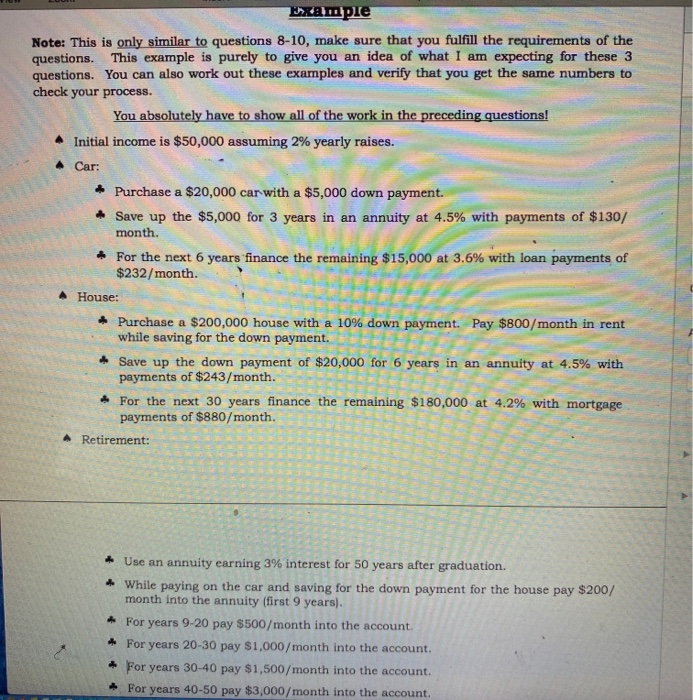

Using your chosen career path you will be formulating a plan and a budget to purchase a new car and a house while saving for retirement. We will be assuming that when you graduate college you will not have any parental assistance or money in savings. We will also assume that you do not have to pay off your student debts. You may include payment of student loans in your budget. Please note that for a well-balanced budget your debts should not exceed 40% of your monthly pre-tax income. This includes student loans, car payments, and housing costs (mortgage or rent). Directions: On a separate piece of paper complete the following objectives. Keep in mind that these questions are not mutually exclusive, you are creating a cohesive budget, so for every answer that you give, make sure that it works out with the rest of your answers to maintain affordability. SHOW ALL OF YOUR WORK FOR CREDIT Submission: You will be submitting 1 pdf document of your (neatly) handwritten project response with the questions completed in numerical order. You will also be submitting 1 excel spreadsheet with labelled tabs for the amortization tables for each loan option. I suggest that you copy my entire amortization table sheet and paste it into the 6 tabs that you will need for the 6 loan options. 1. Choose the profession most similar to your expected career path from the following and use the listed salary as your initial salary. Registered Nurse, $42,196 * Construction Manager, $54,051 Social Worker, $40,913 2. Create a function, S(t), representing your pre-tax salary for t years after you graduate, assuming a yearly 3% raise. 3. What is your yearly pre-tax salary in 2, 5, 10, 15, 20, and 30 years? 4. What is your monthly pre-tax salary initially (from your initial salary), and in 2, 5, 10, 15. 20 and 30 years? Please note that these values will help you decide if the following options are within the budget you are creating . The following should not be considered individually, but as a whole to create a monthly budget that you can afford according to your growing income. Find all of the information that you need given the loan and savings options to purchase a car, house and save for retirement, then decide oh which option you will choose. Also note that for the loans, amortization tables are a very useful tool for determining total amount paid, et cetera. anlatha nwina munting I expect to see your formula filled out with the The following should not be considered individually, but as a whole to create a monthly budget that you can afford according to your growing income. Find all of the information that you need given the loan and savings options to purchase a car, house and save for retirement, then decide on which option you will choose. Also note that for the loans, amortization tables are a very useful tool for determining total amount paid, et cetera. For each option in each of the following questions I expect to see your formula filled out with the appropriate information when finding your payment or future values. I also expect to see all of the work for exploring the annuities. For the loans I still need to see your formula filled out for - the payment amount, but you may use the amortization table to find any other information, and you must include the information that you found in your project write-up. For questions 5-7 feel free to include any thoughts you have including on which option might be better to choose. These musings do not have to be the answers you choose for question 8, because what you want at first might not fit into a good monthly budget. 5. You would like to buy a new car soon, and you found the car that you want for $15,000. You can get a 5 year loan compounded monthly at 6% interest. Please note that for a well balanced budget, a car payment should be about 10% or less of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact on monthly budget, et cetera): Purchase the car immediately with no down payment. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5% for 2 years, then take out a loan for the rest. b. Create an amortization table for each of the 2 loan options. 6. Right now you are renting an apartment for $700/month (this should be factored into your budget), and you would like to buy a new home. The median house price in your area is $180,000, so you budget for a house of that price. You are able to get a 30 year mortgage paying an interest rate of 3.75%. Please note that for a well-balanced budget your housing cost should not exceed 28% of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact 6. Right now you are renting an apartment for $700/month (this should be factored into your budget), and you would like to buy a new home. The median house price in your area is $180,000, so you budget for a house of that price. You are able to get a 30 year mortgage paying an interest rate of 3.75%. Please note that for a well-balanced budget your housing cost should not exceed 28% of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact on monthly budget, et cetera: (Note: Keep in mind that while you are saving for a down payment, you will have to be paying rent until you purchase your home.) Purchase the home immediately with no down payment. Save up for a 10% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest, paying $200/ month extra. b. Create an amortization schedule for each of the 4 loan options. 7. You need to save for retirement. Assume that the job that you get out of college is the one that you will keep for 45 years, then you will retire. You can make monthly payments into an ordinary annuity with an interest rate of 4%. (Use this annuity to calculate the following) a. Explore each of the following (find total amount saved, total amount put into account, impact on monthly budget, et cetera): Save early: Determine an affordable monthly amount to put into an ordinary annuity for 20 years, reassessing the payment amount every 10 years (so that the amount you are paying into savings can increase with your income), then stop making payments and let the amount that you saved continue earning interest (lump sum) for the next 25 years. Save laters Don't start putting money into a retirement account until 15 years after graduating college, then determine an affordable monthly amount to put the amount you are paying into savings can increase with your income), then stop making payments and let the amount that you saved continue earning interest (lump sum) for the next 25 years. Save later: Don't start putting money into a retirement account until 15 years after graduating college, then determine an affordable monthly amount to put into an ordinary annuity until retirement, (30 years) reassessing the payment amount every 10 years (so that the amount you are paying into savings can increase with your income). Save consistently: Start saving early and don't stop until retirement. Determine an affordable monthly payment amount reassessing the payment amount every 10 years to increase payments. 8. Which option will you chobse for the car? The mortgage? The retirement fund? Explain why you chose each option. 9. Create a monthly budget for the first year after graduating (using the initial salary), and for 5, 10, 20 and 30 years after graduating. (See example) 10. Create a timeline for the loans and savings accounts that you chose. (See example) Example Note: This is only similar to questions 8-10, make sure that you fulfill the requirements of the questions. This example is purely to give you an idea of what I am expecting for these 3 questions. You can also work out these examples and verify that you get the same numbers to check your process. You absolutely have to show all of the work in the preceding questions! Initial income is $50,000 assuming 2% yearly raises. Car: + Purchase a $20,000 car with a $5,000 down payment Save up the $5,000 for 3 years in an annuity at 4.5% with payments of $130/ month. 4 For the next 6 years finance the remaining $15,000 at 3.6% with loan payments of $232/month House: Example Note: This is only similar to questions 8-10, make sure that you fulfill the requirements of the questions. This example is purely to give you an idea of what I am expecting for these 3 questions. You can also work out these examples and verify that you get the same numbers to check your process. You absolutely have to show all of the work in the preceding questions! * Initial income is $50,000 assuming 2% yearly raises. Car: Purchase a $20,000 car with a $5,000 down payment. + Save up the $5,000 for 3 years in an annuity at 4.5% with payments of $130/ month. * For the next 6 years finance the remaining $15,000 at 3.6% with loan payments of $232/month. House: FLEEEEEEE + Purchase a $200,000 house with a 10% down payment. Pay $800/month in rent while saving for the down payment. + Save up the down payment of $20,000 for 6 years in an annuity at 4.5% with payments of $243/month. 4 For the next 30 years finance the remaining $180,000 at 4.2% with mortgage payments of $880/month A Retirement: 28 . . * Use an annuity earning 3% interest for 50 years after graduation. * While paying on the car and saving for the down payment for the house pay $200/ month into the annuity (first 9 years) * For years 9-20 pay $500/month into the account - For years 20-30 pay $1,000/month into the account. For years 30-40 pay $1,500/month into the account. For years 40-50 pay $3,000/month into the account. Using your chosen career path you will be formulating a plan and a budget to purchase a new car and a house while saving for retirement. We will be assuming that when you graduate college you will not have any parental assistance or money in savings. We will also assume that you do not have to pay off your student debts. You may include payment of student loans in your budget. Please note that for a well-balanced budget your debts should not exceed 40% of your monthly pre-tax income. This includes student loans, car payments, and housing costs (mortgage or rent). Directions: On a separate piece of paper complete the following objectives. Keep in mind that these questions are not mutually exclusive, you are creating a cohesive budget, so for every answer that you give, make sure that it works out with the rest of your answers to maintain affordability. SHOW ALL OF YOUR WORK FOR CREDIT Submission: You will be submitting 1 pdf document of your (neatly) handwritten project response with the questions completed in numerical order. You will also be submitting 1 excel spreadsheet with labelled tabs for the amortization tables for each loan option. I suggest that you copy my entire amortization table sheet and paste it into the 6 tabs that you will need for the 6 loan options. 1. Choose the profession most similar to your expected career path from the following and use the listed salary as your initial salary. Registered Nurse, $42,196 * Construction Manager, $54,051 Social Worker, $40,913 2. Create a function, S(t), representing your pre-tax salary for t years after you graduate, assuming a yearly 3% raise. 3. What is your yearly pre-tax salary in 2, 5, 10, 15, 20, and 30 years? 4. What is your monthly pre-tax salary initially (from your initial salary), and in 2, 5, 10, 15. 20 and 30 years? Please note that these values will help you decide if the following options are within the budget you are creating . The following should not be considered individually, but as a whole to create a monthly budget that you can afford according to your growing income. Find all of the information that you need given the loan and savings options to purchase a car, house and save for retirement, then decide oh which option you will choose. Also note that for the loans, amortization tables are a very useful tool for determining total amount paid, et cetera. anlatha nwina munting I expect to see your formula filled out with the The following should not be considered individually, but as a whole to create a monthly budget that you can afford according to your growing income. Find all of the information that you need given the loan and savings options to purchase a car, house and save for retirement, then decide on which option you will choose. Also note that for the loans, amortization tables are a very useful tool for determining total amount paid, et cetera. For each option in each of the following questions I expect to see your formula filled out with the appropriate information when finding your payment or future values. I also expect to see all of the work for exploring the annuities. For the loans I still need to see your formula filled out for - the payment amount, but you may use the amortization table to find any other information, and you must include the information that you found in your project write-up. For questions 5-7 feel free to include any thoughts you have including on which option might be better to choose. These musings do not have to be the answers you choose for question 8, because what you want at first might not fit into a good monthly budget. 5. You would like to buy a new car soon, and you found the car that you want for $15,000. You can get a 5 year loan compounded monthly at 6% interest. Please note that for a well balanced budget, a car payment should be about 10% or less of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact on monthly budget, et cetera): Purchase the car immediately with no down payment. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5% for 2 years, then take out a loan for the rest. b. Create an amortization table for each of the 2 loan options. 6. Right now you are renting an apartment for $700/month (this should be factored into your budget), and you would like to buy a new home. The median house price in your area is $180,000, so you budget for a house of that price. You are able to get a 30 year mortgage paying an interest rate of 3.75%. Please note that for a well-balanced budget your housing cost should not exceed 28% of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact 6. Right now you are renting an apartment for $700/month (this should be factored into your budget), and you would like to buy a new home. The median house price in your area is $180,000, so you budget for a house of that price. You are able to get a 30 year mortgage paying an interest rate of 3.75%. Please note that for a well-balanced budget your housing cost should not exceed 28% of your monthly pre-tax income, make sure that the option you choose is within this range. a. Explore each of the following (find the payment amount, total amount paid, impact on monthly budget, et cetera: (Note: Keep in mind that while you are saving for a down payment, you will have to be paying rent until you purchase your home.) Purchase the home immediately with no down payment. Save up for a 10% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest. Save up for a 20% down payment with an ordinary annuity compounded monthly at 5.5% for 5 years, then take out a loan for the rest, paying $200/ month extra. b. Create an amortization schedule for each of the 4 loan options. 7. You need to save for retirement. Assume that the job that you get out of college is the one that you will keep for 45 years, then you will retire. You can make monthly payments into an ordinary annuity with an interest rate of 4%. (Use this annuity to calculate the following) a. Explore each of the following (find total amount saved, total amount put into account, impact on monthly budget, et cetera): Save early: Determine an affordable monthly amount to put into an ordinary annuity for 20 years, reassessing the payment amount every 10 years (so that the amount you are paying into savings can increase with your income), then stop making payments and let the amount that you saved continue earning interest (lump sum) for the next 25 years. Save laters Don't start putting money into a retirement account until 15 years after graduating college, then determine an affordable monthly amount to put the amount you are paying into savings can increase with your income), then stop making payments and let the amount that you saved continue earning interest (lump sum) for the next 25 years. Save later: Don't start putting money into a retirement account until 15 years after graduating college, then determine an affordable monthly amount to put into an ordinary annuity until retirement, (30 years) reassessing the payment amount every 10 years (so that the amount you are paying into savings can increase with your income). Save consistently: Start saving early and don't stop until retirement. Determine an affordable monthly payment amount reassessing the payment amount every 10 years to increase payments. 8. Which option will you chobse for the car? The mortgage? The retirement fund? Explain why you chose each option. 9. Create a monthly budget for the first year after graduating (using the initial salary), and for 5, 10, 20 and 30 years after graduating. (See example) 10. Create a timeline for the loans and savings accounts that you chose. (See example) Example Note: This is only similar to questions 8-10, make sure that you fulfill the requirements of the questions. This example is purely to give you an idea of what I am expecting for these 3 questions. You can also work out these examples and verify that you get the same numbers to check your process. You absolutely have to show all of the work in the preceding questions! Initial income is $50,000 assuming 2% yearly raises. Car: + Purchase a $20,000 car with a $5,000 down payment Save up the $5,000 for 3 years in an annuity at 4.5% with payments of $130/ month. 4 For the next 6 years finance the remaining $15,000 at 3.6% with loan payments of $232/month House: Example Note: This is only similar to questions 8-10, make sure that you fulfill the requirements of the questions. This example is purely to give you an idea of what I am expecting for these 3 questions. You can also work out these examples and verify that you get the same numbers to check your process. You absolutely have to show all of the work in the preceding questions! * Initial income is $50,000 assuming 2% yearly raises. Car: Purchase a $20,000 car with a $5,000 down payment. + Save up the $5,000 for 3 years in an annuity at 4.5% with payments of $130/ month. * For the next 6 years finance the remaining $15,000 at 3.6% with loan payments of $232/month. House: FLEEEEEEE + Purchase a $200,000 house with a 10% down payment. Pay $800/month in rent while saving for the down payment. + Save up the down payment of $20,000 for 6 years in an annuity at 4.5% with payments of $243/month. 4 For the next 30 years finance the remaining $180,000 at 4.2% with mortgage payments of $880/month A Retirement: 28 . . * Use an annuity earning 3% interest for 50 years after graduation. * While paying on the car and saving for the down payment for the house pay $200/ month into the annuity (first 9 years) * For years 9-20 pay $500/month into the account - For years 20-30 pay $1,000/month into the account. For years 30-40 pay $1,500/month into the account. For years 40-50 pay $3,000/month into the account