Question

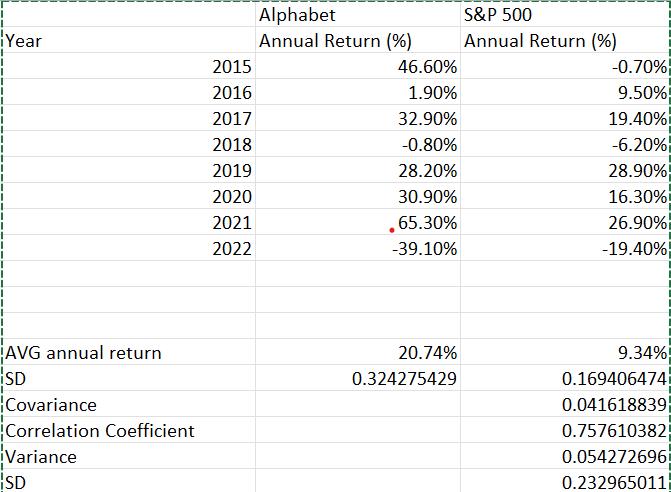

Using the S&P 500 index as a proxy for the market portfolio, what would be the estimated Beta for the Alphabet stock? Show your calculations.

Using the S&P 500 index as a proxy for the "market portfolio", what would be the estimated Beta for the Alphabet stock? Show your calculations. If you are using Excel, post an image of the section of the spreadsheet that shows your calculations.

Question 5 (2 points) Using the calculated Beta for Alphabet stock returns, and assuming the risk free rate is 2.5 percent and the market risk premium is 7 percent, what would be the expected CAPM Alphabet stock return? Show your calculations. If using Excel, post an image of the section of the spreadsheet showing your calculations.

Year I 1 1 1 I 1 1 I 1 I I AVG annual return SD Covariance Correlation Coefficient Variance SD 2015 2016 2017 2018 2019 2020 2021 2022 Alphabet Annual Return (%) 46.60% 1.90% 32.90% -0.80% 28.20% 30.90% .65.30% -39.10% 20.74% 0.324275429 S&P 500 Annual Return (%) -0.70%- 9.50% 19.40% -6.20% 28.90% 16.30% 26.90% -19.40% 9.34% 0.169406474 0.041618839 0.757610382 0.054272696 0.232965011

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started