Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the Tax Rate Schedules, compute Morgan's 2019 Federal income tax liability. Morgan (age 45) is single and provides more than 50% of the support

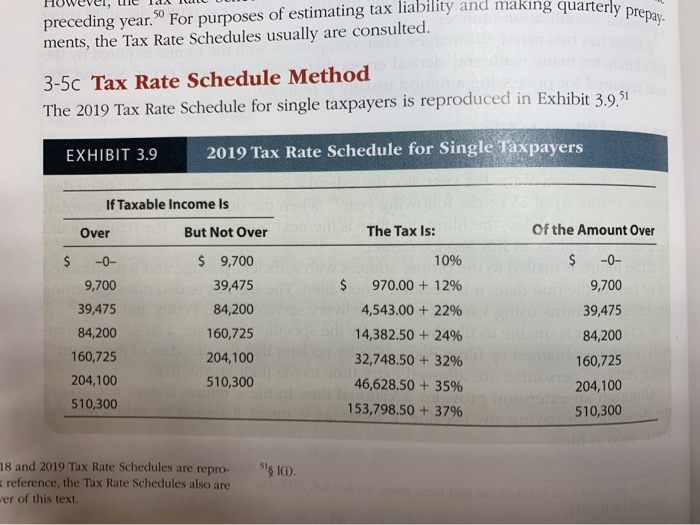

Using the Tax Rate Schedules, compute Morgan's 2019 Federal income tax liability. Morgan (age 45) is single and provides more than 50% of the support of Tammy (a family friend, age 36), Jen (a niece, age 18), and Jerold (a nephew, age 18). Both Tammy and Jen live with Morgan, but Jerold (a citizen of France) lives in Canada. Morgan earns a $95,000 salary, contributes $5,000 to a traditional IRA, and receives sales proceeds of $15,000 for an RV that cost $60,000 and was used only for vacations. She incurs $8,200 in itemized deductions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started