Answered step by step

Verified Expert Solution

Question

1 Approved Answer

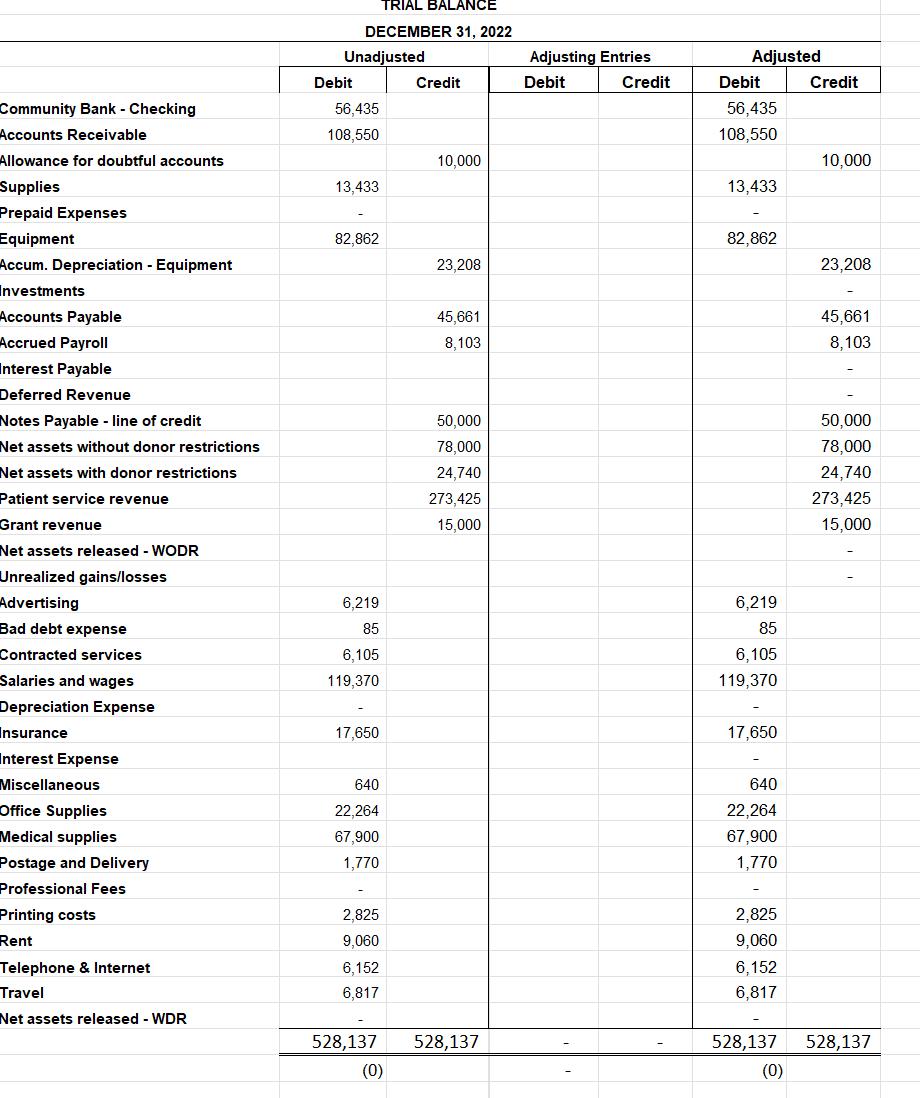

Using the trial balance given; record the adjusting entries 1 The Company relies on the its auditor to calculate its provision for depreciation. Using the

Using the trial balance given; record the adjusting entries

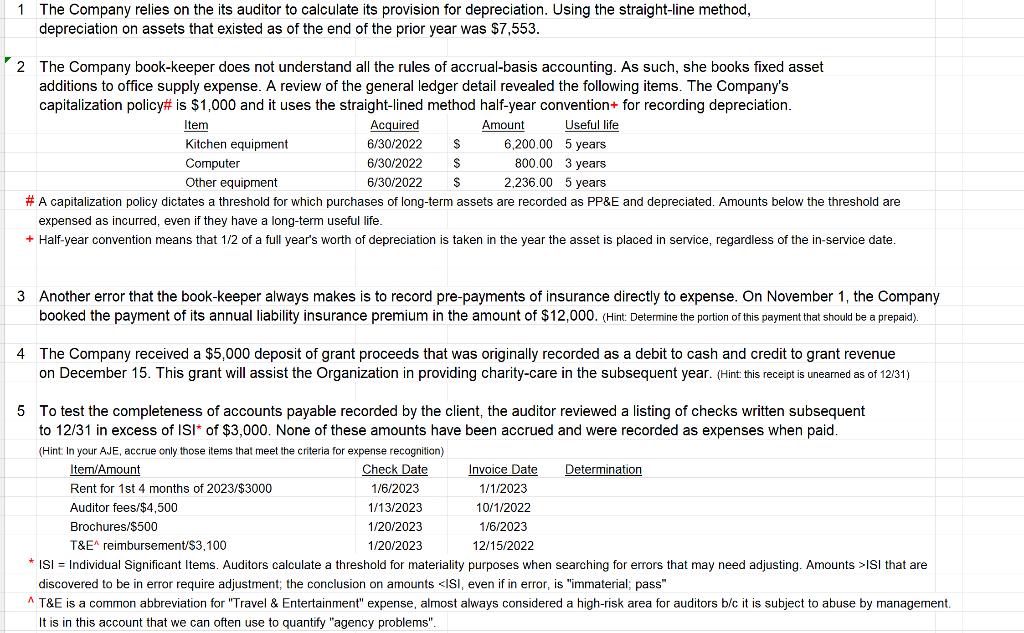

1 The Company relies on the its auditor to calculate its provision for depreciation. Using the straight-line method, depreciation on assets that existed as of the end of the prior year was $7,553. 2 The Company book-keeper does not understand all the rules of accrual-basis accounting. As such, she books fixed asset additions to office supply expense. A review of the general ledger detail revealed the following items. The Company's capitalization policy# is $1,000 and it uses the straight-lined method half-year convention+ for recording depreciation. Amount Useful life 6,200.00 5 years 800.00 3 years 2,236.00 5 years Item Acquired Kitchen equipment. Computer 6/30/2022 6/30/2022 6/30/2022 Other equipment # A capitalization policy dictates a threshold for which purchases of long-term assets are recorded as PP&E and depreciated. Amounts below the threshold are expensed as incurred, even if they have a long-term useful life. + Half-year convention means that 1/2 of a full year's worth of depreciation is taken in the year the asset is placed in service, regardless of the in-service date. $ $ 3 Another error that the book-keeper always makes is to record pre-payments of insurance directly to expense. On November 1, the Company booked the payment of its annual liability insurance premium in the amount of $12,000. (Hint: Determine the portion of this payment that should be a prepaid). 4 The Company received a $5,000 deposit of grant proceeds that was originally recorded as a debit to cash and credit to grant revenue on December 15. This grant will assist the Organization in providing charity-care in the subsequent year. (Hint: this receipt is unearned as of 12/31) 5 To test the completeness of accounts payable recorded by the client, the auditor reviewed a listing of checks written subsequent to 12/31 in excess of ISI* of $3,000. None of these amounts have been accrued and were recorded as expenses when paid. (Hint: In your AJE, accrue only those items that meet the criteria for expense recognition) Item/Amount Check Date Rent for 1st 4 months of 2023/$3000 Auditor fees/$4,500 Brochures/$500 Invoice Date 1/1/2023 10/1/2022 1/6/2023 12/15/2022 Determination 1/6/2023 1/13/2023 1/20/2023 T&E^ reimbursement/$3,100 1/20/2023 *ISI = Individual Significant Items. Auditors calculate a threshold for materiality purposes when searching for errors that may need adjusting. Amounts >ISI that are discovered to be in error require adjustment; the conclusion on amounts

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Adjusting Entries Adjusting Entry 1 Depreciation Debit Depreciation Expense 7553Credit Accumulated D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started