Using the Statement of Cash Flows, which operating activity items stand out to you, and why?

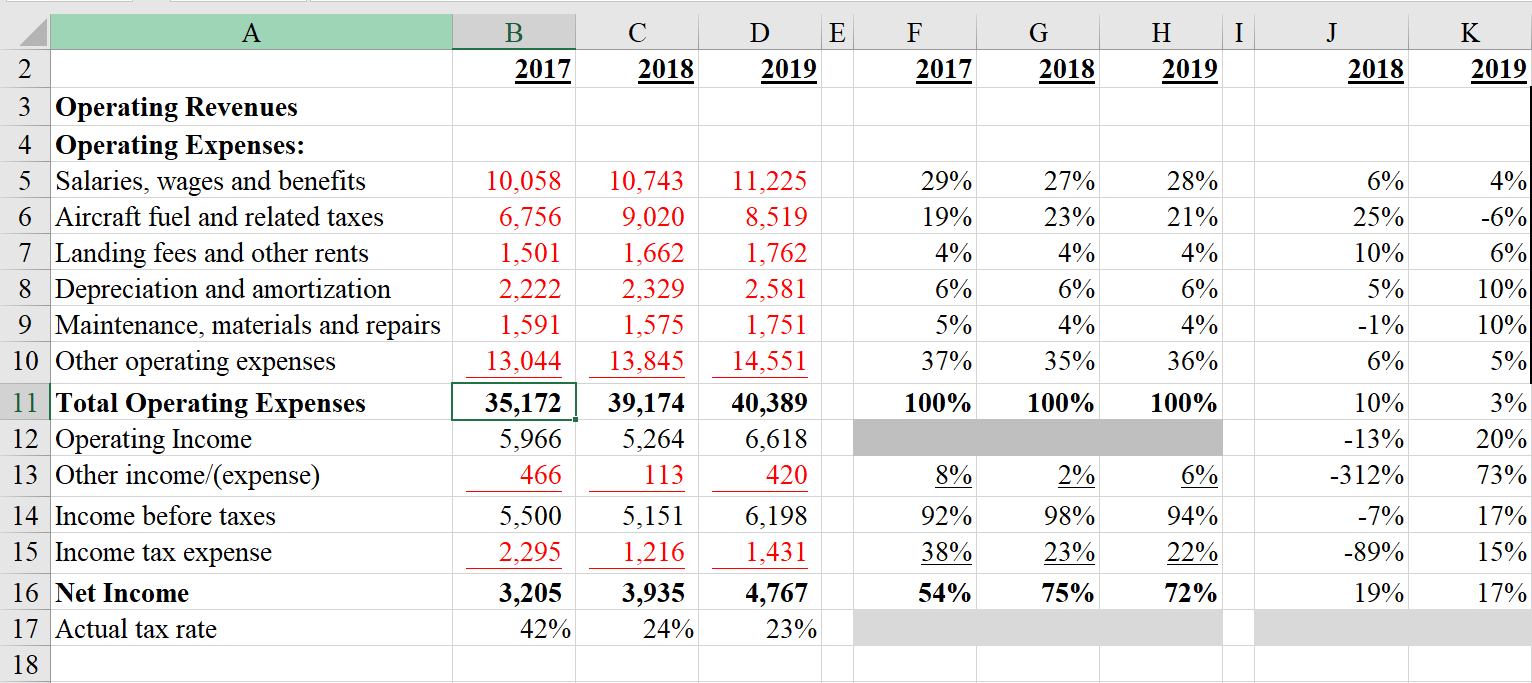

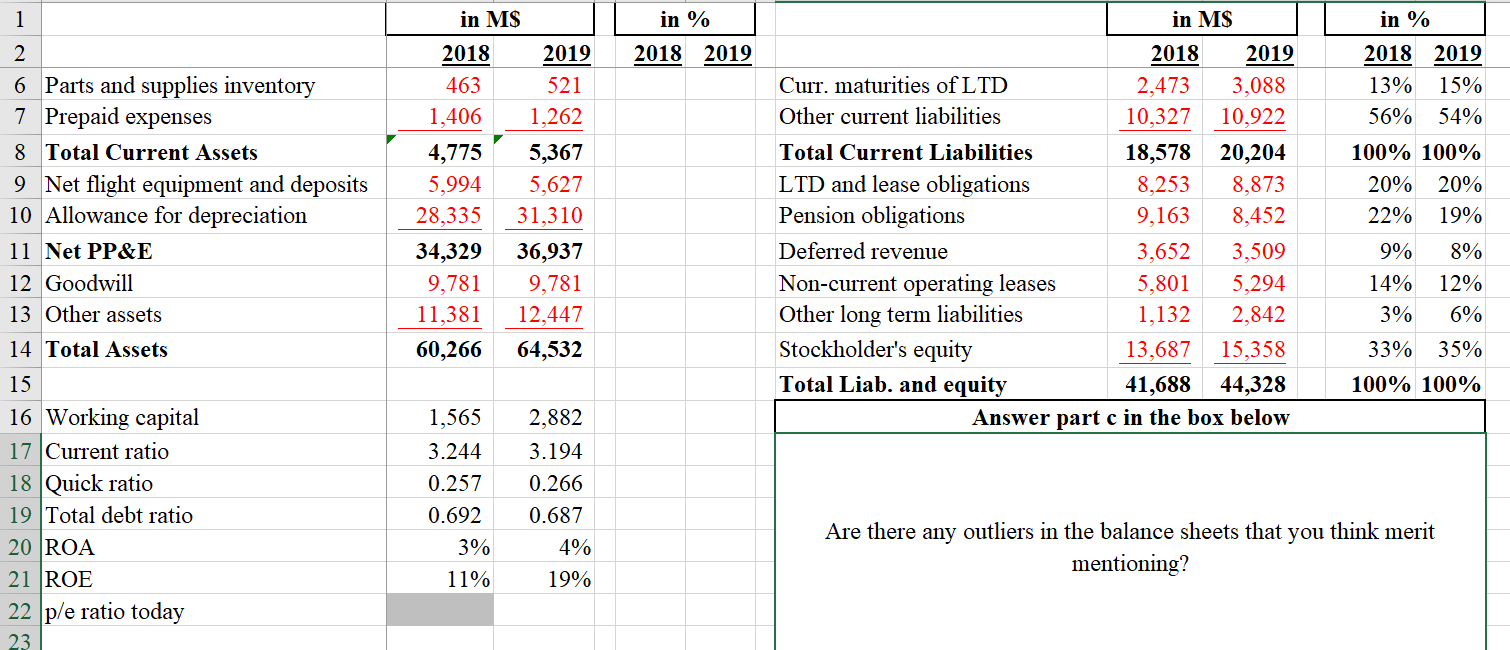

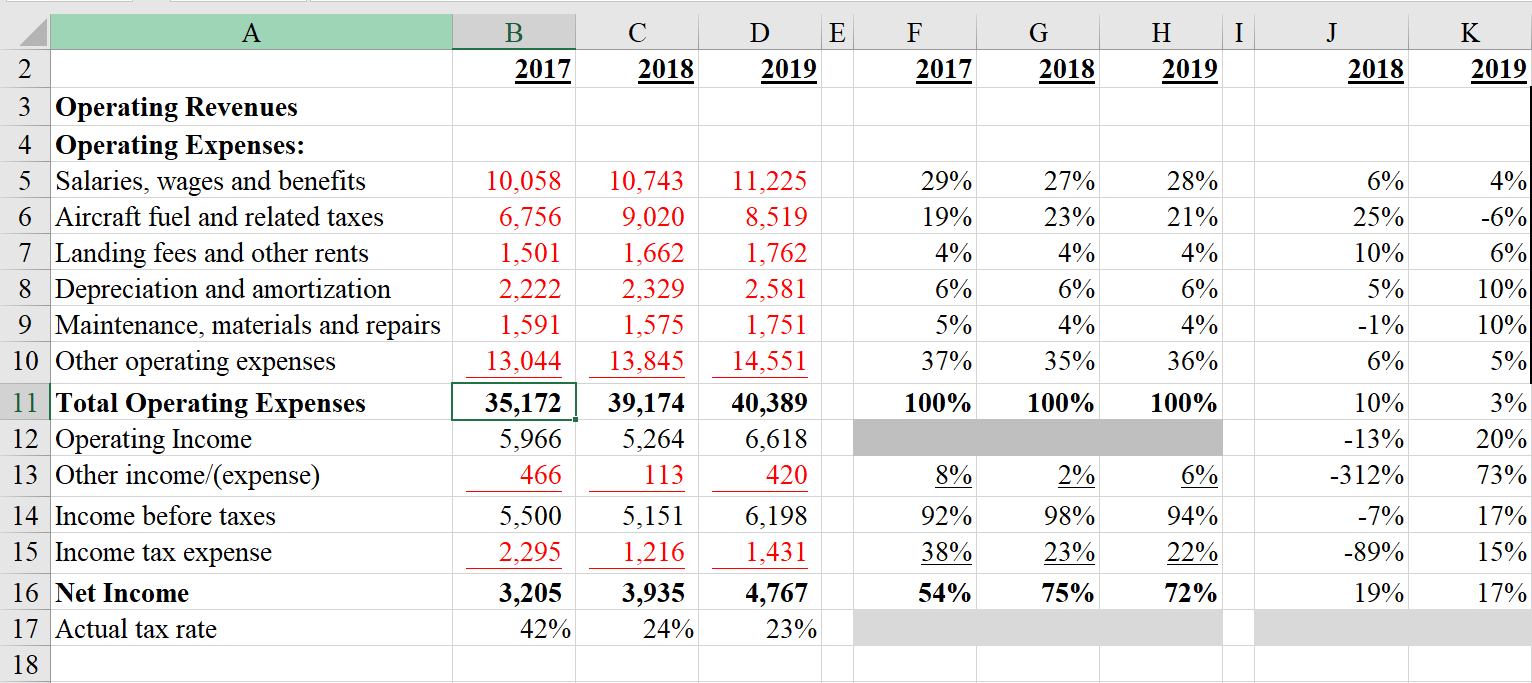

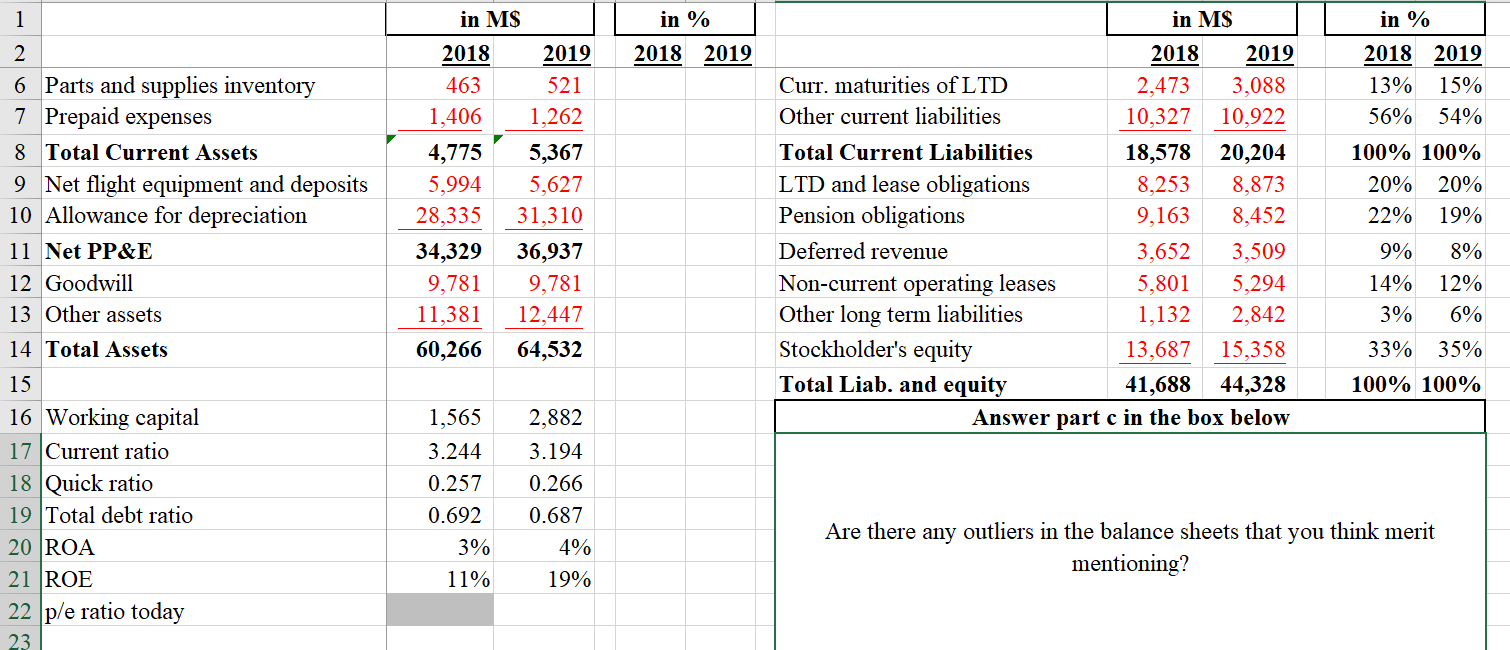

E F I J B 2017 2018 D 2019 G 2018 H 2019 K 2019 2017 2018 27% 23% 4% 28% 21% 4% 6% 25% 10% 5% -1% 29% 19% 4% 6% 5% 37% 4% -6% 6% 10% 10% A 2 3 Operating Revenues 4 Operating Expenses: 5 Salaries, wages and benefits 6 Aircraft fuel and related taxes 7 Landing fees and other rents 8 Depreciation and amortization 9 Maintenance, materials and repairs 10 Other operating expenses 11 Total Operating Expenses 12 Operating Income 13 Other income/(expense) 14 Income before taxes 15 Income tax expense 16 Net Income 17 Actual tax rate 18 6% 10,743 9,020 1,662 2,329 1,575 13,845 39,174 5,264 113 5,151 1,216 4% 35% 6% 4% 36% 6% 10,058 6,756 1,501 2,222 1,591 13,044 35,172 5,966 466 5,500 2,295 3,205 42% 5% 11,225 8,519 1,762 2,581 1,751 14,551 40,389 6,618 420 6,198 1,431 4,767 23% 100% 100% 100% 3% 20% 73% 8% 2% 6% 10% -13% -312% -7% -89% O 92% 38% 98% 23% 94% 22% 17% 15% 54% 75% 72% 19% 17% 3,935 24% 1 in MS in % 2018 2019 2019 521 1,262 2 6 Parts and supplies inventory 7 Prepaid expenses 8 Total Current Assets 9 Net flight equipment and deposits 10 Allowance for depreciation 11 Net PP&E 12 Goodwill 13 Other assets 14 Total Assets 15 16 Working capital 17 Current ratio 18 Quick ratio 19 Total debt ratio 20 ROA 21 ROE 22 p/e ratio today 23 2018 463 1,406 4,775 5,994 28,335 34,329 9,781 11,381 60,266 5,367 5,627 31,310 36,937 9,781 12,447 64,532 in MS 2018 2019 Curr. maturities of LTD 2,473 3,088 Other current liabilities 10,327 10,922 Total Current Liabilities 18,578 20,204 LTD and lease obligations 8,253 8,873 Pension obligations 9,163 8,452 Deferred revenue 3,652 3,509 Non-current operating leases 5,801 5,294 Other long term liabilities 1,132 2,842 Stockholder's equity 13,687 15,358 Total Liab. and equity 41,688 44,328 Answer part c in the box below in % 2018 2019 13% 15% 56% 54% 100% 100% 20% 20% 22% 19% 9% 8% 14% 12% 3% 6% 33% 35% 100% 100% 1,565 3.244 0.257 0.692 3% 11% 2,882 3.194 0.266 0.687 4% 19% Are there any outliers in the balance sheets that you think merit mentioning? E F I J B 2017 2018 D 2019 G 2018 H 2019 K 2019 2017 2018 27% 23% 4% 28% 21% 4% 6% 25% 10% 5% -1% 29% 19% 4% 6% 5% 37% 4% -6% 6% 10% 10% A 2 3 Operating Revenues 4 Operating Expenses: 5 Salaries, wages and benefits 6 Aircraft fuel and related taxes 7 Landing fees and other rents 8 Depreciation and amortization 9 Maintenance, materials and repairs 10 Other operating expenses 11 Total Operating Expenses 12 Operating Income 13 Other income/(expense) 14 Income before taxes 15 Income tax expense 16 Net Income 17 Actual tax rate 18 6% 10,743 9,020 1,662 2,329 1,575 13,845 39,174 5,264 113 5,151 1,216 4% 35% 6% 4% 36% 6% 10,058 6,756 1,501 2,222 1,591 13,044 35,172 5,966 466 5,500 2,295 3,205 42% 5% 11,225 8,519 1,762 2,581 1,751 14,551 40,389 6,618 420 6,198 1,431 4,767 23% 100% 100% 100% 3% 20% 73% 8% 2% 6% 10% -13% -312% -7% -89% O 92% 38% 98% 23% 94% 22% 17% 15% 54% 75% 72% 19% 17% 3,935 24% 1 in MS in % 2018 2019 2019 521 1,262 2 6 Parts and supplies inventory 7 Prepaid expenses 8 Total Current Assets 9 Net flight equipment and deposits 10 Allowance for depreciation 11 Net PP&E 12 Goodwill 13 Other assets 14 Total Assets 15 16 Working capital 17 Current ratio 18 Quick ratio 19 Total debt ratio 20 ROA 21 ROE 22 p/e ratio today 23 2018 463 1,406 4,775 5,994 28,335 34,329 9,781 11,381 60,266 5,367 5,627 31,310 36,937 9,781 12,447 64,532 in MS 2018 2019 Curr. maturities of LTD 2,473 3,088 Other current liabilities 10,327 10,922 Total Current Liabilities 18,578 20,204 LTD and lease obligations 8,253 8,873 Pension obligations 9,163 8,452 Deferred revenue 3,652 3,509 Non-current operating leases 5,801 5,294 Other long term liabilities 1,132 2,842 Stockholder's equity 13,687 15,358 Total Liab. and equity 41,688 44,328 Answer part c in the box below in % 2018 2019 13% 15% 56% 54% 100% 100% 20% 20% 22% 19% 9% 8% 14% 12% 3% 6% 33% 35% 100% 100% 1,565 3.244 0.257 0.692 3% 11% 2,882 3.194 0.266 0.687 4% 19% Are there any outliers in the balance sheets that you think merit mentioning