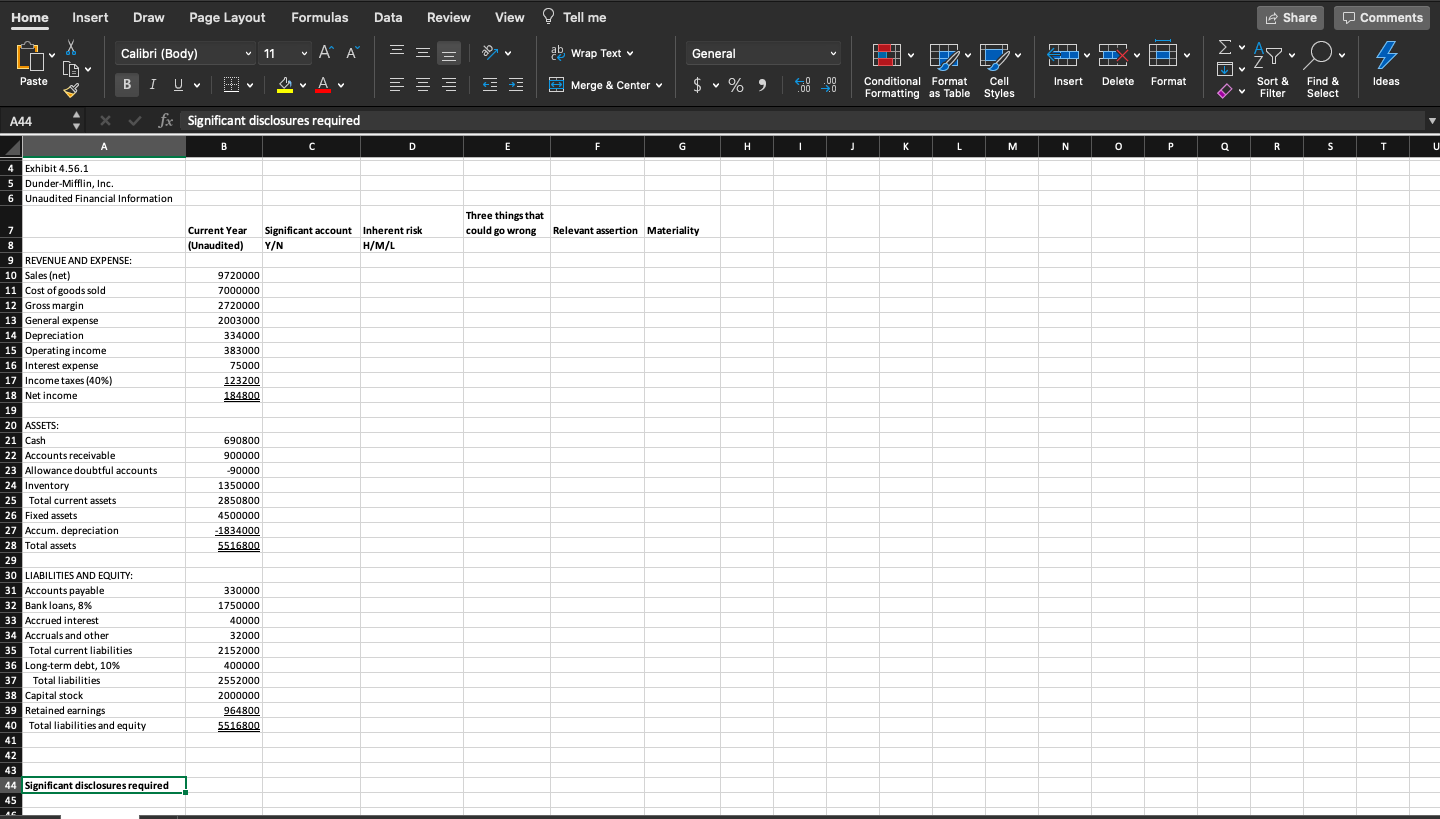

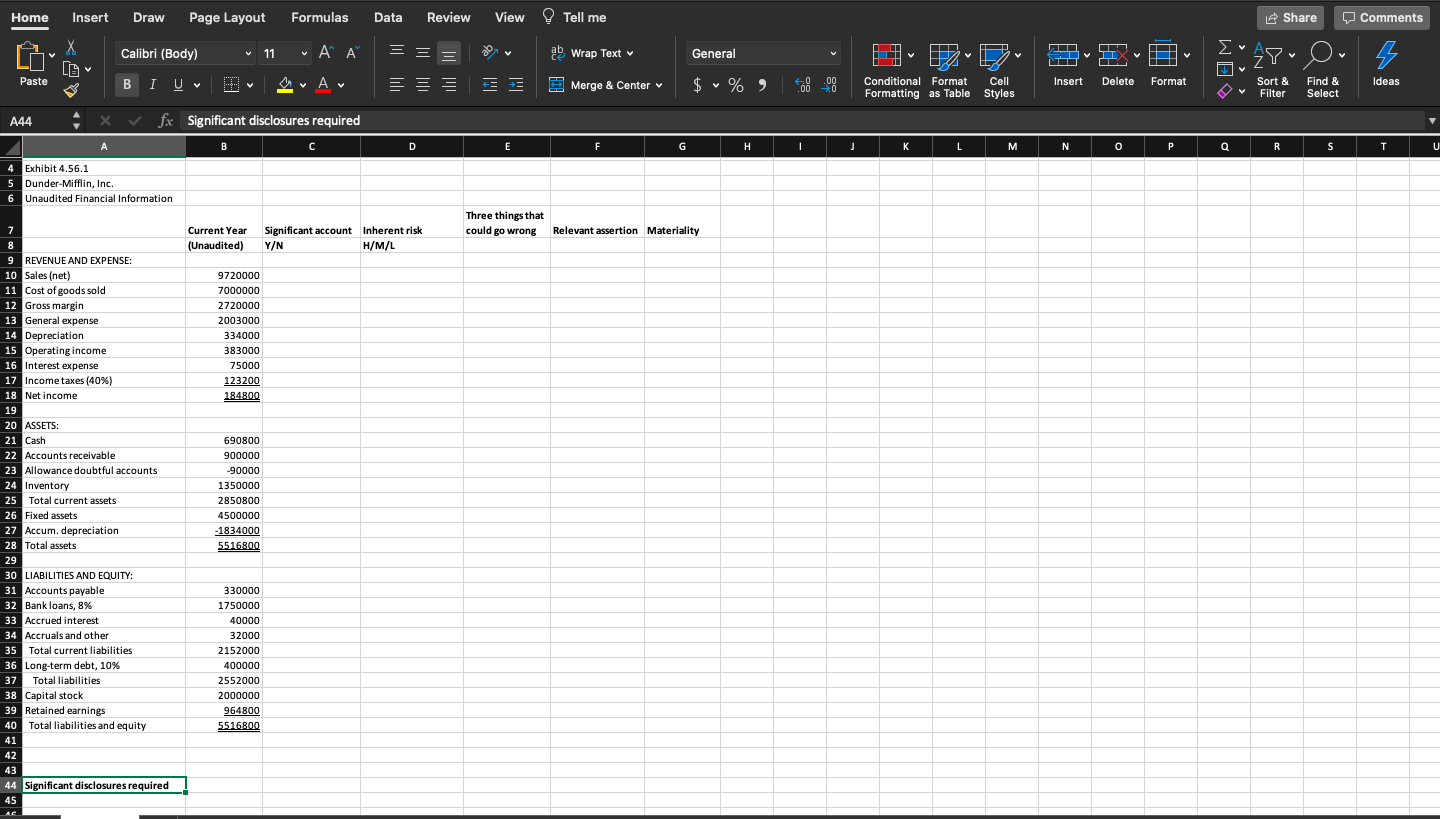

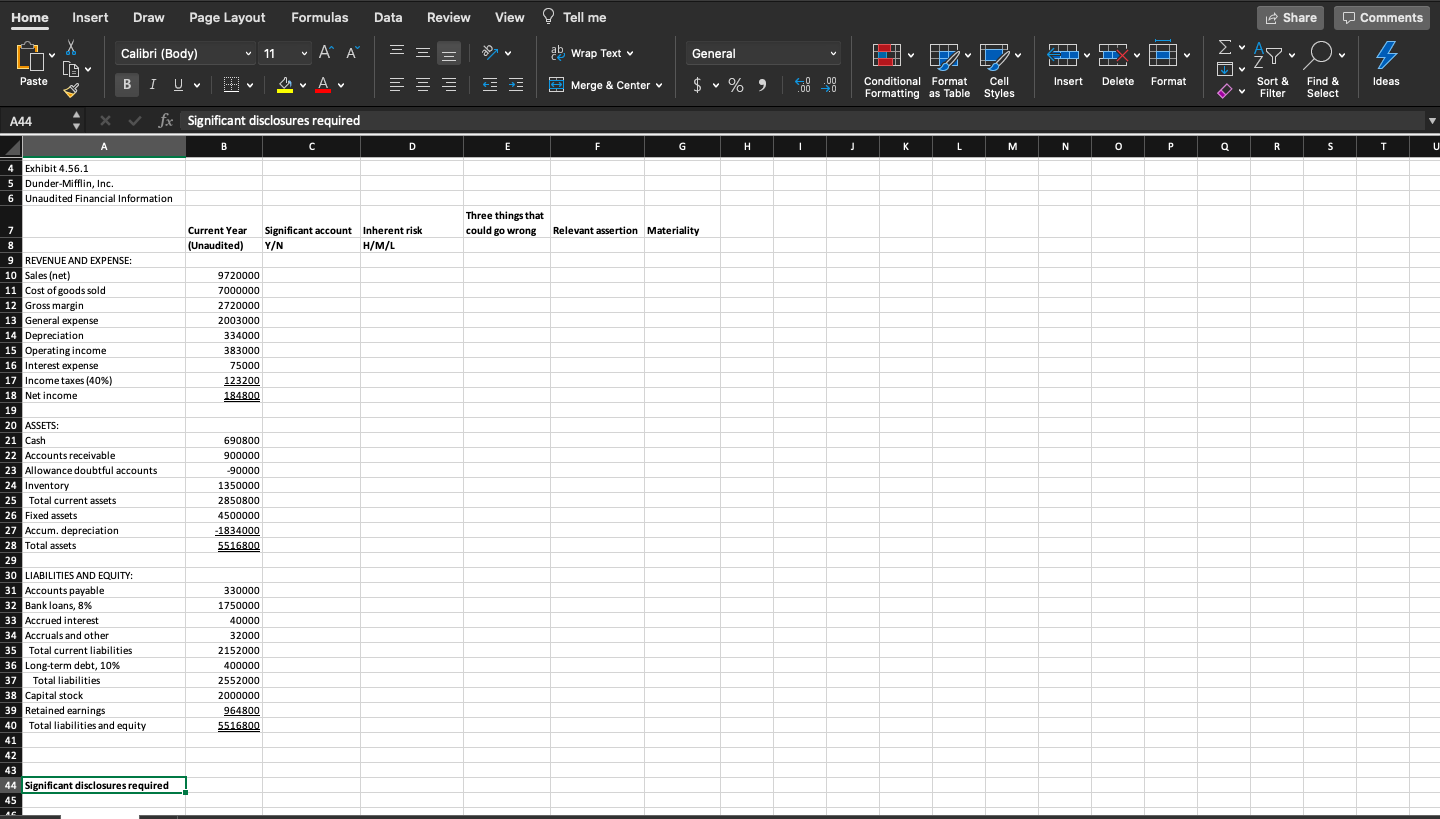

Using your preliminary analytics for Problem 4.56, identify each significant account and disclosure.

Using Exhibit 4.12 as a guide, for each significant identified in #1 above, list three things that could go wrong for that account.

Using 4.12 as a guide, for each of the three things that you list for each significant account, indicate the relevant assertion.

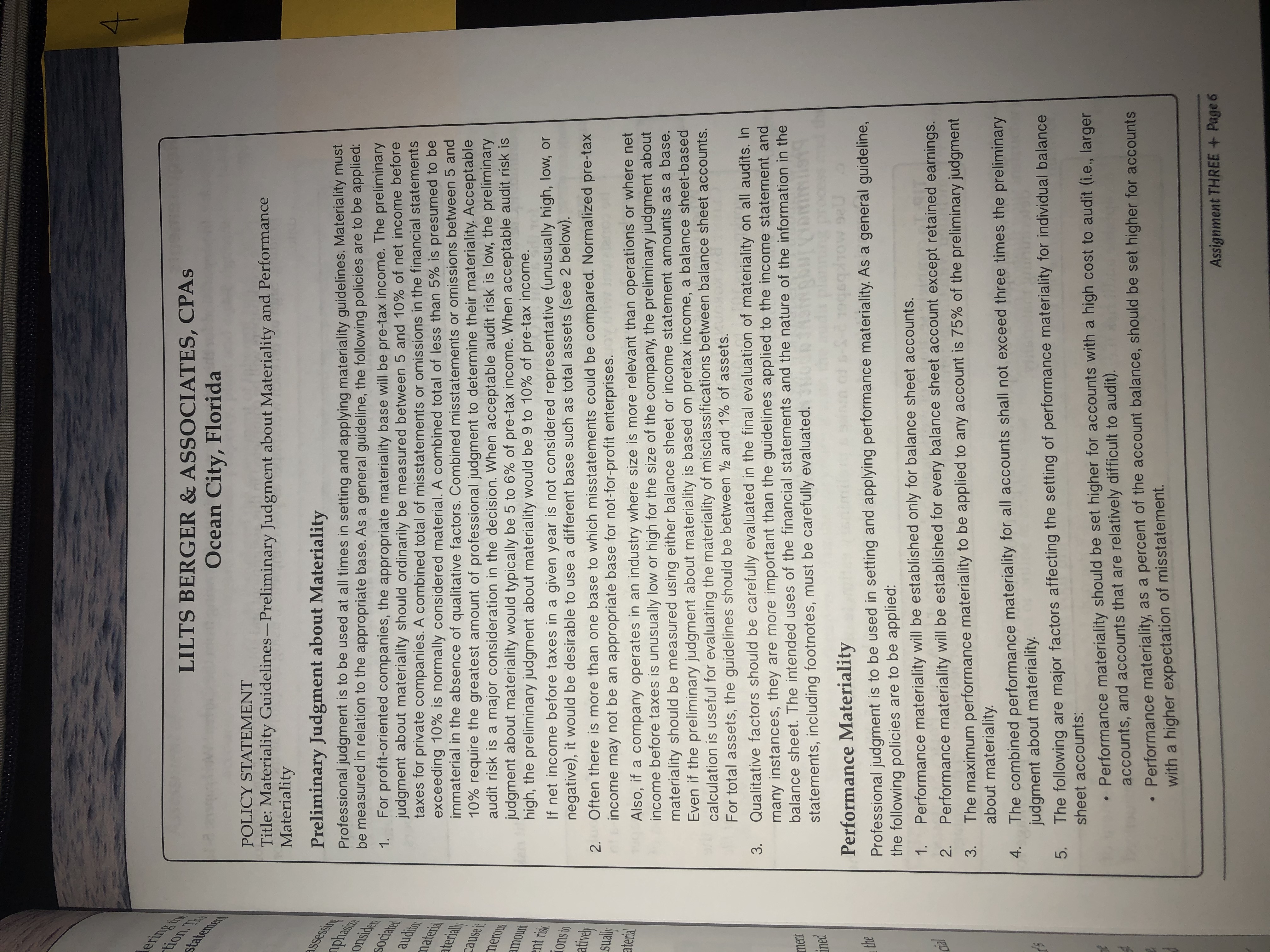

Assuming that the audit risk is high for this client, calculate performance materiality and allocate this materiality to each balance sheet account except retained earnings. Use the guidelines in the policy statement for Lilts Berger & Associates on Page 6 of the Oceanview booklet.

4 LILTS BERGER & ASSOCIATES, CPAs Ocean City, Florida POLICY STATEMENT Materiality Title: Materiality Guidelines-Preliminary Judgment about Materiality and Performance ssessing Preliminary Judgment about Materiality phasia onsiders Professional judgment is to be used at all times in setting and applying materiality guidelines. Materiality must be measured in relation to the appropriate base. As a general guideline, the following policies are to be applied: Sociated 1. For profit-oriented companies, the appropriate materiality base will be pre-tax income. The preliminary auditor judgment about materiality should ordinarily be measured between 5 and 10% of net income before naterial taxes for private companies. A combined total of misstatements or omissions in the financial statements aterially exceeding 10% is normally considered material. A combined total of less than 5% is presumed to be cause it immaterial in the absence of qualitative factors. Combined misstatements or omissions between 5 and 10% require the greatest amount of professional judgment to determine their materiality. Acceptable nerous audit risk is a major consideration in the decision. When acceptable audit risk is low, the preliminary imount judgment about materiality would typically be 5 to 6% of pre-tax income. When acceptable audit risk is nt risk high, the preliminary judgment about materiality would be 9 to 10% of pre-tax income. ons to If net income before taxes in a given year is not considered representative (unusually high, low, or tively negative), it would be desirable to use a different base such as total assets (see 2 below). sually 2. Often there is more than one base to which misstatements could be compared. Normalized pre-tax aterial income may not be an appropriate base for not-for-profit enterprises. Also, if a company operates in an industry where size is more relevant than operations or where net income before taxes is unusually low or high for the size of the company, the preliminary judgment about materiality should be measured using either balance sheet or income statement amounts as a base. Even if the preliminary judgment about materiality is based on pretax income, a balance sheet-based calculation is useful for evaluating the materiality of misclassifications between balance sheet accounts. For total assets, the guidelines should be between 1/2 and 1% of assets. 3. Qualitative factors should be carefully evaluated in the final evaluation of materiality on all audits. In many instances, they are more important than the guidelines applied to the income statement and ment balance sheet. The intended uses of the financial statements and the nature of the information in the ined statements, including footnotes, must be carefully evaluated. Performance Materiality the Professional judgment is to be used in setting and applying performance materiality. As a general guideline, the following policies are to be applied: 1 . Performance materiality will be established only for balance sheet accounts. 2. Performance materiality will be established for every balance sheet account except retained earnings. 3 . The maximum performance materiality to be applied to any account is 75% of the preliminary judgment about materiality. 4 . The combined performance materiality for all accounts shall not exceed three times the preliminary judgment about materiality. 5. The following are major factors affecting the setting of performance materiality for individual balance sheet accounts: Performance materiality should be set higher for accounts with a high cost to audit (i.e., larger accounts, and accounts that are relatively difficult to audit). . Performance materiality, as a percent of the account balance, should be set higher for accounts with a higher expectation of misstatement. Assignment THREE + Page 6Home Insert Draw Page Layout Formulas Data Review View Tell me Share Comments X Calibri (Body) 11 A ab, Wrap Text v General LIX Paste B I U A = += FE Merge & Center v $ ~ % " Conditional Format Cell Insert Delete Format Sort & Find & Ideas Formatting as Table Styles Filter Select A44 X V fx Significant disclosures required B C D E F G H M N 0 P Q R S T Exhibit 4.56.1 5 Dunder-Mifflin, Inc. 6 Unaudited Financial Information Three things that Current Year Significant account Inherent risk could go wrong Relevant assertion Materiality Unaudited) Y/N H/M/L 9 REVENUE AND EXPENSE 10 Sales (net) 9720000 Cost of goods sold 7000000 Gross margin 2720000 13 General expense 2003000 Depreciation 334000 Operating income 383000 Interest expense 75000 Income taxes (40%) 123200 Net income 184800 ASSETS: Cash 690800 Accounts receivable 900000 Allowance doubtful accounts 90000 Inventory 1350000 Total current assets 2850800 ed assets 4500000 Accum. depreciation 1834000 28 Total assets 5516800 29 30 LIABILITIES AND EQUITY: 31 Accounts payable 330000 Bank loans, 8%% 1750000 Accrued interest Accruals and other 32000 Total current liabilities 2152000 Long-term debt, 10% 400000 Total liabilities 2552000 Capital stock 2000000 39 Retained earnings 964800 40 Total liabilities and equity 5516800 42 43 44 Significant disclosures required 45