Question

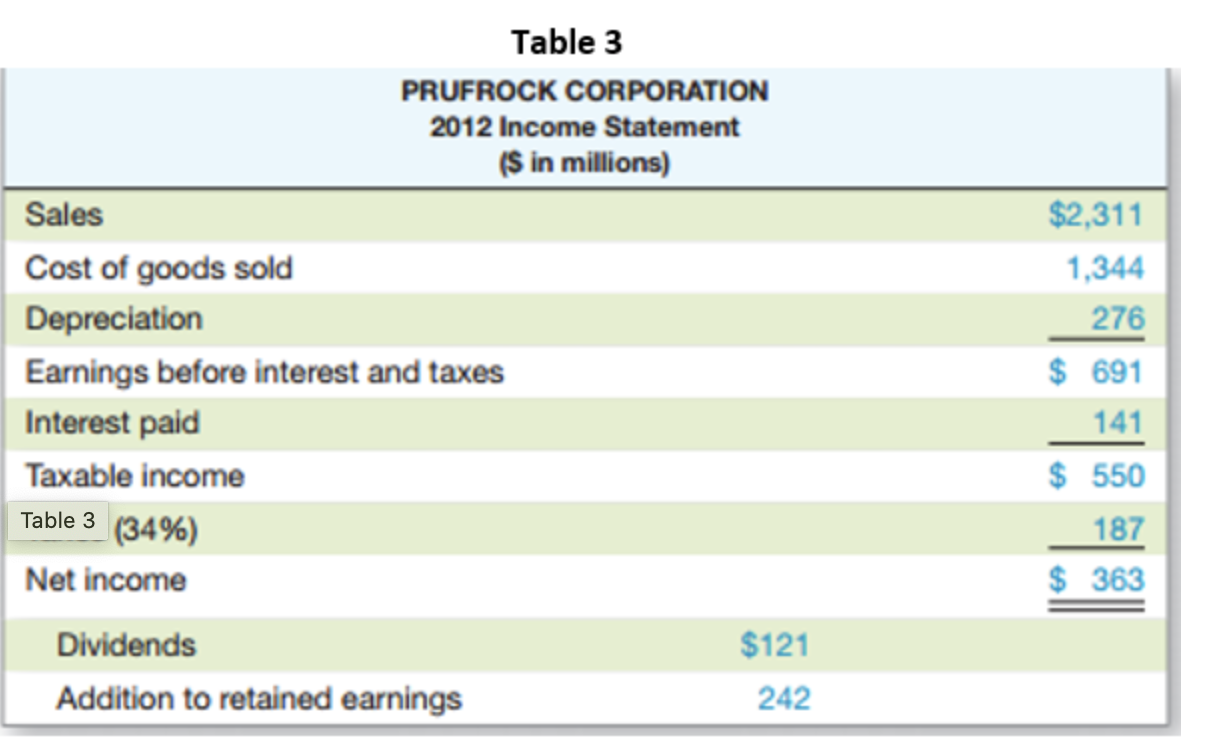

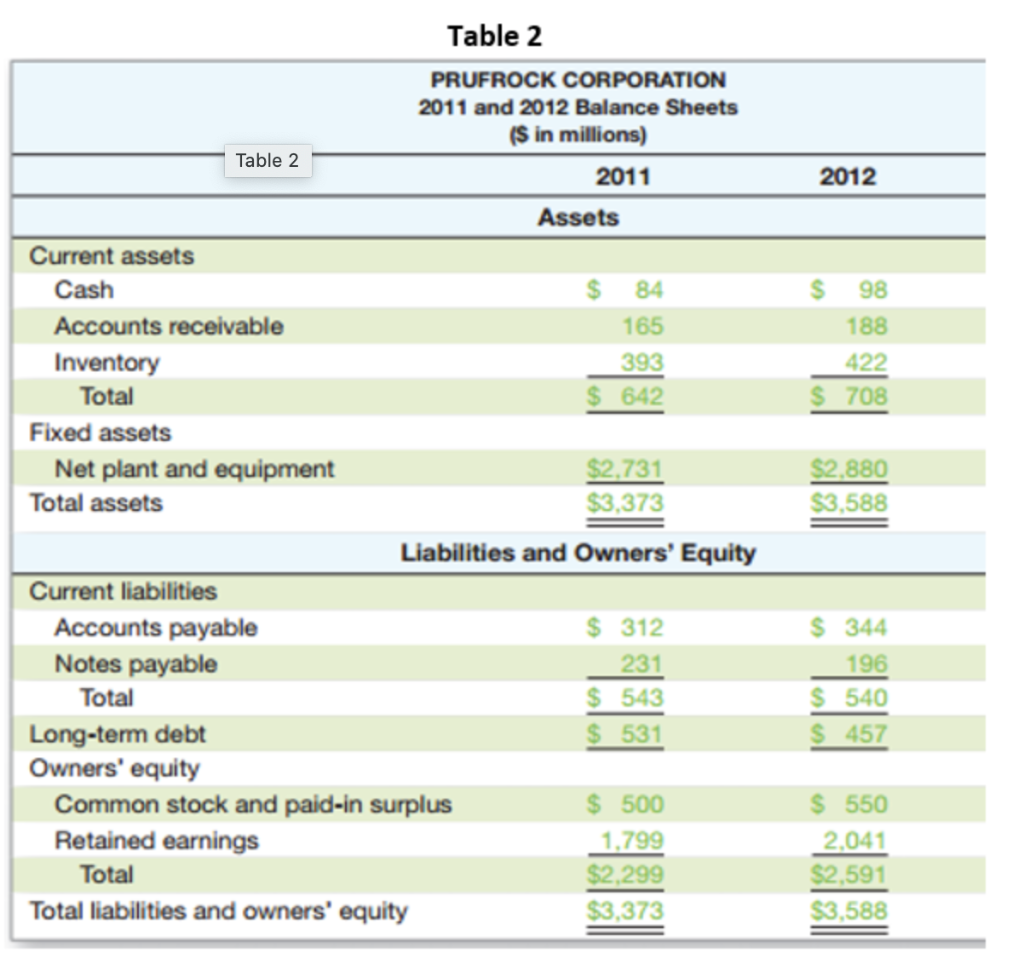

Using the tables below, find a. the external financing needed for year 2013, and b. the internal growth rate for the year 2012. Use the

Using the tables below, find

a. the external financing needed for year 2013, and

b. the internal growth rate for the year 2012.

Use the following assumptions to solve:

1. We are projecting a 20% increase in sales.

2. All current asset accounts maintain the same percentage of sale as in year 2012.

3. For liability accounts, only accounts payable maintain the same percentage as in year 2012. Everything else remains constant.

4. In year 2012 we are using a payout ratio of 1/3, but for 2013 we use a payout ratio of 1/2.

5. We were using 60% of our full production capability last year (a little tricky. you need to figure out if we need to buy fixed assets or not).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started