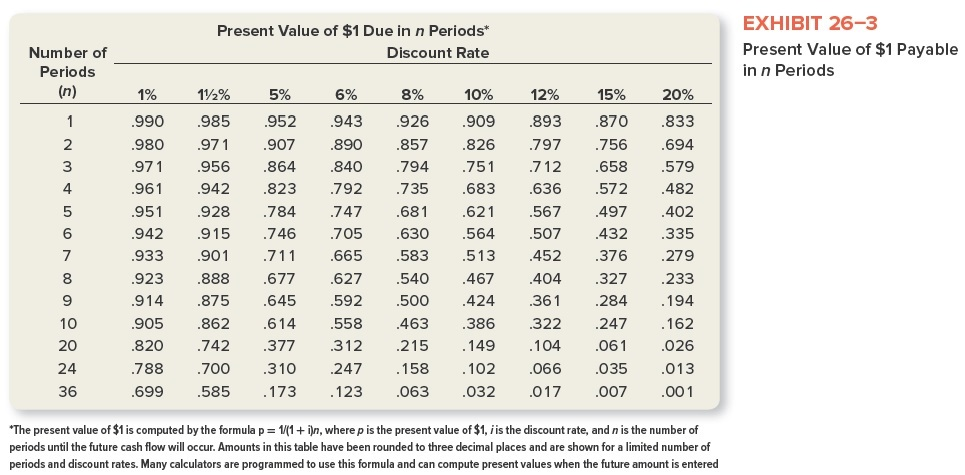

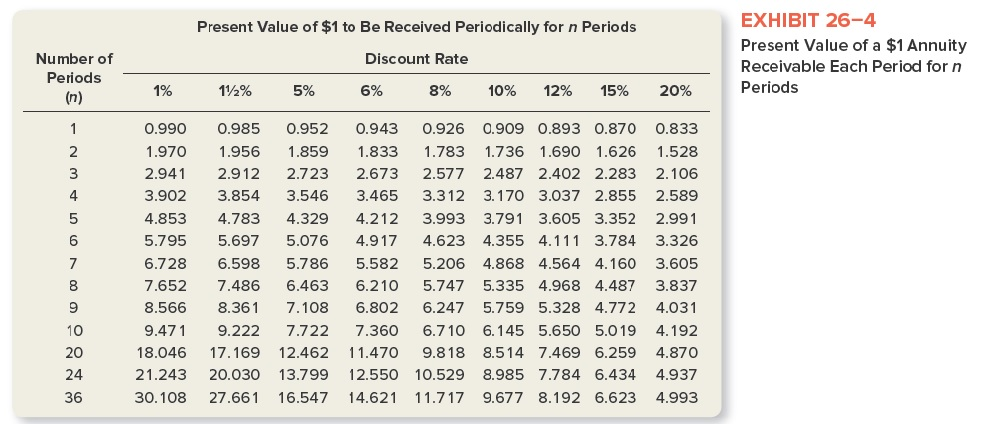

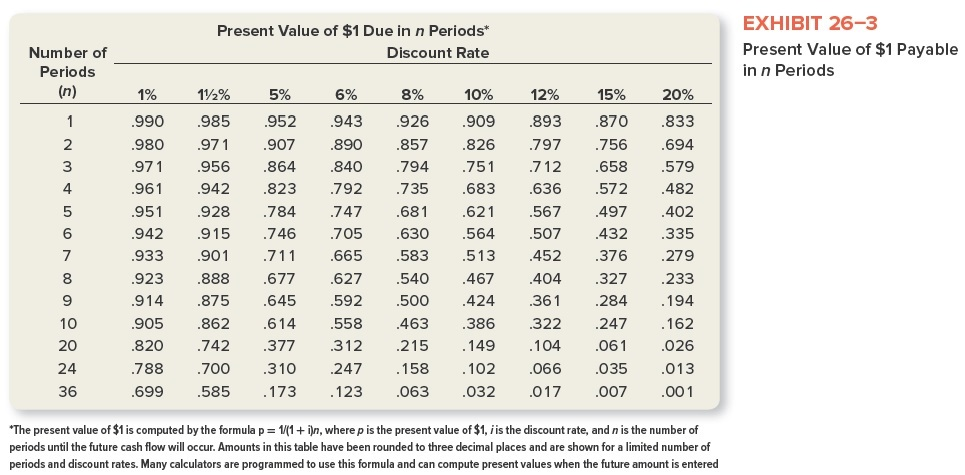

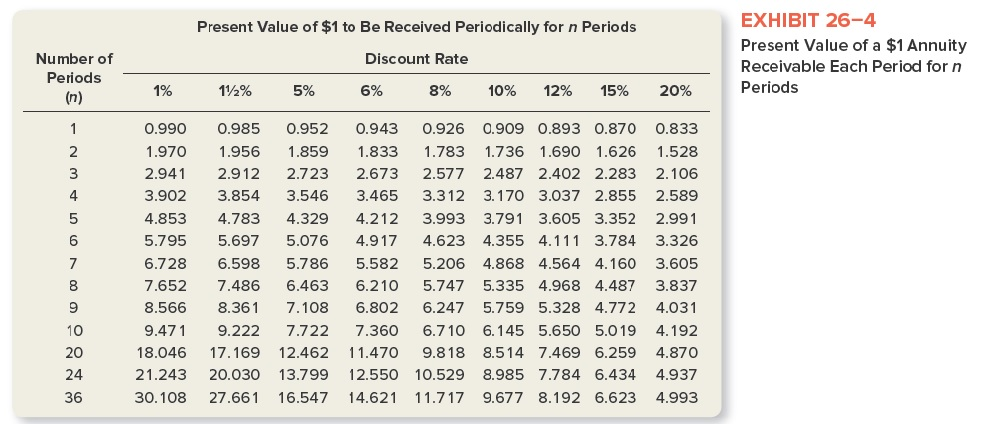

Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. (Round "PV factors" to 3 decimal places. Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.)

-

$10,900 to be received 20 years from today.

-

$15,000 to be received annually for 10 years.

-

$13,800 to be received annually for five years, with an additional $12,000 salvage value expected at the end of the fifth year.

-

$30,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received)

Present Value of $1 Due in n Periods* Discount Rate Number of Periods (n) EXHIBIT 26-3 Present Value of $1 Payable in n Periods 1% 112% 5% 6% 8% 12% 15% 20% 833 1 2 3 .990 .980 .971 .961 985 .971 .956 .942 .926 .857 .794 .735 .694 579 .952 .907 .864 .823 .784 .746 .711 4 5 .951 .942 6 .928 .915 .901 .888 .875 10% .909 .826 .751 .683 .621 .564 .513 .467 .424 .386 .149 .102 .032 943 .890 .840 .792 .747 .705 .665 .627 .592 .558 .312 .247 .123 7 .870 .756 .658 .572 .497 .432 .376 .327 .284 .482 .402 .335 .279 .933 .893 .797 .712 .636 .567 .507 .452 .404 .361 .322 .104 .066 .017 .681 .630 .583 .540 .500 .463 .215 8 .923 .914 9 .233 .194 .162 10 .677 .645 .614 .377 .310 20 .905 .820 .788 .699 .026 .862 .742 .700 .585 .247 .061 .035 .007 .158 24 36 .013 .001 .173 .063 *The present value of $1 is computed by the formula p= 1/(1+i)n, where p is the present value of $1, jis the discount rate, and n is the number of periods until the future cash flow will occur. Amounts in this table have been rounded to three decimal places and are shown for a limited number of periods and discount rates. Many calculators are programmed to use this formula and can compute present values when the future amount is entered Present Value of $1 to Be Received Periodically for n Periods Discount Rate Number of Periods (n) EXHIBIT 26-4 Present Value of a $1 Annuity Receivable Each Period for n Periods 1% 112% 5% 6% 8% 10% 12% 15% 20% 1 2 3 4 5 6 7 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 18.046 21.243 30.108 0.985 1.956 2.912 3.854 4.783 5.697 6.598 7.486 8.361 9.222 17.169 20.030 27.661 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 12.462 13.799 16.547 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 11.470 12.550 14.621 0.926 0.909 0.893 0.870 0.833 1.783 1.736 1.690 1.626 1.528 2.577 2.487 2.402 2.283 2.106 3.312 3.170 3.037 2.855 2.589 3.993 3.791 3.605 3.352 2.991 4.623 4.355 4.111 3.784 3.326 5.206 4.868 4.564 4.160 3.605 5.747 5.335 4.968 4.487 3.837 6.247 5.759 5.328 4.772 4.031 6.710 6.145 5.650 5.0 19 4.192 9.818 8.514 7.469 6.259 4.870 10.529 8.985 7.784 6.434 4.937 11.717 9.677 8.192 6.623 4.993 8 9 10 20 24 36