Answered step by step

Verified Expert Solution

Question

1 Approved Answer

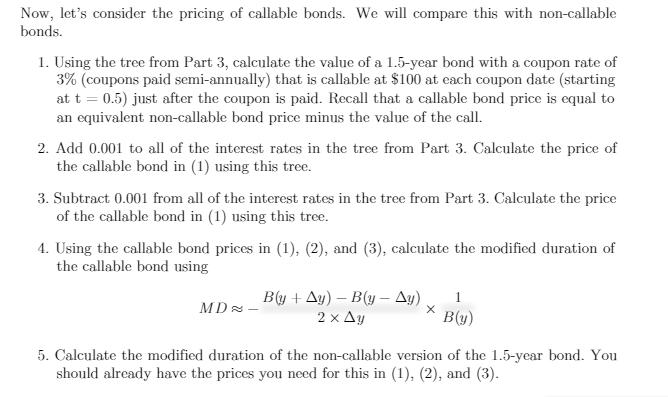

Now, let's consider the pricing of callable bonds. We will compare this with non-callable bonds. 1. Using the tree from Part 3, calculate the

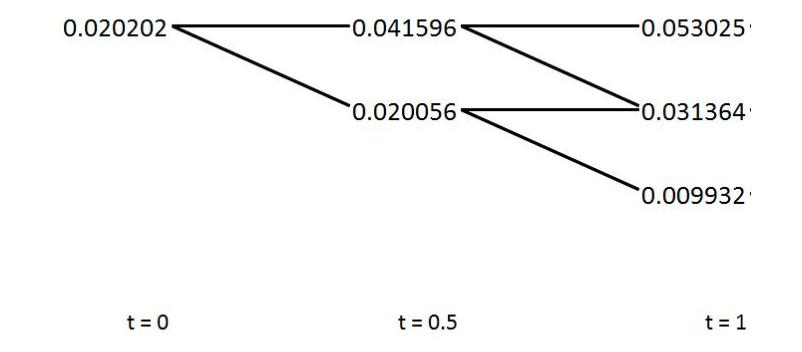

Now, let's consider the pricing of callable bonds. We will compare this with non-callable bonds. 1. Using the tree from Part 3, calculate the value of a 1.5-year bond with a coupon rate of 3% (coupons paid semi-annually) that is callable at $100 at each coupon date (starting at t = 0.5) just after the coupon is paid. Recall that a callable bond price is equal to an equivalent non-callable bond price minus the value of the call. 2. Add 0.001 to all of the interest rates in the tree from Part 3. Calculate the price of the callable bond in (1) using this tree. 3. Subtract 0.001 from all of the interest rates in the tree from Part 3. Calculate the price of the callable bond in (1) using this tree. 4. Using the callable bond prices in (1), (2), and (3), calculate the modified duration of the callable bond using B(y + Ay) B(y - Ay) 2 x Ay 1 MD 2- B(y) 5. Calculate the modified duration of the non-callable version of the 1.5-year bond. You should already have the prices you need for this in (1), (2), and (3). 0.020202 -0.041596 -0.053025 0.020056 0.031364 0.009932 t = 0 t = 0.5 t = 1

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started