X2, 20X3, 20X4, 20X5, 20X6, 20X7? Objective 4: What if Jack decided to use Double Declining Balance Depreciation on the motorcycle instead? What will the depreciation entries be for the end of 20X1, 20X2, 20X3, 20X4, 20X5, 20X6, 20X7 be then? Objective 5: Let's say it's 20X8, and Jack decides to finally sell the motorcycle that he starts his business with. Someone tells him that it's worth no more than $600 and that they won't pay a penny more than that. The motorcycle has a lot of sentimental value, but all Jack is thinking about is what he can buy with $600. He decides to sell the motorcycle to this person. What does the journal entry look like, and was it a good idea if JUSED wants higher Net Income? Objective 6: The example above, we assumed that JUSED is using a Direct write-off method. Let's assume JUSED uses the Allowance method instead. The following are beginning balances for select Accounts in 20X2: Accounts Receivable - Debit 24,000 Allowance for Doubtful Accounts - Credit 300 Assume there were $700 worth of write offs throughout 20X2 and that the ending balance of Accounts Receivable in 20X2 was a Debit of 40,000. If JUSED uses the Percent of Receivables method and estimates that 1% of Accounts Receivable is uncollectible, what is the Bad Debts journal entry that'll be posted at the end of 20X2, based on the Allowance method? Journal Entries T-Accounts Trial Balance Trial Balances January 31, 20XX Unadjusted Tral Balance Debit Credit Ads De Credit Account Cash Accounts Receivable Uscared Revenue Common Stock Consulting Revenue Subscription Service Revenue Wages Expense Insurance Expense 0 0 Journal Entries T-Accounts Trial Balance Assets Prepaid Insurance Warning: This s tatemplate, so there might be a need to add more Ar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started