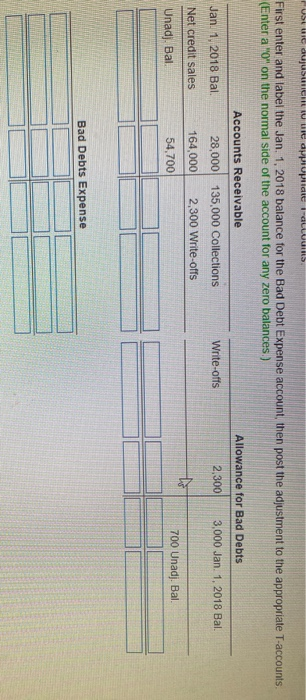

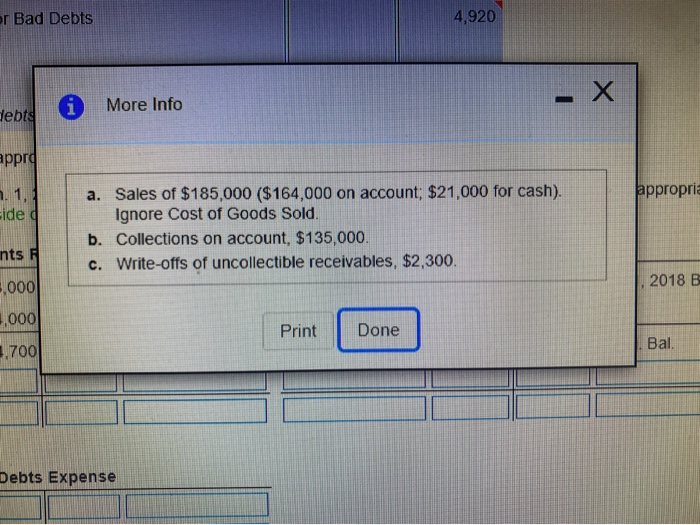

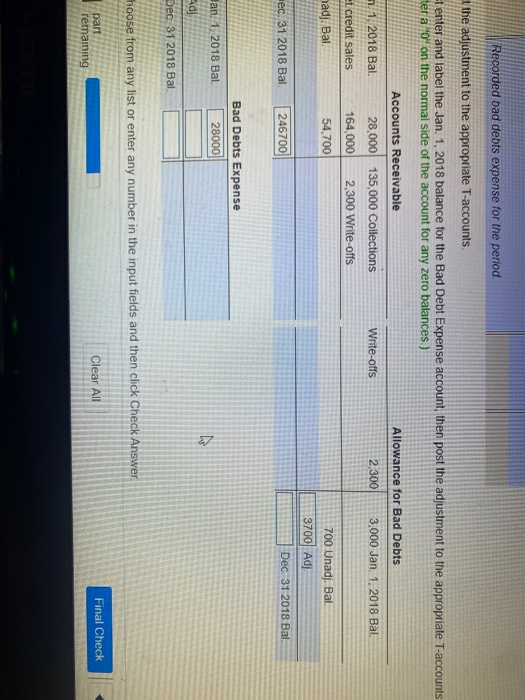

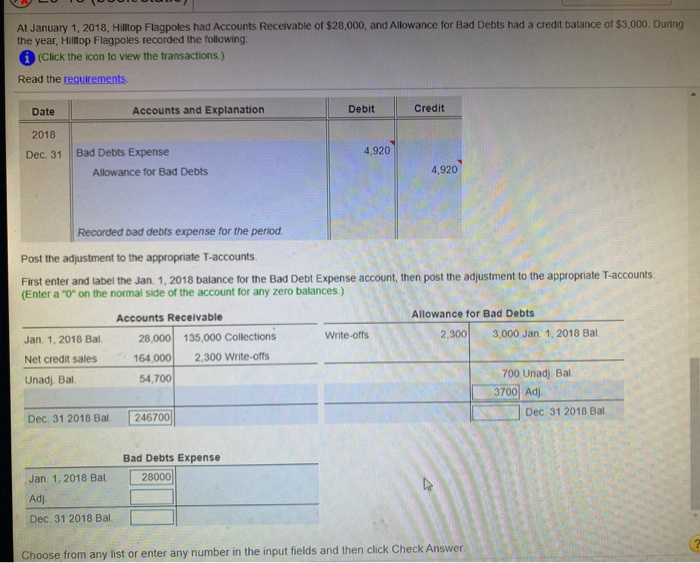

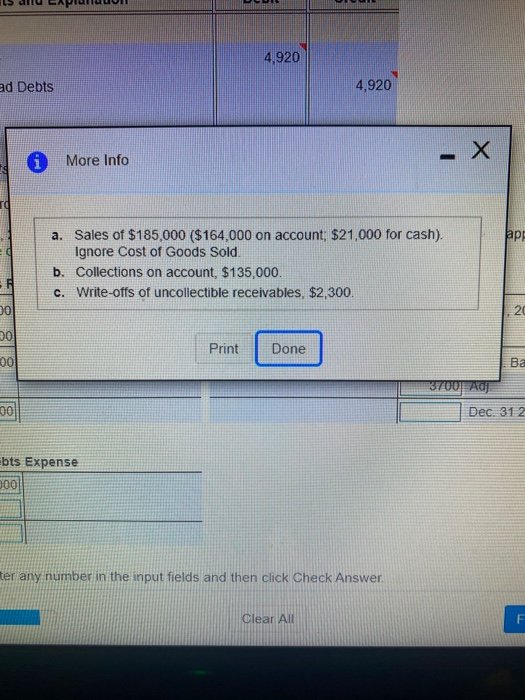

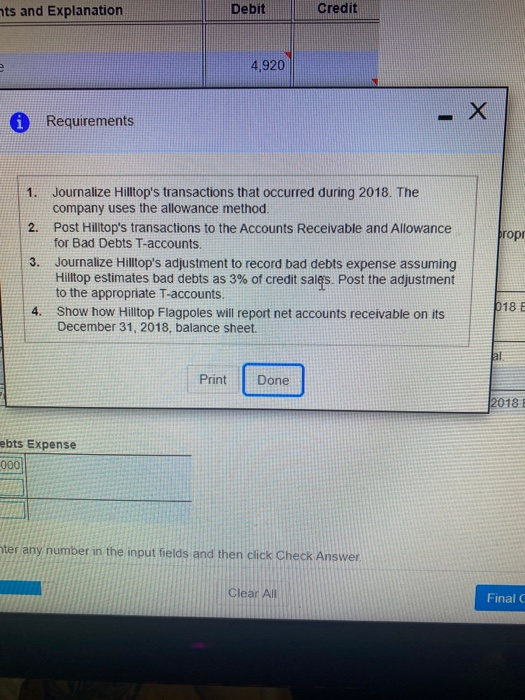

USLUi dujusiu tapi pildid - UUS First enter and label the Jan 1, 2018 balance for the Bad Debt Expense account then post the adjustment to the appropriate T-accounts (Enter a "0" on the normal side of the account for any zero balances.) Accounts Receivable Allowance for Bad Debts Jan. 1. 2018 Bal. Write-offs 2,300 3,000 Jan 1, 2018 Bal. Net credit sales 28,000 135,000 Collections 164,000 2.300 Write-offs 54,700 to Unadj. Bal 700 Unadj. Bal. Bad Debts Expense or Bad Debts 4,920 i - X debts More Info appro appropria n.1, side a a. Sales of $185,000 ($164,000 on account; $21,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $135,000. c. Write-offs of uncollectible receivables, $2,300. nts 2018 B ,000 ,000 Print Done Bal 3.700 Debts Expense Recorded bad debts expense for the period. t the adjustment to the appropriate T-accounts tenter and label the Jan. 1, 2018 balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts ter a "oon the normal side of the account for any zero balances) Accounts Receivable Allowance for Bad Debts n. 1. 2018 Bal. 28,000 135,000 Collections Write-offs 2,300 3,000 Jan 1, 2018 Bal. et credit sales 164,000 2,300 Write-offs nadj. Bal. 54,700 700 Unadj. Bal. 3700 Adj. ec. 31 2018 Bal 246700 Dec 31 2018 Bal. Bad Debts Expense 28000 Jan. 1. 2018 Bal. dy Dec 31 2018 Bal. Thoose from any list or enter any number in the input fields and then click Check Answer part Clear All Final Check remaining At January 1, 2018, Hilltop Flagpoles had Accounts Receivable of $28,000, and Allowance for Bad Debts had a credit balance of $3,000. During the year, Hilltop Flagpoles recorded the following: (Click the icon to view the transactions.) Read the requirements Date Accounts and Explanation Debit Credit 2018 Dec. 31 4,920 Bad Debts Expense Allowance for Bad Debts 4,920 Recorded bad debts expense for the period. Post the adjustment to the appropriate T-accounts First enter and label the Jan 1, 2018 balance for the Bad Debt Expense account, then post the adjustment to the appropriate T-accounts (Enter a "0" on the normal side of the account for any zero balances.) Accounts Receivable Allowance for Bad Debts Jan. 1. 2018 Bal 28,000 135,000 Collections Write-offs 2,300 3,000 Jan 1, 2018 Bal Net credit sales 164,000 2,300 Write-offs Unadj. Bal 54,700 700 Unadj. Bal 3700 Adj Dec. 31 2018 Bal 246700 Dec 31 2018 Bal Bad Debts Expense 280001 Jan 1, 2018 Bal Adj Dec 31 2018 Bal Choose from any list or enter any number in the input fields and then click Check Answer 4,920 ad Debts 4,920 More Info - X ap a. Sales of $185,000 ($164,000 on account, $21,000 for cash). Ignore Cost of Goods Sold. b. Collections on account, $135,000. c. Write-offs of uncollectible receivables. $2,300. 20 00 00 Print Done 00 Ba 3700||A Dec. 312 00 bts Expense 000 ter any number in the input fields and then click Check Answer. Clear All F nts and Explanation Debit Credit e 4,920 Requirements 1. 2. propr 3. Journalize Hilltop's transactions that occurred during 2018. The company uses the allowance method. Post Hilltop's transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts. Journalize Hilltop's adjustment to record bad debts expense assuming Hilltop estimates bad debts as 3% of credit sals. Post the adjustment to the appropriate T-accounts. Show how Hilltop Flagpoles will report net accounts receivable on its December 31, 2018, balance sheet. 4. 018 E al Print Done 2018 ebts Expense 000 hter any number in the input fields and then click Check Answer Clear All Final