Answered step by step

Verified Expert Solution

Question

1 Approved Answer

using the standard values of the case determine the output for option 3. thank yoi it is two documents but this a question for my

using the standard values of the case determine the output for option 3. thank yoi

it is two documents but this a question for my project

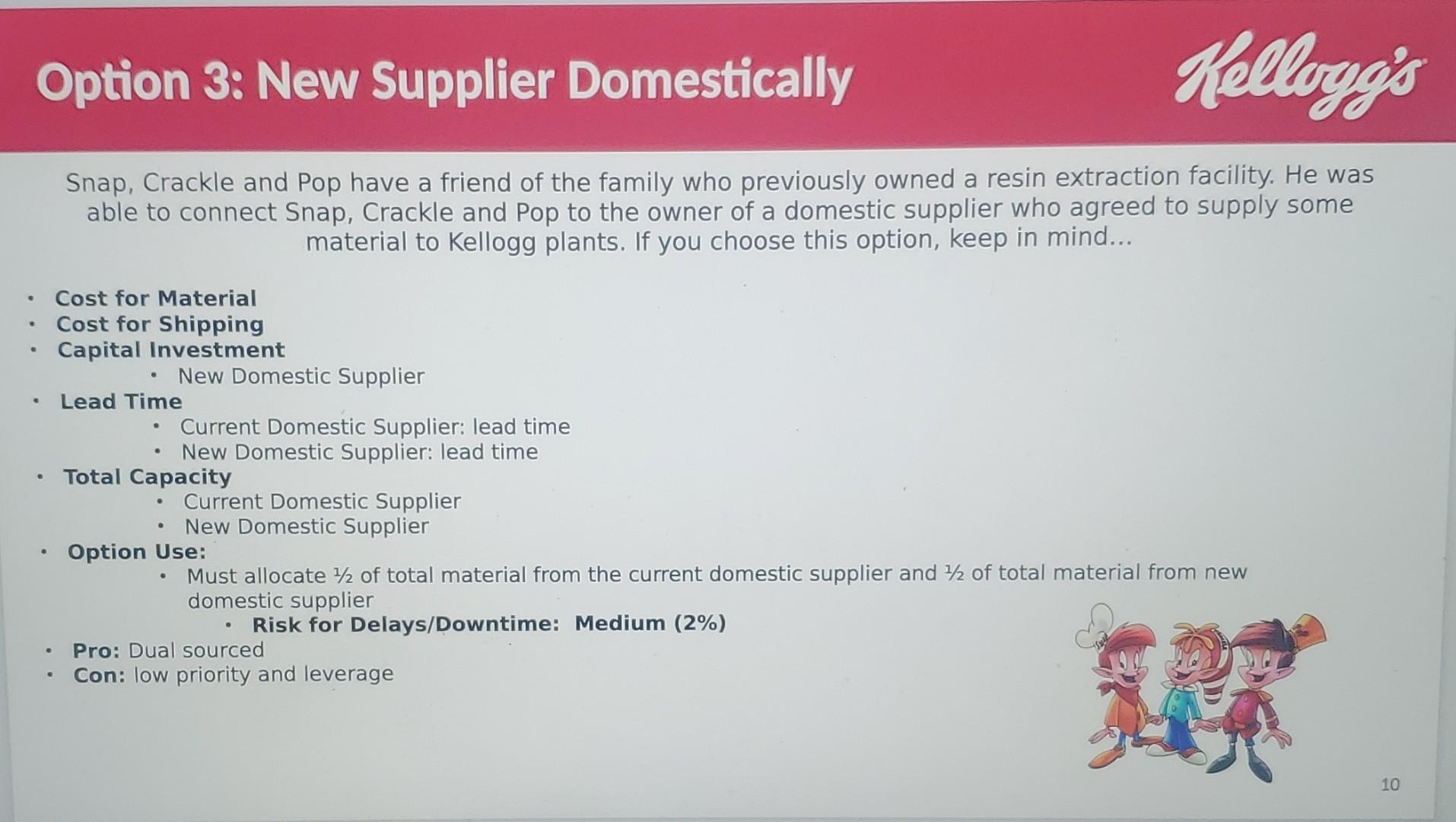

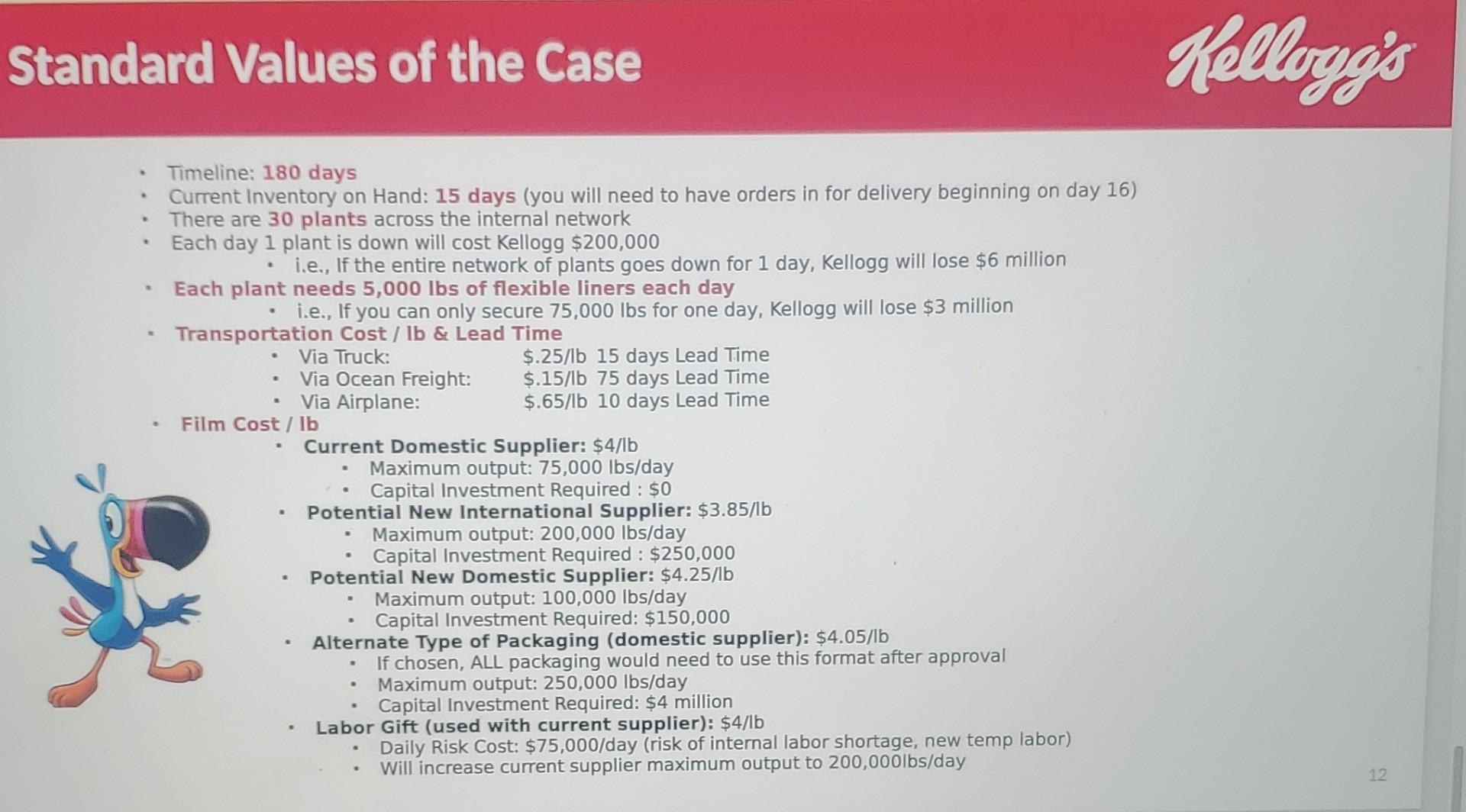

Option 3: New Supplier Domestically Kellogg's Snap, Crackle and Pop have a friend of the family who previously owned a resin extraction facility. He was able to connect Snap, Crackle and pop to the owner of a domestic supplier who agreed to supply some material to Kellogg plants. If you choose this option, keep in mind... . . Cost for Material Cost for Shipping Capital Investment New Domestic Supplier Lead Time Current Domestic Supplier: lead time New Domestic Supplier: lead time Total Capacity Current Domestic Supplier New Domestic Supplier Option Use: Must allocate 12 of total material from the current domestic supplier and 2 of total material from new domestic supplier Risk for Delays/Downtime: Medium (2%) Pro: Dual sourced Con: low priority and leverage . 10 Standard Values of the Case Kellogg's . . . . Timeline: 180 days Current Inventory on Hand: 15 days (you will need to have orders in for delivery beginning on day 16) There are 30 plants across the internal network Each day 1 plant is down will cost Kellogg $200,000 i.e., If the entire network of plants goes down for 1 day, Kellogg will lose $6 million Each plant needs 5,000 lbs of flexible liners each day i.e., If you can only secure 75,000 lbs for one day, Kellogg will lose $3 million Transportation Cost / Ib & Lead Time Via Truck: $.25/lb 15 days Lead Time Via Ocean Freight: $.15/lb 75 days Lead Time Via Airplane: $.65/lb 10 days Lead Time Film Cost / Ib Current Domestic Supplier: $4/1b Maximum output: 75,000 lbs/day Capital Investment Required : $0 Potential New International Supplier: $3.85/1b Maximum output: 200,000 lbs/day Capital Investment Required : $250,000 Potential New Domestic Supplier: $4.25/lb Maximum output: 100,000 lbs/day Capital Investment Required: $150,000 Alternate Type of Packaging (domestic supplier): $4.05/lb If chosen, ALL packaging would need to use this format after approval Maximum output: 250,000 lbs/day Capital Investment Required: $4 million Labor Gift (used with current supplier): $4/1b Daily Risk Cost: $75,000/day (risk of internal labor shortage, new temp labor) Will increase current supplier maximum output to 200,000lbs/day . . . . . 12. Option 3: New Supplier Domestically Kellogg's Snap, Crackle and Pop have a friend of the family who previously owned a resin extraction facility. He was able to connect Snap, Crackle and pop to the owner of a domestic supplier who agreed to supply some material to Kellogg plants. If you choose this option, keep in mind... . . Cost for Material Cost for Shipping Capital Investment New Domestic Supplier Lead Time Current Domestic Supplier: lead time New Domestic Supplier: lead time Total Capacity Current Domestic Supplier New Domestic Supplier Option Use: Must allocate 12 of total material from the current domestic supplier and 2 of total material from new domestic supplier Risk for Delays/Downtime: Medium (2%) Pro: Dual sourced Con: low priority and leverage . 10 Standard Values of the Case Kellogg's . . . . Timeline: 180 days Current Inventory on Hand: 15 days (you will need to have orders in for delivery beginning on day 16) There are 30 plants across the internal network Each day 1 plant is down will cost Kellogg $200,000 i.e., If the entire network of plants goes down for 1 day, Kellogg will lose $6 million Each plant needs 5,000 lbs of flexible liners each day i.e., If you can only secure 75,000 lbs for one day, Kellogg will lose $3 million Transportation Cost / Ib & Lead Time Via Truck: $.25/lb 15 days Lead Time Via Ocean Freight: $.15/lb 75 days Lead Time Via Airplane: $.65/lb 10 days Lead Time Film Cost / Ib Current Domestic Supplier: $4/1b Maximum output: 75,000 lbs/day Capital Investment Required : $0 Potential New International Supplier: $3.85/1b Maximum output: 200,000 lbs/day Capital Investment Required : $250,000 Potential New Domestic Supplier: $4.25/lb Maximum output: 100,000 lbs/day Capital Investment Required: $150,000 Alternate Type of Packaging (domestic supplier): $4.05/lb If chosen, ALL packaging would need to use this format after approval Maximum output: 250,000 lbs/day Capital Investment Required: $4 million Labor Gift (used with current supplier): $4/1b Daily Risk Cost: $75,000/day (risk of internal labor shortage, new temp labor) Will increase current supplier maximum output to 200,000lbs/day . . . . . 12Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started