Answered step by step

Verified Expert Solution

Question

1 Approved Answer

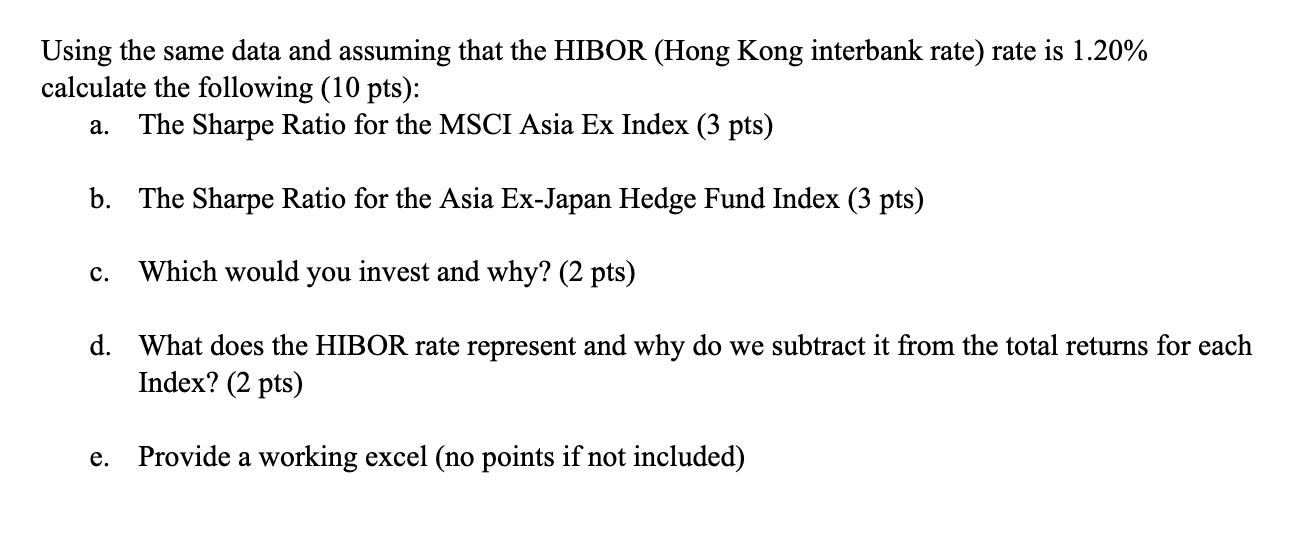

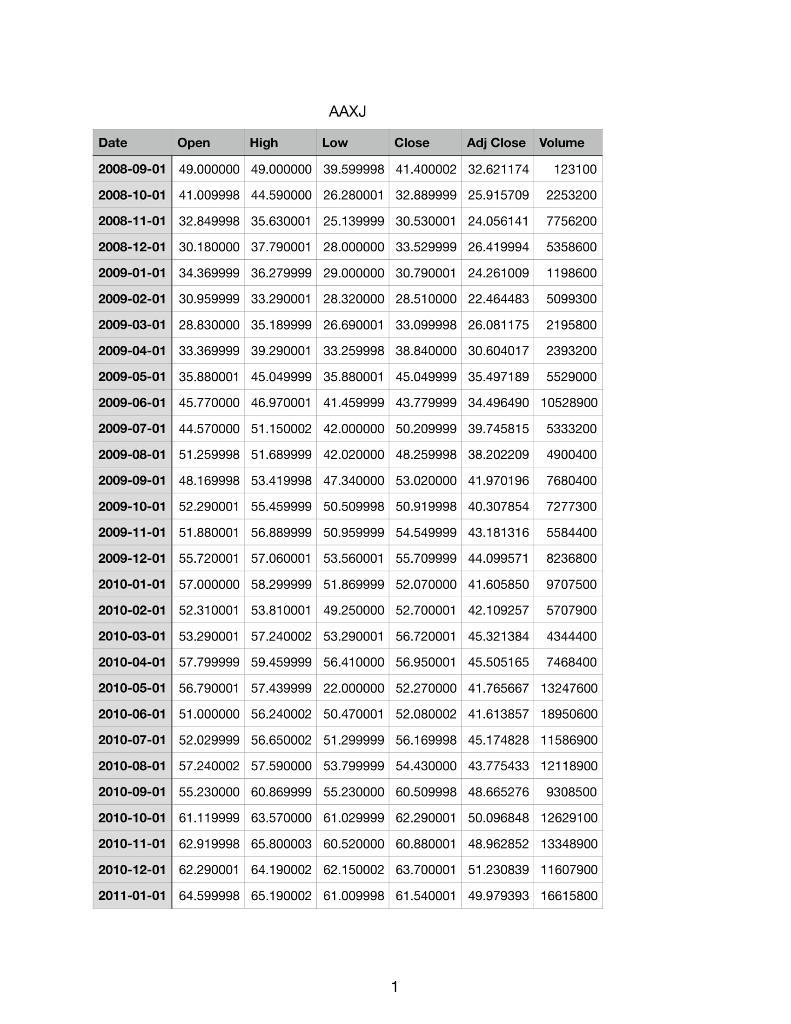

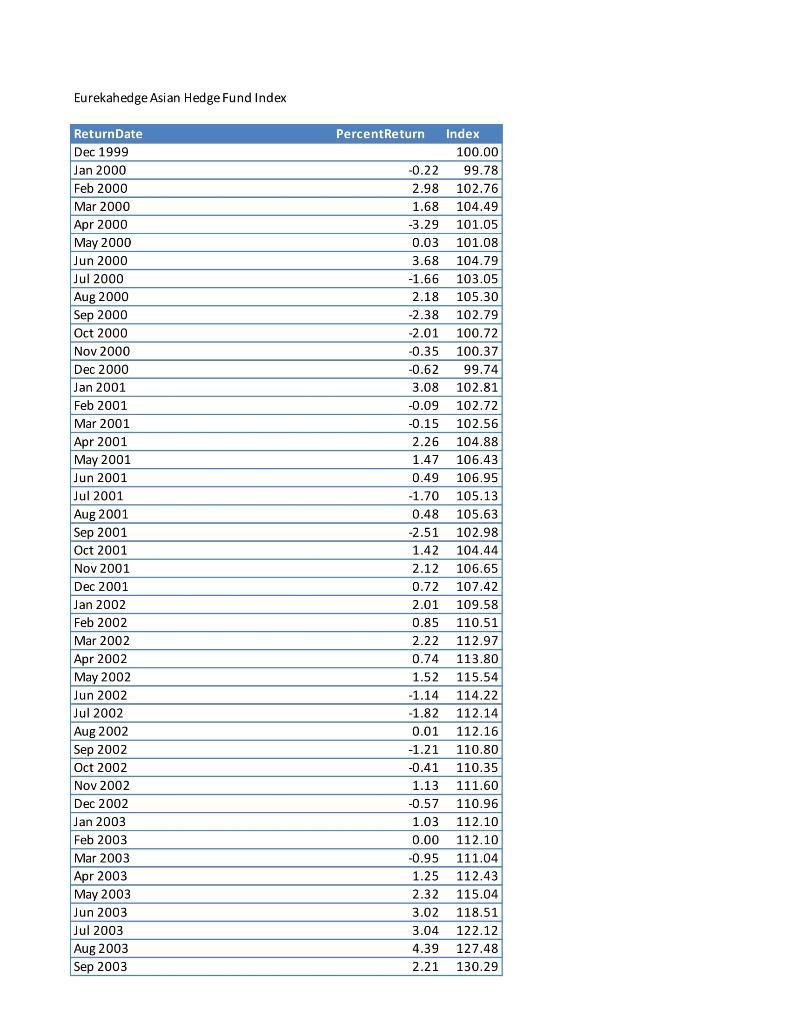

Using the same data and assuming that the HIBOR (Hong Kong interbank rate) rate is 1.20% calculate the following (10 pts): a. The Sharpe

Using the same data and assuming that the HIBOR (Hong Kong interbank rate) rate is 1.20% calculate the following (10 pts): a. The Sharpe Ratio for the MSCI Asia Ex Index (3 pts) b. The Sharpe Ratio for the Asia Ex-Japan Hedge Fund Index (3 pts) C. Which would you invest and why? (2 pts) d. What does the HIBOR rate represent and why do we subtract it from the total returns for each Index? (2 pts) Provide a working excel (no points if not included) e. Date AAXJ High Close Adj Close Volume Open 2008-09-01 49.000000 49.000000 39.599998 41.400002 32.621174 123100 2008-10-01 41.009998 44.590000 26.280001 32.889999 25.915709 2253200 2008-11-01 32.849998 35.630001 25.139999 30.530001 24.056141 7756200 2008-12-01 30.180000 37.790001 28.000000 33.529999 26.419994 5358600 2009-01-01 34.369999 36.279999 29.000000 30.790001 24.261009 1198600 2009-02-01 30.959999 33.290001 28.320000 28.510000 22.464483 5099300 2009-03-01 28.830000 35.189999 26.690001 33.099998 26.081175 2195800 2009-04-01 33.369999 39.290001 33.259998 38.840000 30.604017 2393200 2009-05-01 35.880001 45.049999 35.880001 45.049999 35.497189 5529000 2009-06-01 45.770000 46.970001 41.459999 43.779999 34.496490 10528900 2009-07-01 44.570000 51.150002 42.000000 50.209999 39.745815 5333200 2009-08-01 51.259998 51.689999 42.020000 48.259998 38.202209 4900400 2009-09-01 48.169998 53.419998 47.340000 53.020000 41.970196 7680400 2009-10-01 52.290001 55.459999 50.509998 50.919998 40.307854 7277300 2009-11-01 51.880001 56.889999 50.959999 54.549999 43.181316 5584400 2009-12-01 55.720001 57.060001 53.560001 55.709999 44.099571 8236800 2010-01-01 57.000000 58.299999 51.869999 52.070000 41.605850 9707500 2010-02-01 52.310001 53.810001 49.250000 52.700001 42.109257 5707900 2010-03-01 53.290001 57.240002 53.290001 56.720001 45.321384 4344400 2010-04-01 57.799999 59.459999 56.410000 56.950001 45.505165 7468400 2010-05-01 56.790001 57.439999 22.000000 52.270000 41.765667 13247600 2010-06-01 51.000000 56.240002 50.470001 52.080002 41.613857 18950600 2010-07-01 52.029999 56.650002 51.299999 56.169998 45.174828 11586900 2010-08-01 57.240002 57.590000 53.799999 54.430000 43.775433 12118900 2010-09-01 55.230000 60.869999 55.230000 60.509998 48.665276 9308500 2010-10-01 61.119999 63.570000 61.029999 62.290001 50.096848 12629100 2010-11-01 62.919998 65.800003 60.520000 60.880001 48.962852 13348900 2010-12-01 62.290001 64.190002 62.150002 63.700001 51.230839 11607900 2011-01-01 64.599998 65.190002 61.009998 61.540001 49.979393 16615800 Low 1 Eurekahedge Asian Hedge Fund Index ReturnDate Dec 1999 Jan 2000 Feb 2000 Mar 2000 Apr 2000 May 2000 Jun 2000 Jul 2000 Aug 2000 Sep 2000 Oct 2000 Nov 2000 Dec 2000 Jan 2001 Feb 2001 Mar 2001 Apr 2001 May 2001 Jun 2001 Jul 2001 Aug 2001 Sep 2001 Oct 2001 Nov 2001 Dec 2001 Jan 2002 Feb 2002 Mar 2002 Apr 2002 May 2002 Jun 2002 Jul 2002 Aug 2002 Sep 2002 Oct 2002 Nov 2002 Dec 2002 Jan 2003 Feb 2003 Mar 2003 Apr 2003 May 2003 Jun 2003 Jul 2003 Aug 2003 Sep 2003 PercentReturn Index -0.22 2.98 1.68 -3.29 0.03 3.68 100.00 99.78 102.76 104.49 101.05 101.08 104.79 -1.66 103.05 2.18 105.30 -2.38 102.79 -2.01 100.72 -0.35 100.37 -0.62 99.74 3.08 102.81 -0.09 102.72 -0.15 102.56 2.26 104.88 1.47 106.43 0.49 106.95 -1.70 105.13 0.48 105.63 -2.51 102.98 1.42 104.44 2.12 106.65 0.72 107.42 2.01 109.58 0.85 110.51 2.22 112.97 0.74 113.80 1.52 115.54 -1.14 114.22 -1.82 112.14 0.01 112.16 -1.21 110.80 -0.41 110.35 1.13 111.60 -0.57 110.96 1.03 112.10 0.00 112.10 -0.95 111.04 1.25 112.43 2.32 115.04 3.02 118.51 3.04 122.12 4.39 127.48 2.21 130.29

Step by Step Solution

★★★★★

3.60 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a The Sharpe Ratio for the MSCI Asia Ex Index To calculate the Sharpe Ratio we need to first calculate the excess return of the MSCI Asia Ex Index ove...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started