Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ut of (NOTE: ENTER YOUR ANSWER IN PERCENT, BUT WITHOUT THE % SIGN, rounded to 2 decimal places, for instance as 7.89, not as 7.89%,

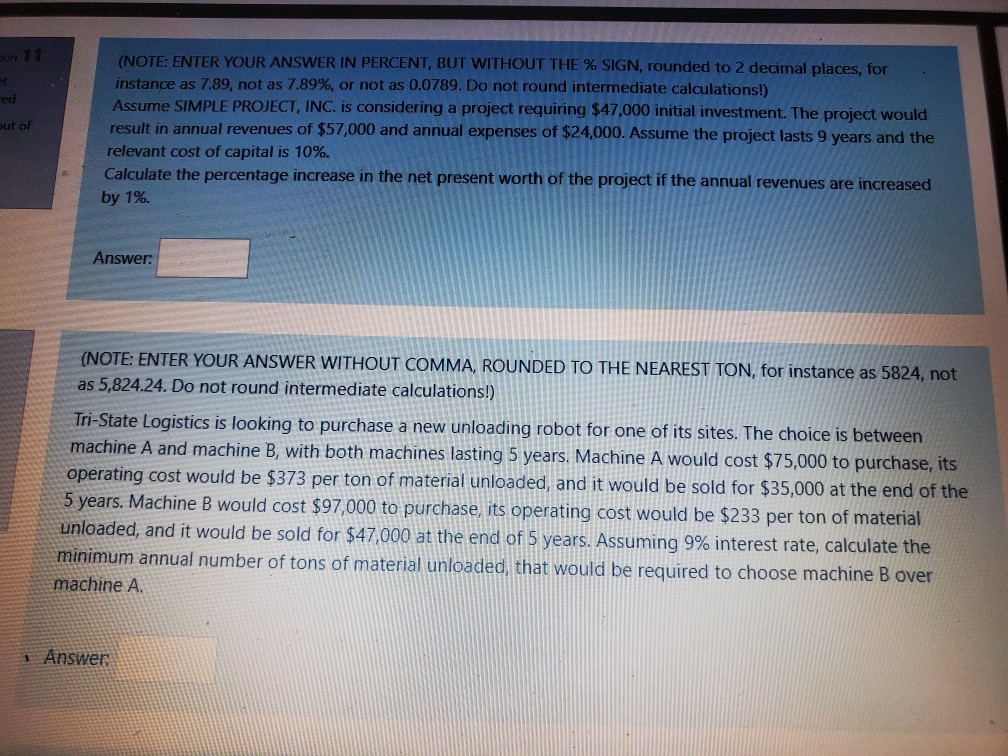

ut of (NOTE: ENTER YOUR ANSWER IN PERCENT, BUT WITHOUT THE % SIGN, rounded to 2 decimal places, for instance as 7.89, not as 7.89%, or not as 0.0789. Do not round intermediate calculations!) Assume SIMPLE PROJECT, INC. is considering a project requiring $47,000 initial investment. The project would result in annual revenues of $57,000 and annual expenses of $24,000. Assume the project lasts 9 years and the relevant cost of capital is 10%. Calculate the percentage increase in the net present worth of the project if the annual revenues are increased by 1%. Answer: (NOTE: ENTER YOUR ANSWER WITHOUT COMMA, ROUNDED TO THE NEAREST TON, for instance as 5824, not! as 5,824.24. Do not round intermediate calculations!) Tri-State Logistics is looking to purchase a new unloading robot for one of its sites. The choice is between machine A and machine B, with both machines lasting 5 years. Machine A would cost $75,000 to purchase, its operating cost would be $373 per ton of material unloaded, and it would be sold for $35,000 at the end of the 5 years. Machine B would cost $97,000 to purchase, its operating cost would be $233 per ton of material unloaded, and it would be sold for $47,000 at the end of 5 years. Assuming 9% interest rate, calculate the minimum annual number of tons of material unloaded, that would be required to choose machine B over! machine A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started