Answered step by step

Verified Expert Solution

Question

1 Approved Answer

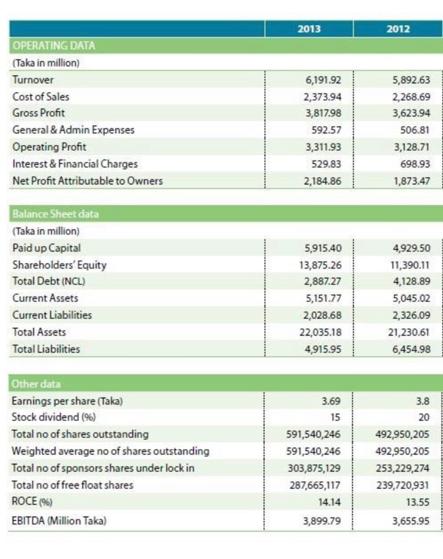

how a capital structure impact a company? what is debt to equity? calculate the debt to equity ratio for the years 2012 and 2013 show

how a capital structure impact a company? what is debt to equity?

calculate the debt to equity ratio for the years 2012 and 2013 show the calculations? analysis debt to equity ratio both year and compear . Also analyses the capital structure of the year 2012 and 2013.word limit 2500

Give a literature review, past research summary of capital structure in APA Format (1000 word)

OPERATING DATA (Taka in million) Turnover Cost of Sales Gross Profit 2013 2012 6,191.92 5,892.63 2,373.94 2,268.69 3,817.98 3,623.94 General & Admin Expenses 592.57 506.81 Operating Profit 3,311.93 3,128.71 Interest & Financial Charges 529.83 698.93 Net Profit Attributable to Owners 2,184.86 1,873.47 Balance Sheet data (Taka in million) Paid up Capital Shareholders' Equity Total Debt (NCL) Current Assets Current Liabilities Total Assets Total Liabilities Other data 5,915.40 4,929.50 13,875.26 11,390.11 2,887.27 4,128.89 5,151.77 5,045.02 2,028.68 2,326.09 22,035.18 21,230.61 4,915.95 6,454.98 Earnings per share (Taka) 3.69 3.8 Stock dividend (%) 15 20 Total no of shares outstanding 591,540,246 492,950,205 Weighted average no of shares outstanding 591,540,246 492,950,205 Total no of sponsors shares under lock in 303,875,129 253,229,274 Total no of free float shares 287,665,117 239,720,931 ROCE (%) 14.14 EBITDA (Million Taka) 3,899.79 13.55 3,655.95

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started