using this information complete the form 1040, form 8889, schedule 1,schedule A, schedule B

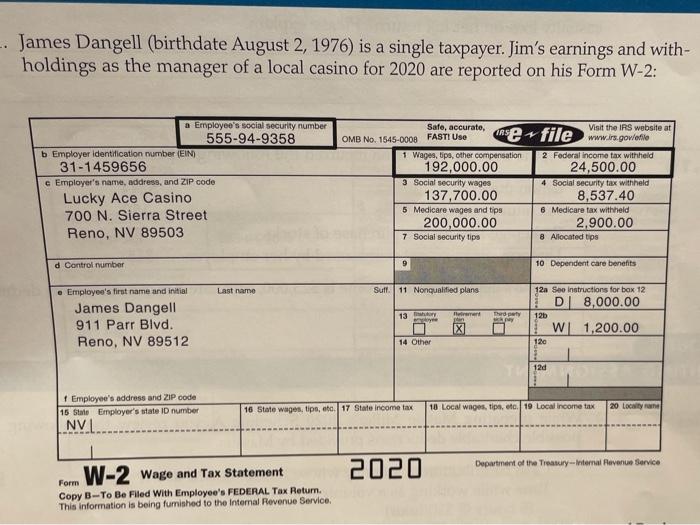

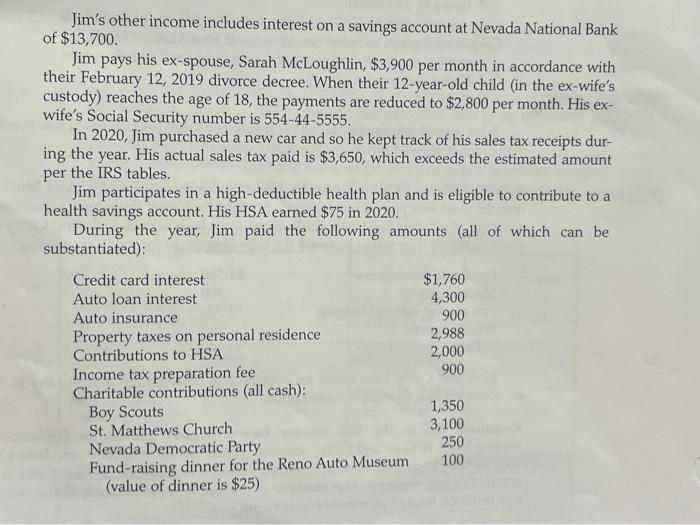

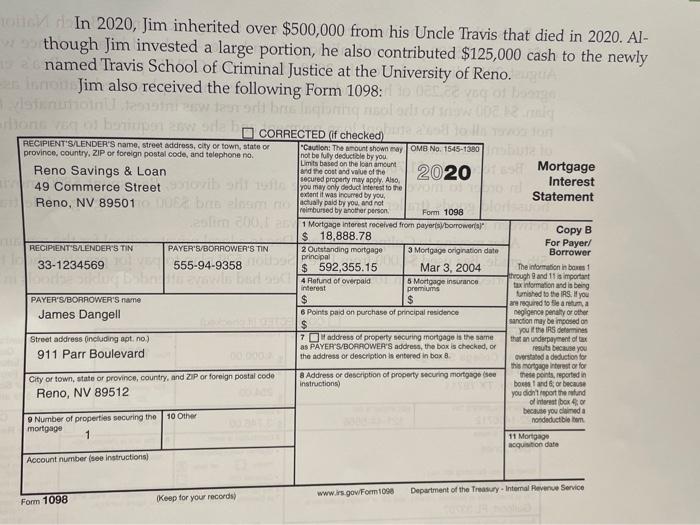

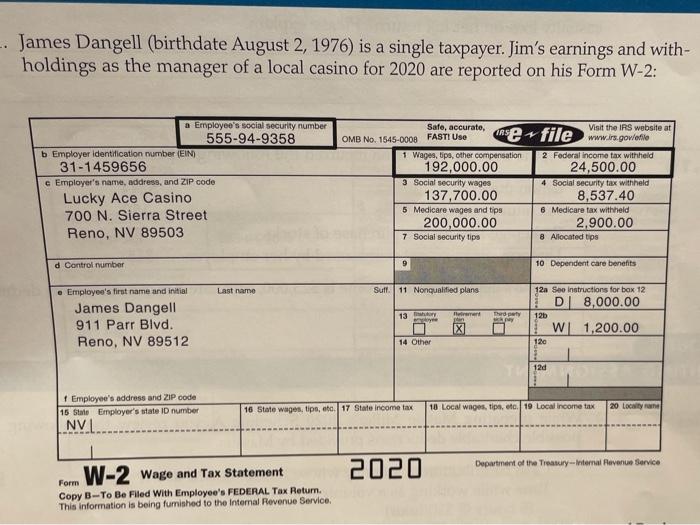

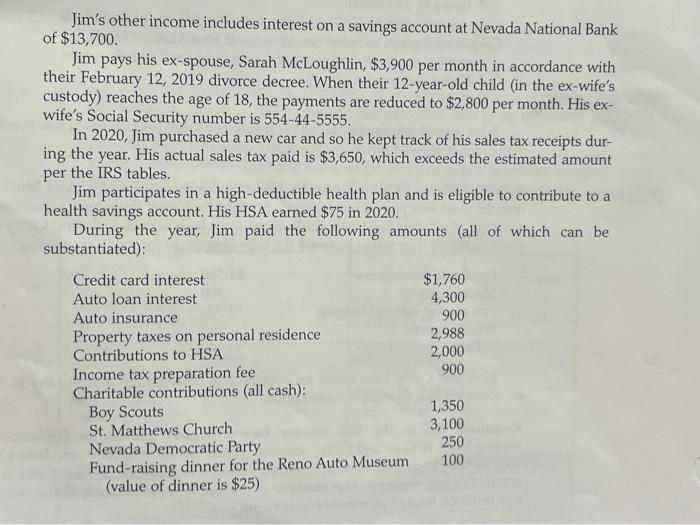

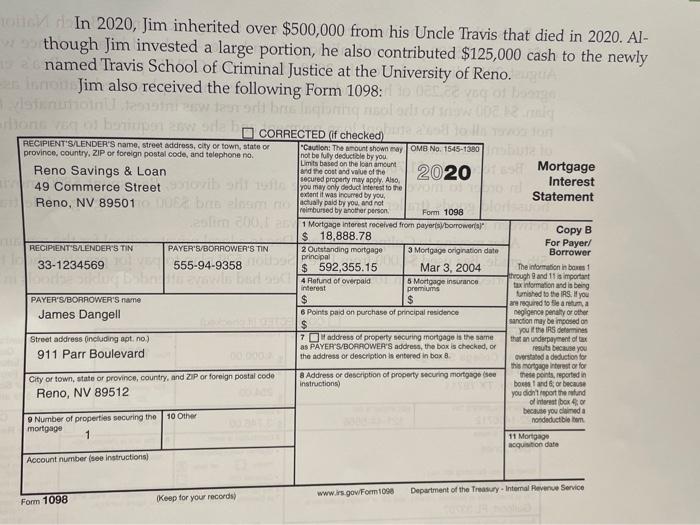

-- James Dangell (birthdate August 2, 1976) is a single taxpayer. Jim's earnings and with- holdings as the manager of a local casino for 2020 are reported on his Form W-2: Visit the IRS website at URS e-file www.rsgoviatie a Employee's social security number 555-94-9358 b Employer identification number (EIN) 31-1459656 c Employer's name, address, and ZIP code Lucky Ace Casino 700 N. Sierra Street Reno, NV 89503 Safe, accurate, OMB No 1545-0008 FASTI Use 1 Wages, tips, other compensation 192,000.00 3 Social security wages 137,700.00 5 Medicare wages and tips 200,000.00 7 Social security tips 2 Federal income tax withheld 24,500.00 4 Social Security tax withheld 8,537.40 6 Medicare tax withheld 2.900.00 8 Allocated tips d Control rumber 9 10 Dependent care benefits Last name Sufl. 11 Nonqualified plans e Employee's first name and initial James Dangell 911 Parr Blvd. Reno, NV 89512 13 hory Jan Therapy 120 See Instructions for bax 12 D 8,000.00 12b WL 1,200.00 120 14 Other 16 State Wages, tips, etc. 17 State income tax 10 Local wages, tips, etc. 19 Local income tax 1 Employee's address and ZIP code 15 State Employer's state ID number NVL 20 Lily Form W-2 wage and Tax Statement Department of the Treasury - Internal Revenue Service 2020 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service Jim's other income includes interest on a savings account at Nevada National Bank of $13,700. Jim pays his ex-spouse, Sarah McLoughlin, $3,900 per month in accordance with their February 12, 2019 divorce decree. When their 12-year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex- wife's Social Security number is 554-44-5555. In 2020, Jim purchased a new car and so he kept track of his sales tax receipts dur- ing the year. His actual sales tax paid is $3,650, which exceeds the estimated amount per the IRS tables. Jim participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2020. During the year, Jim paid the following amounts (all of which can be substantiated): Credit card interest $1,760 Auto loan interest 4,300 Auto insurance 900 Property taxes on personal residence 2,988 Contributions to HSA 2,000 Income tax preparation fee 900 Charitable contributions (all cash): Boy Scouts 1,350 St. Matthews Church 3,100 Nevada Democratic Party 250 Fund-raising dinner for the Reno Auto Museum 100 (value of dinner is $25) In 2020, Jim inherited over $500,000 from his Uncle Travis that died in 2020. Al- though Jim invested a large portion, he also contributed $125,000 cash to the newly named Travis School of Criminal Justice at the University of Reno. on Jim also received the following Form 1098: To Thon Bob SH CORRECTED (if checked) 49 Commerce Street on Mortgage Interest Statement RECIPIENT'S/LENDER'S name, street address, city of town, state or province, country, ZIP or foreign postal code, and telephone no. Caution: The amount shown may OMB No. 1545-1380 not be fully deductible by you Limits based on the loan amount Reno Savings & Loan and the cost and value of the 2020 secured property may apply. Also extent it was by you. Reno, NV 89501 E Dammaly paid by you, and not reimbursed by another person Form 1098 1 Mortgage interest received from payersborrowers $ 18,888.78 RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN 2 Outstanding mortgage 3 Mortgage origination date principal 33-1234569 555-94-9358 $ 592,355.15 Mar 3, 2004 4 Refund of overald 5 Mortgage Insurance interest premiums PAYER'S/BORROWER'S name $ $ James Dangell 6 Points paid on purchase of principal residence $ Street address including apt, no) 7 address of property securing mortgage is the same as PAYER S/BORROWER'S address, the box is checked, of 911 Parr Boulevard the address or description is entered in box Copy B For Payer/ Borrower The information in bars 1 through and 11 important tax information and is being tuished to the IRS. you are required to su, negligence penalty or other sanction may be imposed on you it is determines that underpayment of tax results because you Overstaad a deduction to mortgage Interest or for these points, reported in borstand, or because you didn't report the und of in box because you comeda nondeduct ble to City or town, state or province, country, and ZIP or foreign postal code Reno, NV 89512 8 Address or description of property securing mortgage (see instructions 10 Other o Number of properties securing the mortgage 11 Mortgage acquisition date Account number (see instructions) www.rsgow Form 1090 Department of the Treasury - Internal Revenue Service Form 1098 (Keep for your records) -- James Dangell (birthdate August 2, 1976) is a single taxpayer. Jim's earnings and with- holdings as the manager of a local casino for 2020 are reported on his Form W-2: Visit the IRS website at URS e-file www.rsgoviatie a Employee's social security number 555-94-9358 b Employer identification number (EIN) 31-1459656 c Employer's name, address, and ZIP code Lucky Ace Casino 700 N. Sierra Street Reno, NV 89503 Safe, accurate, OMB No 1545-0008 FASTI Use 1 Wages, tips, other compensation 192,000.00 3 Social security wages 137,700.00 5 Medicare wages and tips 200,000.00 7 Social security tips 2 Federal income tax withheld 24,500.00 4 Social Security tax withheld 8,537.40 6 Medicare tax withheld 2.900.00 8 Allocated tips d Control rumber 9 10 Dependent care benefits Last name Sufl. 11 Nonqualified plans e Employee's first name and initial James Dangell 911 Parr Blvd. Reno, NV 89512 13 hory Jan Therapy 120 See Instructions for bax 12 D 8,000.00 12b WL 1,200.00 120 14 Other 16 State Wages, tips, etc. 17 State income tax 10 Local wages, tips, etc. 19 Local income tax 1 Employee's address and ZIP code 15 State Employer's state ID number NVL 20 Lily Form W-2 wage and Tax Statement Department of the Treasury - Internal Revenue Service 2020 Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being fumished to the Internal Revenue Service Jim's other income includes interest on a savings account at Nevada National Bank of $13,700. Jim pays his ex-spouse, Sarah McLoughlin, $3,900 per month in accordance with their February 12, 2019 divorce decree. When their 12-year-old child (in the ex-wife's custody) reaches the age of 18, the payments are reduced to $2,800 per month. His ex- wife's Social Security number is 554-44-5555. In 2020, Jim purchased a new car and so he kept track of his sales tax receipts dur- ing the year. His actual sales tax paid is $3,650, which exceeds the estimated amount per the IRS tables. Jim participates in a high-deductible health plan and is eligible to contribute to a health savings account. His HSA earned $75 in 2020. During the year, Jim paid the following amounts (all of which can be substantiated): Credit card interest $1,760 Auto loan interest 4,300 Auto insurance 900 Property taxes on personal residence 2,988 Contributions to HSA 2,000 Income tax preparation fee 900 Charitable contributions (all cash): Boy Scouts 1,350 St. Matthews Church 3,100 Nevada Democratic Party 250 Fund-raising dinner for the Reno Auto Museum 100 (value of dinner is $25) In 2020, Jim inherited over $500,000 from his Uncle Travis that died in 2020. Al- though Jim invested a large portion, he also contributed $125,000 cash to the newly named Travis School of Criminal Justice at the University of Reno. on Jim also received the following Form 1098: To Thon Bob SH CORRECTED (if checked) 49 Commerce Street on Mortgage Interest Statement RECIPIENT'S/LENDER'S name, street address, city of town, state or province, country, ZIP or foreign postal code, and telephone no. Caution: The amount shown may OMB No. 1545-1380 not be fully deductible by you Limits based on the loan amount Reno Savings & Loan and the cost and value of the 2020 secured property may apply. Also extent it was by you. Reno, NV 89501 E Dammaly paid by you, and not reimbursed by another person Form 1098 1 Mortgage interest received from payersborrowers $ 18,888.78 RECIPIENT'S/LENDER'S TIN PAYER'S/BORROWER'S TIN 2 Outstanding mortgage 3 Mortgage origination date principal 33-1234569 555-94-9358 $ 592,355.15 Mar 3, 2004 4 Refund of overald 5 Mortgage Insurance interest premiums PAYER'S/BORROWER'S name $ $ James Dangell 6 Points paid on purchase of principal residence $ Street address including apt, no) 7 address of property securing mortgage is the same as PAYER S/BORROWER'S address, the box is checked, of 911 Parr Boulevard the address or description is entered in box Copy B For Payer/ Borrower The information in bars 1 through and 11 important tax information and is being tuished to the IRS. you are required to su, negligence penalty or other sanction may be imposed on you it is determines that underpayment of tax results because you Overstaad a deduction to mortgage Interest or for these points, reported in borstand, or because you didn't report the und of in box because you comeda nondeduct ble to City or town, state or province, country, and ZIP or foreign postal code Reno, NV 89512 8 Address or description of property securing mortgage (see instructions 10 Other o Number of properties securing the mortgage 11 Mortgage acquisition date Account number (see instructions) www.rsgow Form 1090 Department of the Treasury - Internal Revenue Service Form 1098 (Keep for your records)