Question

Using the tables found in your text in Chapter 12, calculate the correct present values for each of the following situations. Show all of your

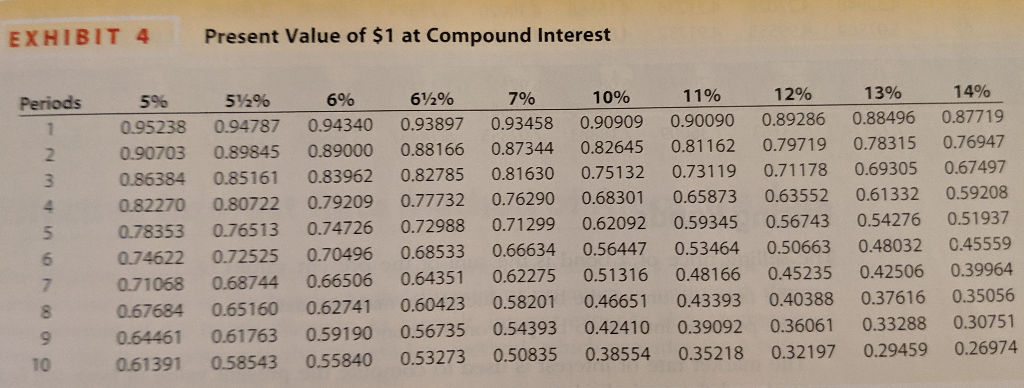

Using the tables found in your text in Chapter 12, calculate the correct present values for each of the following situations. Show all of your calculations in the space provided.

(This is the table)

- At the end of five years you wish to purchase a car for $25,000. You can invest your money at the rate of 5% compounded annually. How much money must you deposit in your investment account today in order to have enough funds to purchase your car?

Interest rate - Actual amount of the deposit is:

Number of periods -

Table used -

Factor from table used -

- You want to buy a business with an annual cash flow of $28,000 for ten years. If you can invest at 5% what would be the maximum purchase price you would be willing to pay today?

Interest rate - Purchase price of business:

Number of periods -

Table used -

Factor from table used -

c) You can afford to make five annual payments of $2,400 to purchase a new motorcycle. At an annual interest rate of 6% compounded annually, how much money would you need to deposit today make your purchase?

Interest rate - Actual amount of the deposit is:

Number of periods -

Table used -

Factor from table used -

d) You would like to purchase your first home in 10 years at a cost of $100,000. You currently have a savings account accumulating interest at the rate of 5.5% compounded annually with a balance of $20,000. How much additional money will you have to deposit today to accumulate the purchase price in ten years?

Interest rate - Additional deposit to savings account:

Number of periods -

Table used -

Factor from table used -

EXHIBIT 4 Present Value of $1 at Compound Interest 14% 12% 13% 11% 10% 6% 7% 6% 5% 5%6 Periods 0.87719 0.88496 0.89286 0.90090 0.90909 0.93897 0.93458 0.94340 0.94787 0.95238 0.78315 0.76947 0.79719 0.81162 0.82645 0.87344 0.88166 0.89000 0.89845 0.90703 0.67497 0.69305 0.73119 0.71178 0.75132 0.81630 0.82785 0.83962 0.85161 0.86384 3 0.59208 0.61332 0.63552 0.65873 0.68301 0.76290 0.79209 0.77732 0.80722 0.82270 4 0.51937 0.54276 0.56743 0.59345 0.62092 0.71299 0.72988 0.74726 0.78353 0.76513 0.45559 0.48032 0.50663 0.53464 0.56447 0.66634 0.68533 0.70496 0.72525 0.74622 0.39964 0.42506 0.48166 0.45235 0.51316 0.62275 0.64351 0.66506 0.68744 7 0.71068 0.35056 0.37616 0.40388 0.58201 0.46651 0.43393 0.60423 0.62741 0.65160 0.67684 0.30751 0.33288 0.36061 0.54393 0.39092 0.42410 0.56735 0.59190 0.61763 0.64461 0.26974 0.29459 0.32197 0.50835 0.38554 0.35218 0.53273 0.55840 0.58543 10 0.61391

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started