Answered step by step

Verified Expert Solution

Question

1 Approved Answer

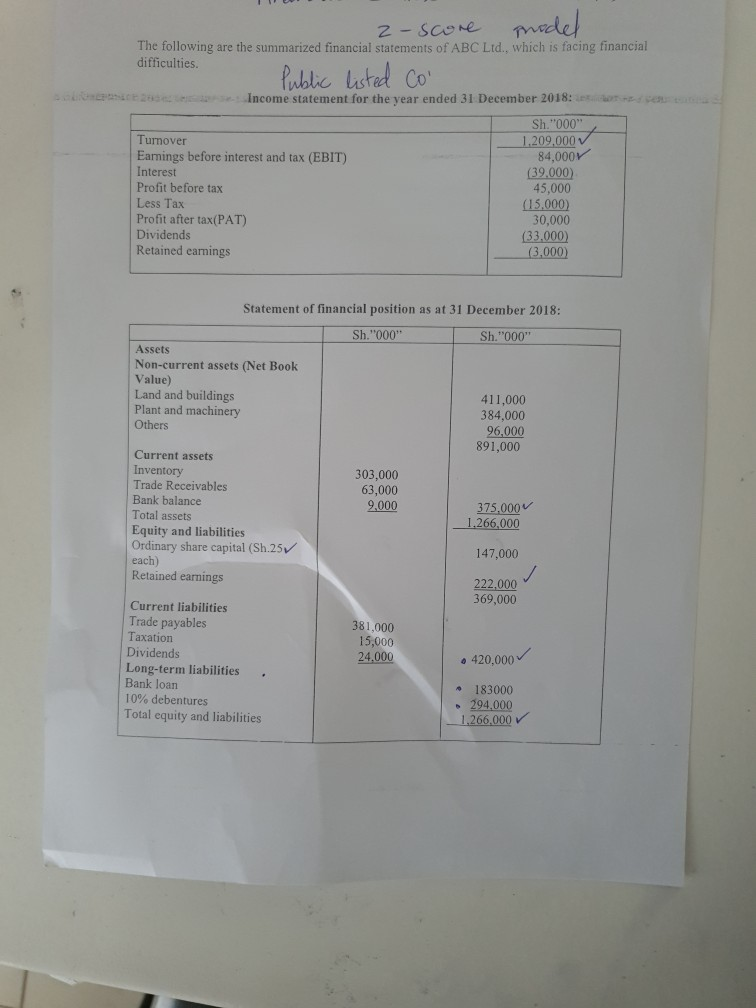

using z-score model to predict corporate failure measures for a public listed company? 2-score prodel The following are the summarized financial statements of ABC Ltd.,

using z-score model to predict corporate failure measures for a public listed company?

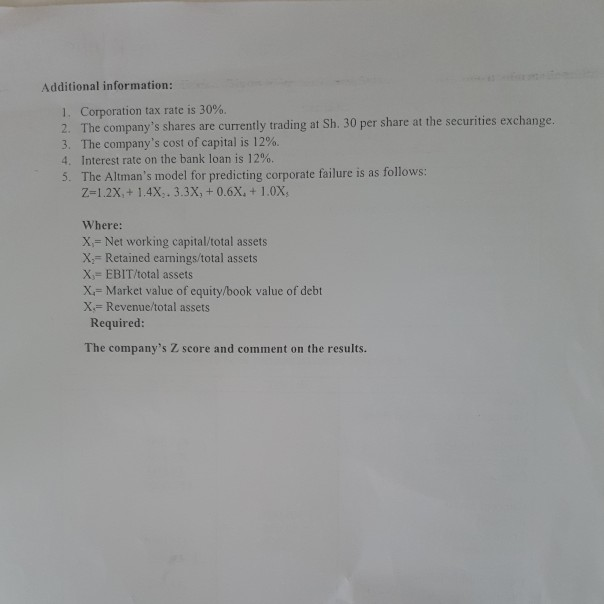

2-score prodel The following are the summarized financial statements of ABC Ltd., which is facing financial difficulties Public listed Co Income statement for the year ended 31 December 2018: Sh."000", Tumover 1.209,000 Earings before interest and tax (EBIT) 84.000 Interest (39,000 Profit before tax 45,000 Less Tax (15,000) Profit after tax(PAT) 30,000 Dividends (33.000) Retained earnings (3.000) Statement of financial position as at 31 December 2018: Sh."000" Sh."000" Assets Non-current assets (Net Book Value) Land and buildings 411,000 Plant and machinery 384,000 Others 96,000 891,000 Current assets Inventory 303,000 Trade Receivables 63,000 Bank balance 9,000 375,000 Total assets 1.266,000 Equity and liabilities Ordinary share capital (Sh.25 147,000 each) Retained earnings 222,000 369,000 Current liabilities Trade payables 381.000 Taxation 15,000 Dividends 24.000 Long-term liabilities Bank loan 183000 10% debentures 294,000 Total equity and liabilities 1,266,000 420,000 Additional information: 1. Corporation tax rate is 30%. 2. The company's shares are currently trading at Sh. 30 per share at the securities exchange. 3. The company's cost of capital is 12% 4. Interest rate on the bank loan is 12%. 5. The Altman's model for predicting corporate failure is as follows: Z=1.2X + 1.4X. 3.3X, +0.6X: +1.0X, Where: X;= Net working capital/total assets XRetained earnings/total assets X = EBIT/total assets X=Market value of equity/book value of debt X=Revenue/total assets Required: The company's Z score and comment on the resultsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started