Question

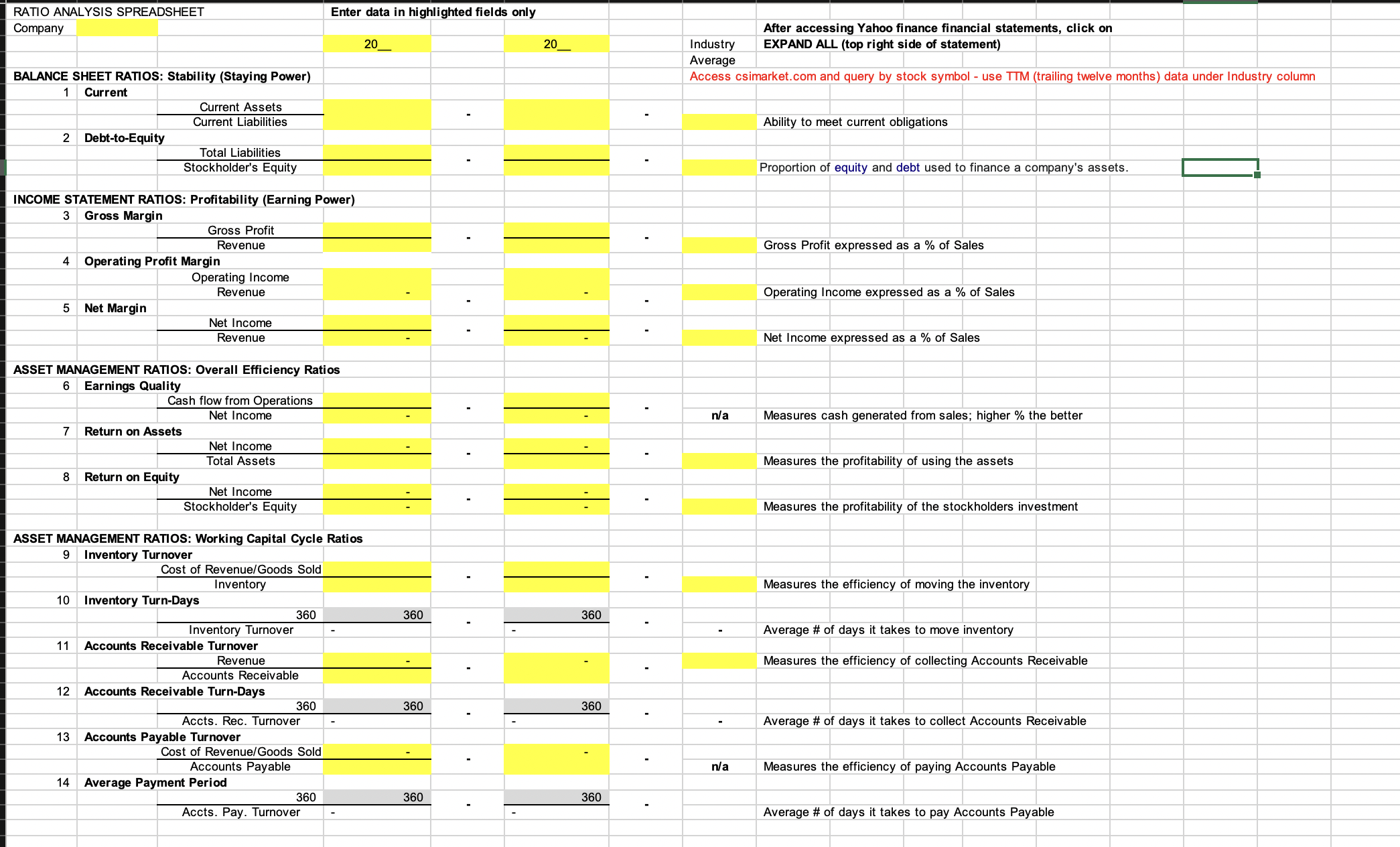

Using the ratio analysis template listed in the test instructions, complete the financial analysis of Yum Brands for the two most recent years. Access Yahoo

Using the ratio analysis template listed in the test instructions, complete the financial analysis of Yum Brands for the two most recent years.

Access Yahoo Finance, enter YUM in stock symbol field, Scroll to "Financials" to select financial statements. For each statement, select "Expand All" in top right corner of statement, to view detailed information. Complete the analysis spreadsheet

Using the space below, analyze the company using the two years of data and reference the industry averages in the following areas:

Staying Power

Earning Power

Overall efficiency ratios

Working capital cycle ratios

Use the CSImarket.com website, listed in the instructions, to look up industry averages (Go to site, enter stock symbol, select Fundamentals. Use Industry column to retrieve data for all ratios except Earnings Quality and Accounts Payable turnover). Use TTM industry data. Enter the data in the analysis spreadsheet.

Submit the spreadsheet via question # 24 below.

Complete the analysis in the space below.

https://csimarket.com/

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started