Answered step by step

Verified Expert Solution

Question

1 Approved Answer

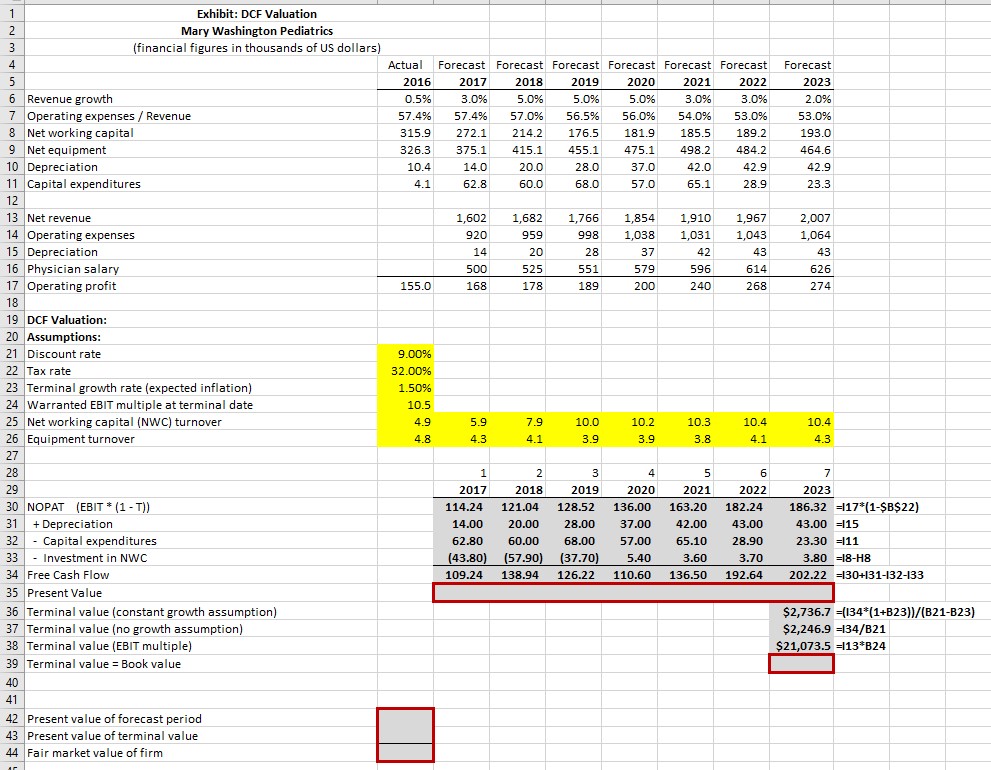

Using the tables below Construct a valuation of Mary Washington Pediatrics to estimate the total fair market value. a. Use more than one estimate for

Using the tables below Construct a valuation of Mary Washington Pediatrics to estimate the total fair market value. a. Use more than one estimate for the terminal value. (Just need help on boxes outlined in red. Please use excel and show cell formulasthank you)

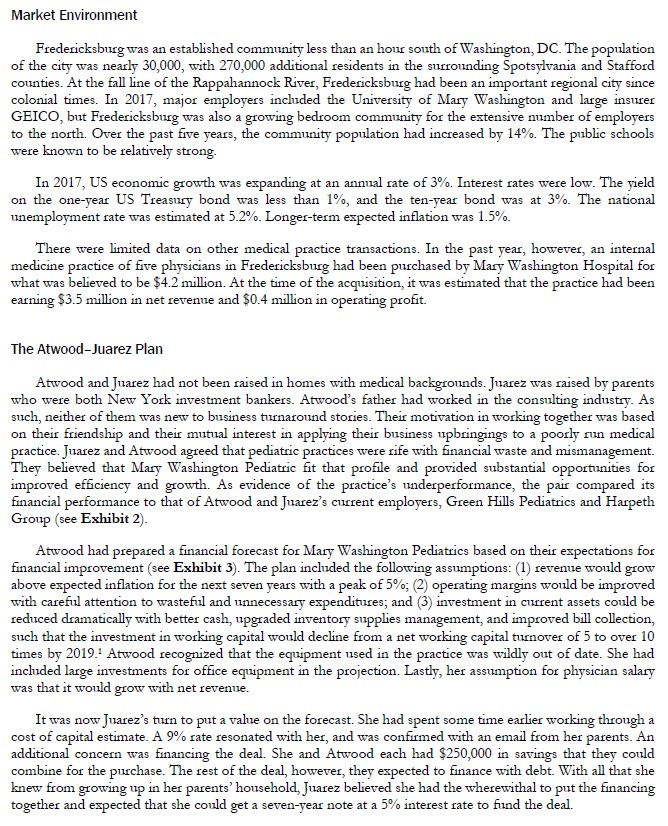

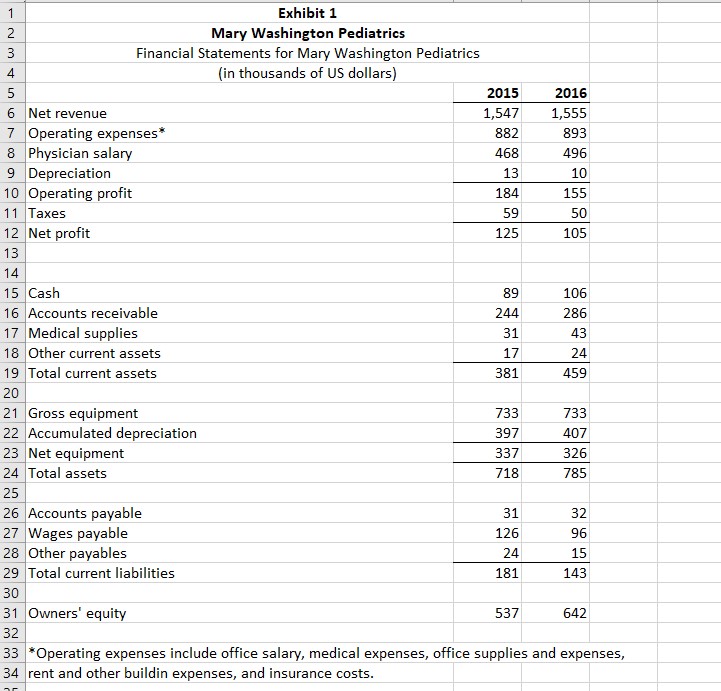

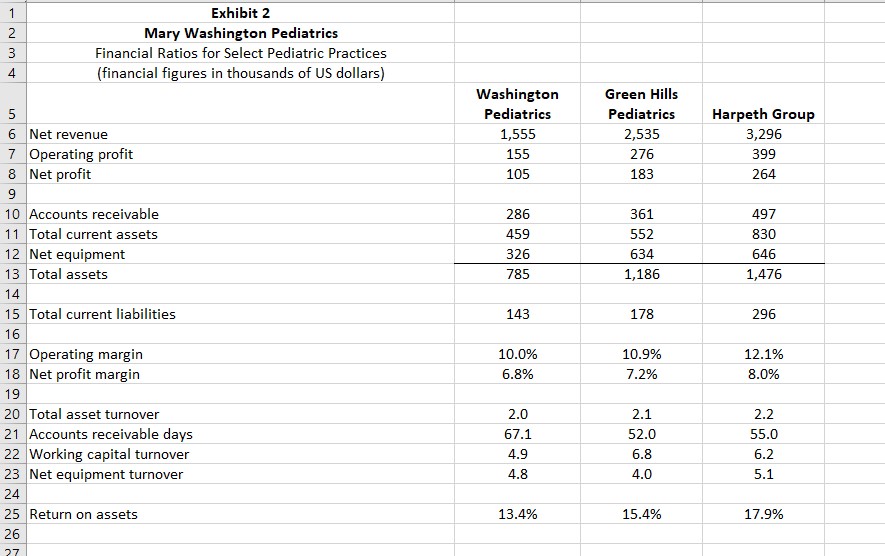

Market Environment Fredericksburg was an established community less than an hour south of Washington, DC. The population of the city was nearly 30,000 , with 270,000 additional residents in the surrounding Spotsylvania and Stafford counties. At the fall line of the Rappahannock River, Fredericksburg had been an important regional city since colonial times. In 2017, major employers included the University of Mary Washington and large insurer GEICO, but Fredericksburg was also a growing bedroom community for the extensive number of employers to the north. Over the past five years, the community population had increased by 14%. The public schools were known to be relatively strong. In 2017, US economic growth was expanding at an annual rate of 3%. Interest rates were low. The yield on the one-year US Treasury bond was less than 1%, and the ten-year bond was at 3%. The national unemployment rate was estimated at 5.2%. Longer-term expected inflation was 1.5%. There were limited data on other medical practice transactions. In the past year, however, an internal medicine practice of five physicians in Fredericksburg had been purchased by Mary Washington Hospital for what was believed to be $4.2 million. At the time of the acquisition, it was estimated that the practice had been earning $3.5 million in net revenue and $0.4 million in operating profit. The Atwood-Juarez Plan Atwood and Juarez had not been raised in homes with medical backgrounds. Juarez was raised by parents who were both New York investment bankers. Atwood's father had worked in the consulting industry. As such, neither of them was new to business turnaround stories. Their motivation in working together was based on their friendship and their mutual interest in applying their business upbringings to a poorly run medical practice. Juarez and Atwood agreed that pediatric practices were rife with financial waste and mismanagement. They believed that Mary Washington Pediatric fit that profile and provided substantial opportunities for improved efficiency and growth. As evidence of the practice's underperformance, the pair compared its financial performance to that of Atwood and Juarez's current employers, Green Hills Pediatrics and Harpeth Group (see Exhibit 2). Atwood had prepared a financial forecast for Mary Washington Pediatrics based on their expectations for financial improvement (see Exhibit 3). The plan included the following assumptions: (1) revenue would grow above expected inflation for the next seven years with a peak of 5%; (2) operating margins would be improved with careful attention to wasteful and unnecessary expenditures; and (3) investment in current assets could be reduced dramatically with better cash, upgraded inventory supplies management, and improved bill collection, such that the investment in working capital would decline from a net working capital turnover of 5 to over 10 times by 2019.1 Atwood recognized that the equipment used in the practice was wildly out of date. She had included large investments for office equipment in the projection. Lastly, her assumption for physician salary was that it would grow with net revenue. It was now Juarez's turn to put a value on the forecast. She had spent some time earlier working through a cost of capital estimate. A 9% rate resonated with her, and was confirmed with an email from her parents. An additional concern was financing the deal. She and Atwood each had $250,000 in savings that they could combine for the purchase. The rest of the deal, however, they expected to finance with debt. With all that she knew from growing up in her parents' household, Juarez believed she had the wherewithal to put the financing together and expected that she could get a seven-year note at a 5% interest rate to find the deal. 33 *Operating expenses include office salary, medical expenses, office supplies and expenses, 34 rent and other buildin expenses, and insurance costs

Market Environment Fredericksburg was an established community less than an hour south of Washington, DC. The population of the city was nearly 30,000 , with 270,000 additional residents in the surrounding Spotsylvania and Stafford counties. At the fall line of the Rappahannock River, Fredericksburg had been an important regional city since colonial times. In 2017, major employers included the University of Mary Washington and large insurer GEICO, but Fredericksburg was also a growing bedroom community for the extensive number of employers to the north. Over the past five years, the community population had increased by 14%. The public schools were known to be relatively strong. In 2017, US economic growth was expanding at an annual rate of 3%. Interest rates were low. The yield on the one-year US Treasury bond was less than 1%, and the ten-year bond was at 3%. The national unemployment rate was estimated at 5.2%. Longer-term expected inflation was 1.5%. There were limited data on other medical practice transactions. In the past year, however, an internal medicine practice of five physicians in Fredericksburg had been purchased by Mary Washington Hospital for what was believed to be $4.2 million. At the time of the acquisition, it was estimated that the practice had been earning $3.5 million in net revenue and $0.4 million in operating profit. The Atwood-Juarez Plan Atwood and Juarez had not been raised in homes with medical backgrounds. Juarez was raised by parents who were both New York investment bankers. Atwood's father had worked in the consulting industry. As such, neither of them was new to business turnaround stories. Their motivation in working together was based on their friendship and their mutual interest in applying their business upbringings to a poorly run medical practice. Juarez and Atwood agreed that pediatric practices were rife with financial waste and mismanagement. They believed that Mary Washington Pediatric fit that profile and provided substantial opportunities for improved efficiency and growth. As evidence of the practice's underperformance, the pair compared its financial performance to that of Atwood and Juarez's current employers, Green Hills Pediatrics and Harpeth Group (see Exhibit 2). Atwood had prepared a financial forecast for Mary Washington Pediatrics based on their expectations for financial improvement (see Exhibit 3). The plan included the following assumptions: (1) revenue would grow above expected inflation for the next seven years with a peak of 5%; (2) operating margins would be improved with careful attention to wasteful and unnecessary expenditures; and (3) investment in current assets could be reduced dramatically with better cash, upgraded inventory supplies management, and improved bill collection, such that the investment in working capital would decline from a net working capital turnover of 5 to over 10 times by 2019.1 Atwood recognized that the equipment used in the practice was wildly out of date. She had included large investments for office equipment in the projection. Lastly, her assumption for physician salary was that it would grow with net revenue. It was now Juarez's turn to put a value on the forecast. She had spent some time earlier working through a cost of capital estimate. A 9% rate resonated with her, and was confirmed with an email from her parents. An additional concern was financing the deal. She and Atwood each had $250,000 in savings that they could combine for the purchase. The rest of the deal, however, they expected to finance with debt. With all that she knew from growing up in her parents' household, Juarez believed she had the wherewithal to put the financing together and expected that she could get a seven-year note at a 5% interest rate to find the deal. 33 *Operating expenses include office salary, medical expenses, office supplies and expenses, 34 rent and other buildin expenses, and insurance costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started