Question

Using the provided template, compute Walmart's weighted average cost of capital. Here are some recommended websites and techniques: - Using Morningstar.com (or Walmarts annual report),

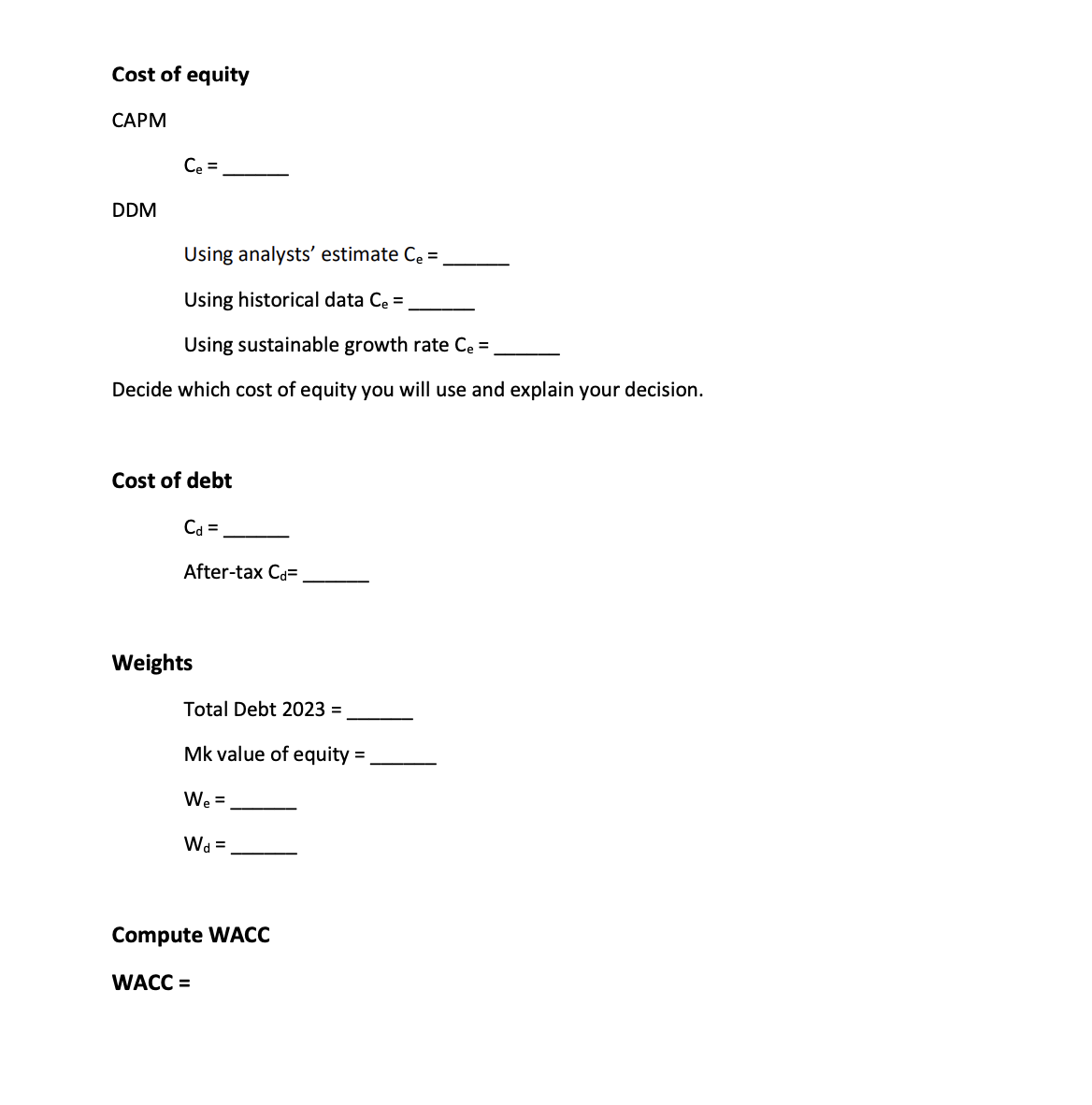

Using the provided template, compute Walmart's weighted average cost of capital. Here are some recommended websites and techniques: - Using Morningstar.com (or Walmarts annual report), access the last five years of financial information (IS and BS). - Using Yahoo Finance, find the stock price for Walmart. Make sure you save a copy of the screen, so I can see when you accessed the website and the price information. - Using Yahoo Finance, find beta. - Using Yahoo Finance, find the number of shares outstanding. - Using Yahoo Finance, access the Analysis and save the Growth Estimates o You can use Next 5 Years as a proxy for dividend growth - Other ways to find the dividend growth o Use the historical growth rate (use the geometric average) o Use the sustainable growth rate Sustainable growth rate = ROE * (1 Dividend payout ratio) Sustainable growth rate = ROE * (1 dividend per share/earnings per share) You can use the latest information and/or averages for ROE and the dividend payout ratio. Make sure your approach is clear and justify it. - To find the market risk premium, use the excel posted on D2L or the following website o http://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/histretSP.ht ml - To find the cost of debt, you can use the balance sheet and the income statement - To find the tax rate, you can use o The annual report (effective tax rate) o The income statement (compute the tax rate) NOTES: Treat short-term debt and long-term debt the same way. Treat retained earnings the same way as common equity. Make sure you explain every step and document your sources. Every resource must be added as an appendix at the end of the project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started